Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Features

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

20 Trending Cryptocurrencies Right Now

You may also like:

Over the last decade, cryptocurrency has become a potential alternative to government-backed currency. Decentralized digital money is an idea that dates back to a whitepaper authored by the shadowy “Satoshi Nakamoto”.

With use cases ranging from NFTs to owning gaming items on the blockchain, to performing real-world payments in countries like El Salvador, many see crypto as a worldwide financial paradigm shift. And today, notable investors like Tim Draper are predicting crypto to make a larger impact than the internet.

As of January 2022, crypto’s total market cap stands at a sizable $1.63T as crypto becomes more widely accepted around the world.

Read below for our list of trending cryptocurrencies on the market (based on Google search demand).

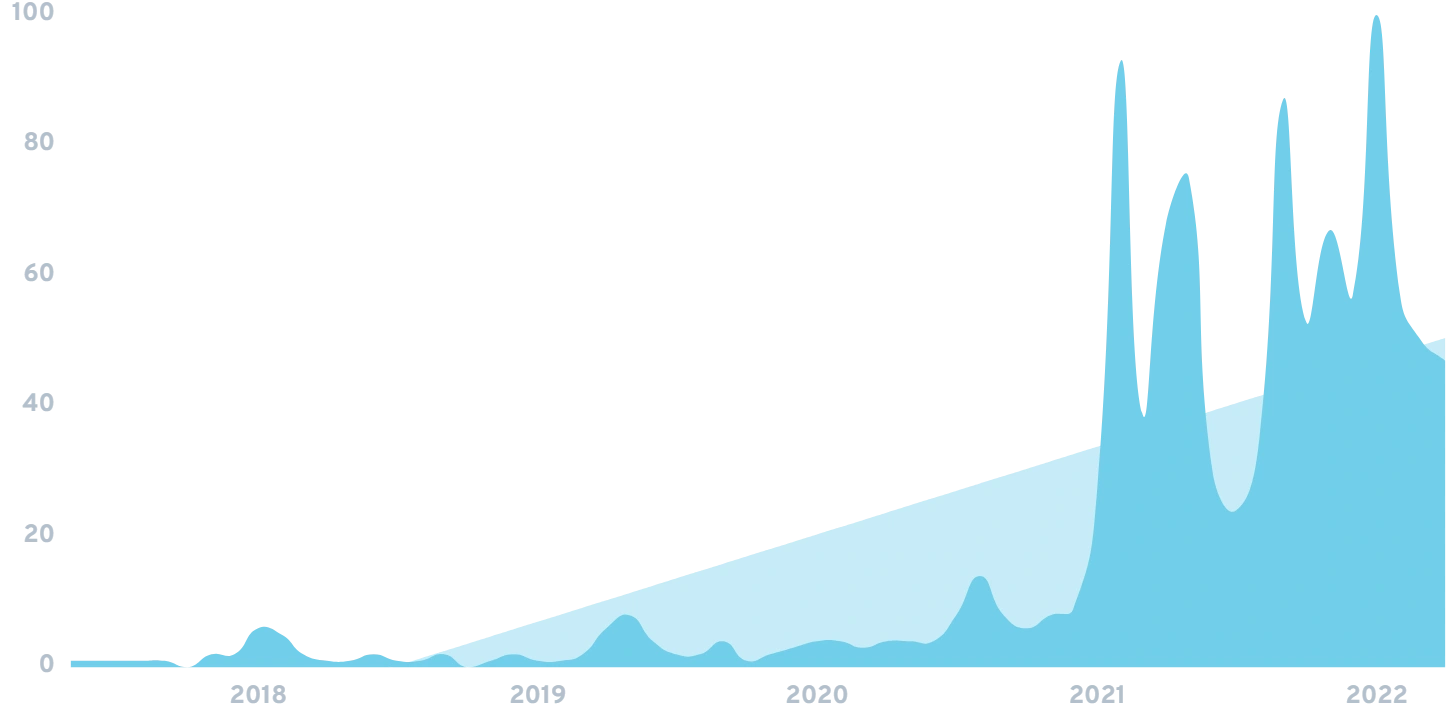

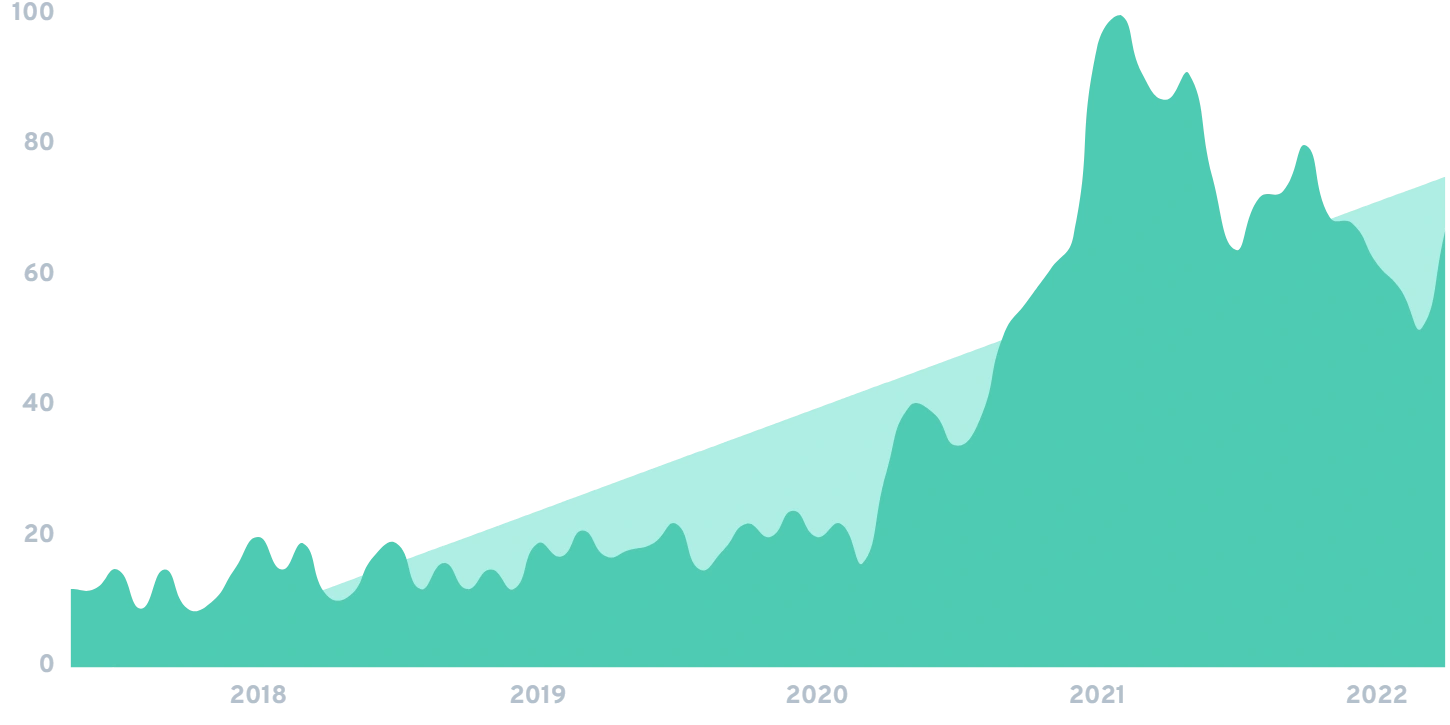

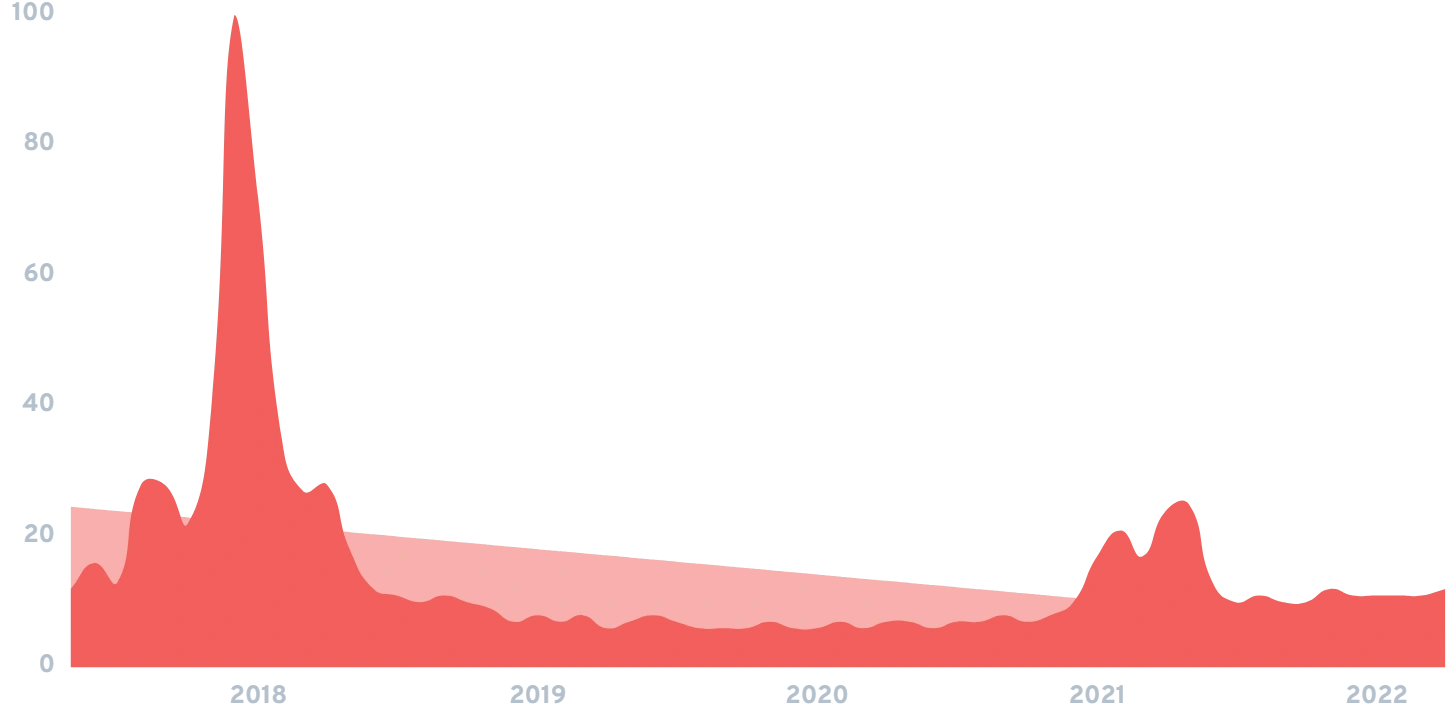

1. Cosmos

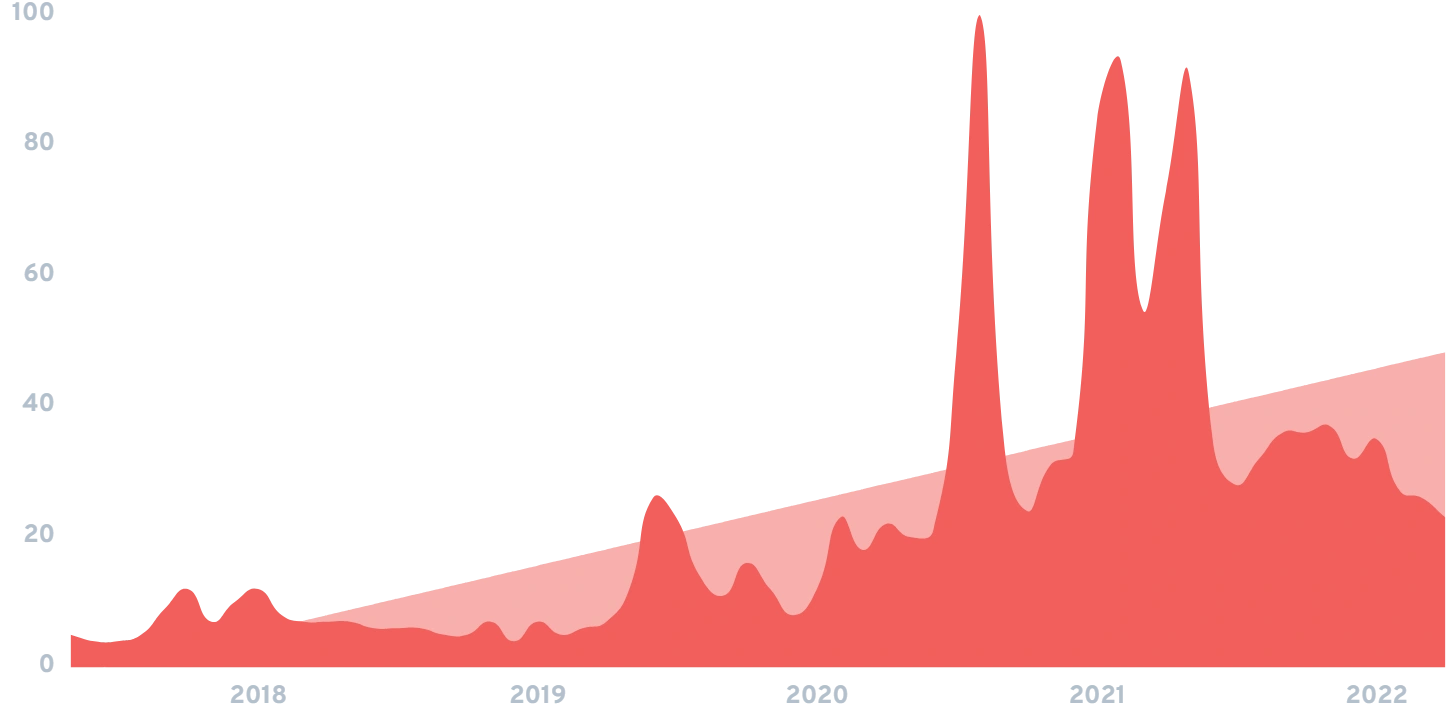

5-year search growth: 4600%

Search growth status: Regular

ICO Year: 2017

Market Cap: $6.9B

What it is: Instead of one decentralized blockchain, Cosmos uses an “internet of blockchains”, connected together by a protocol that allows users to seamlessly exchange assets. Their Cosmos Hub is the heart of the “Interchain” — essentially a new internet made of various blockchains.

256 apps & programs have already launched on Cosmos in addition to $123B worth of assets under management.

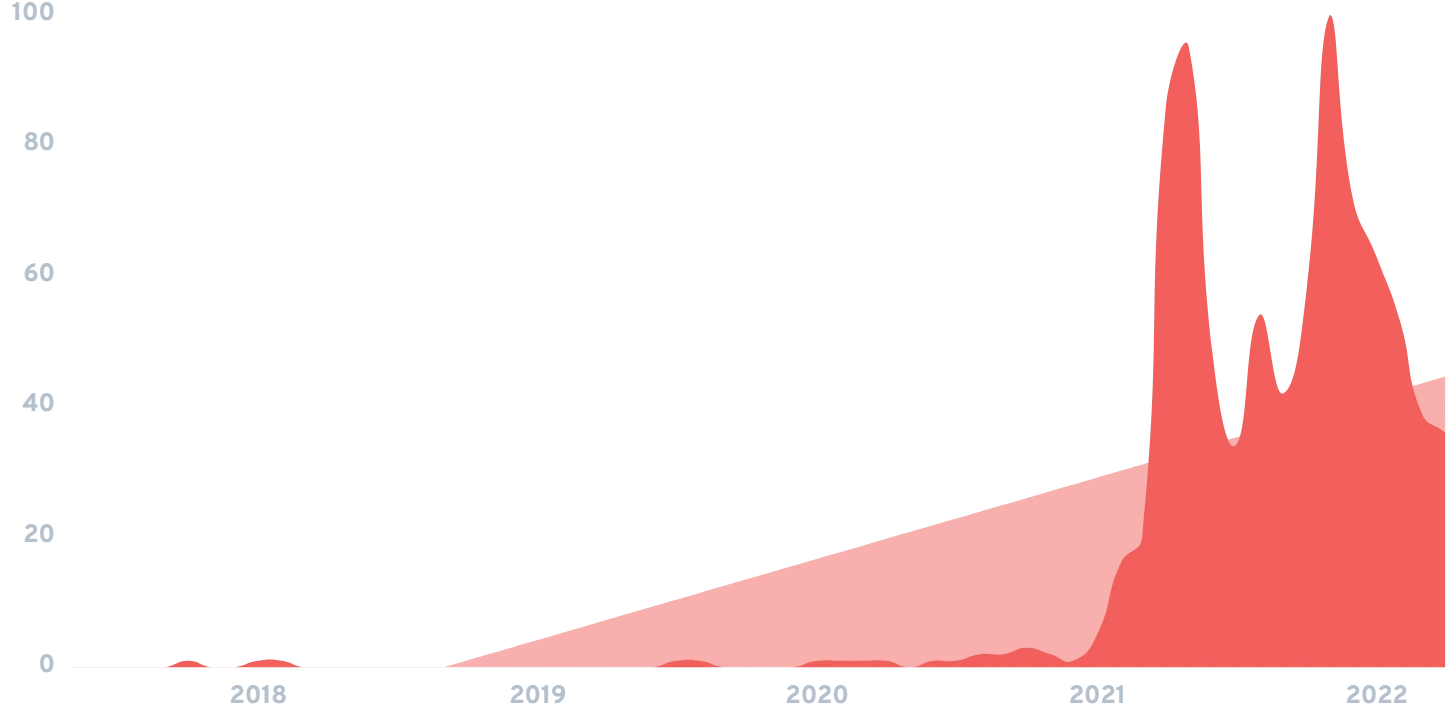

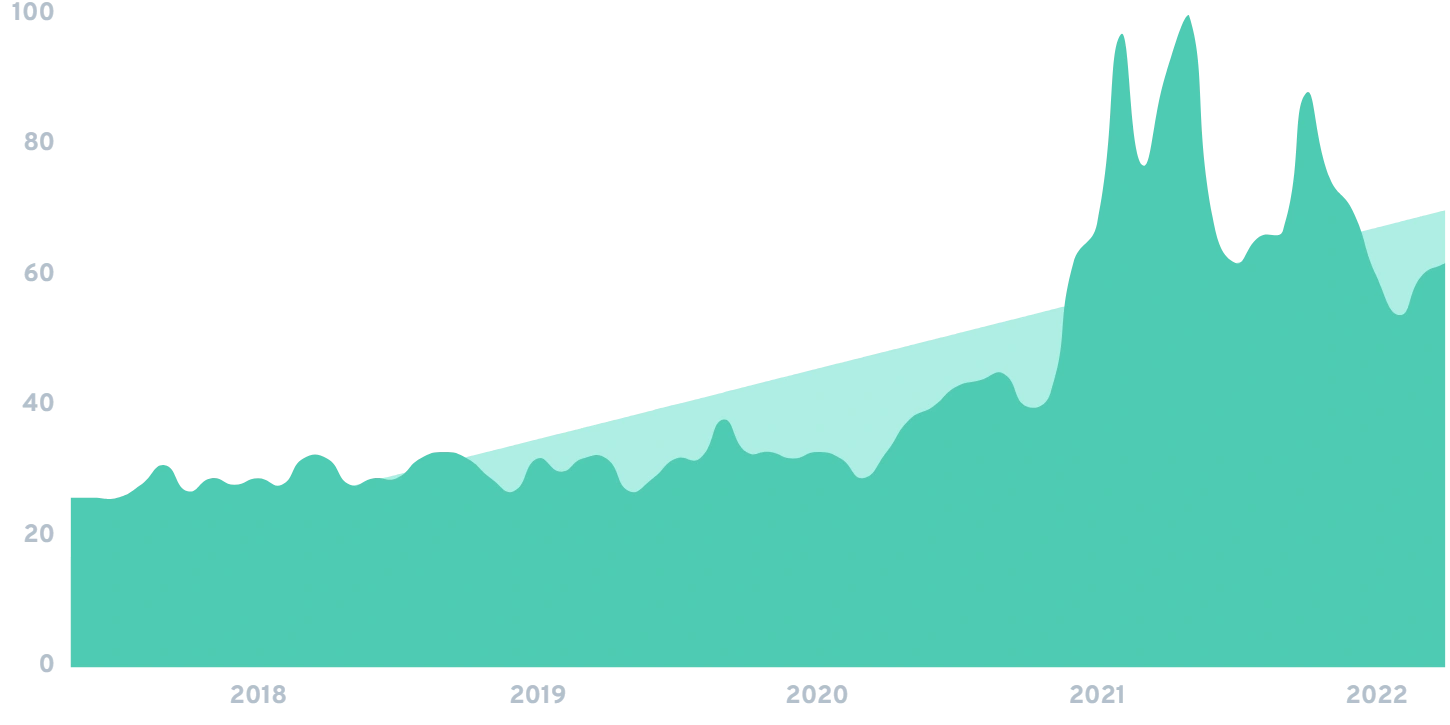

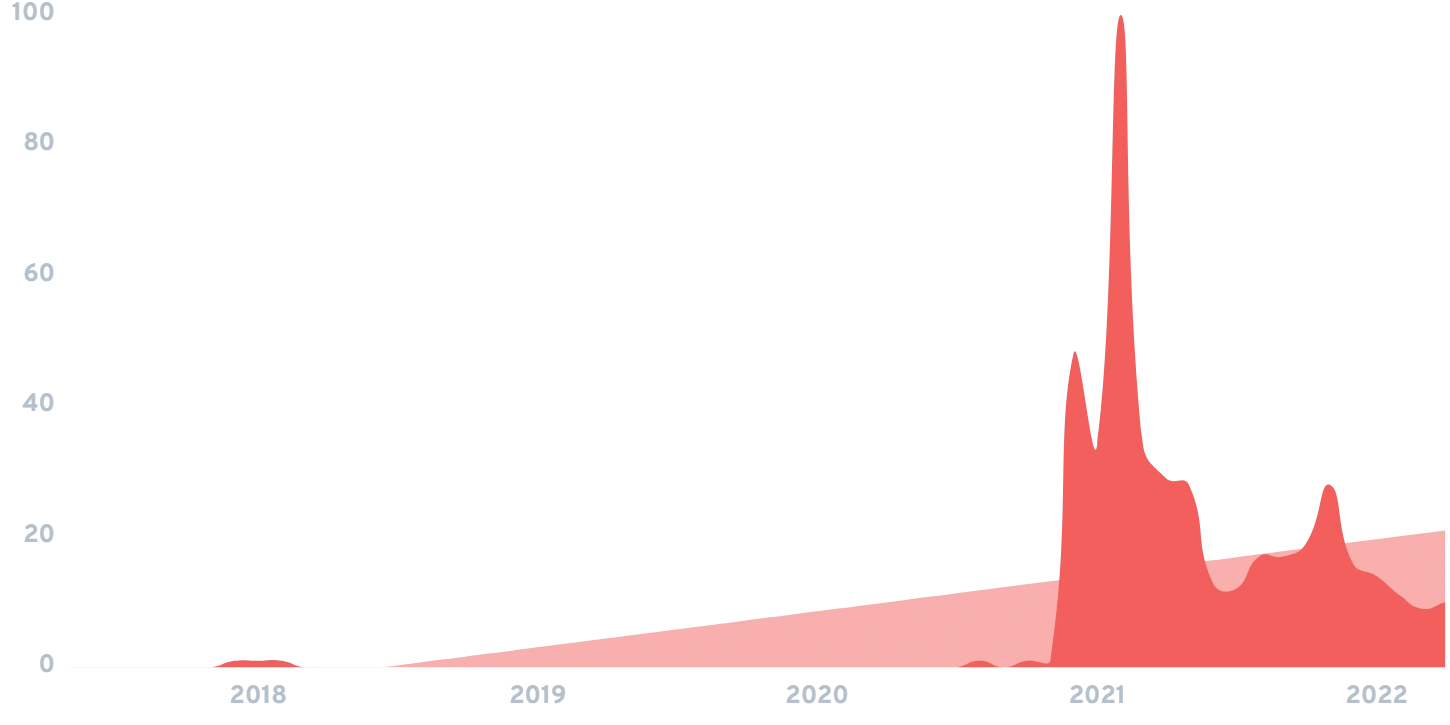

2. Helium

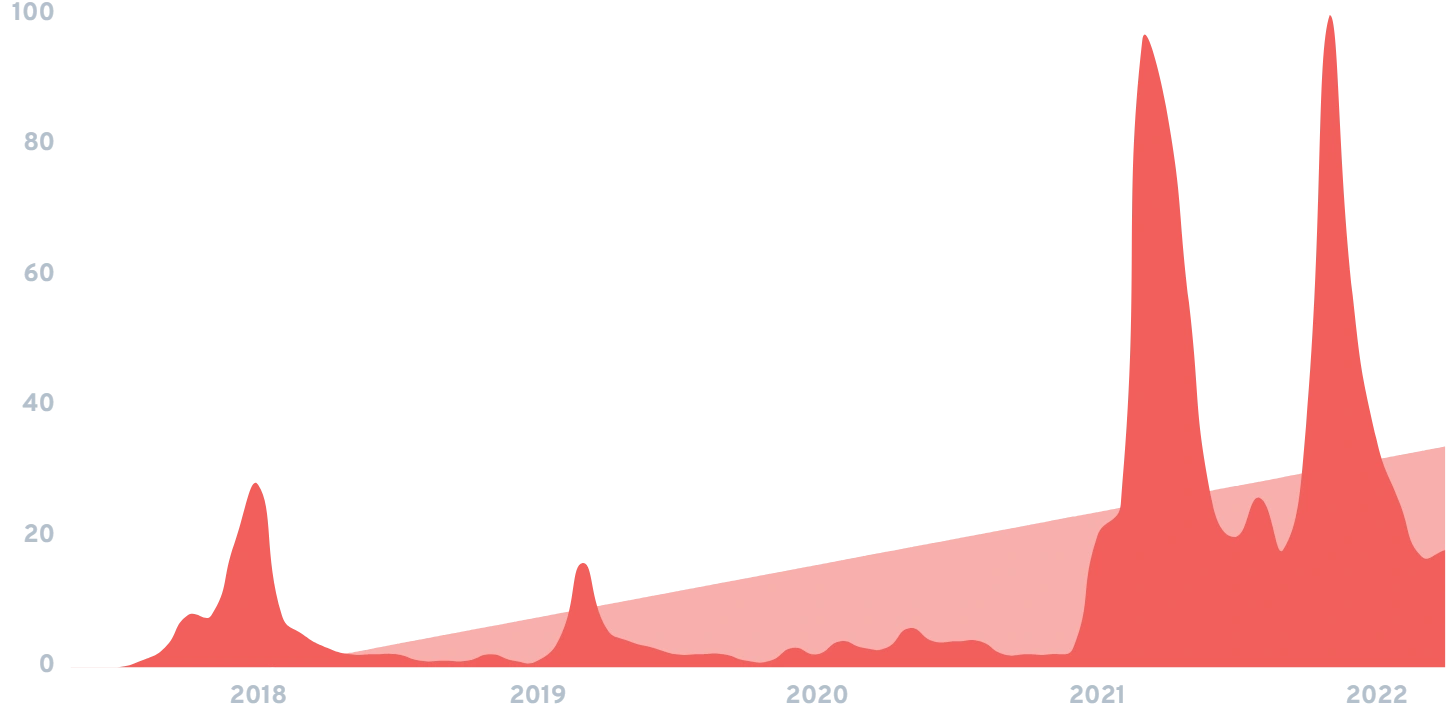

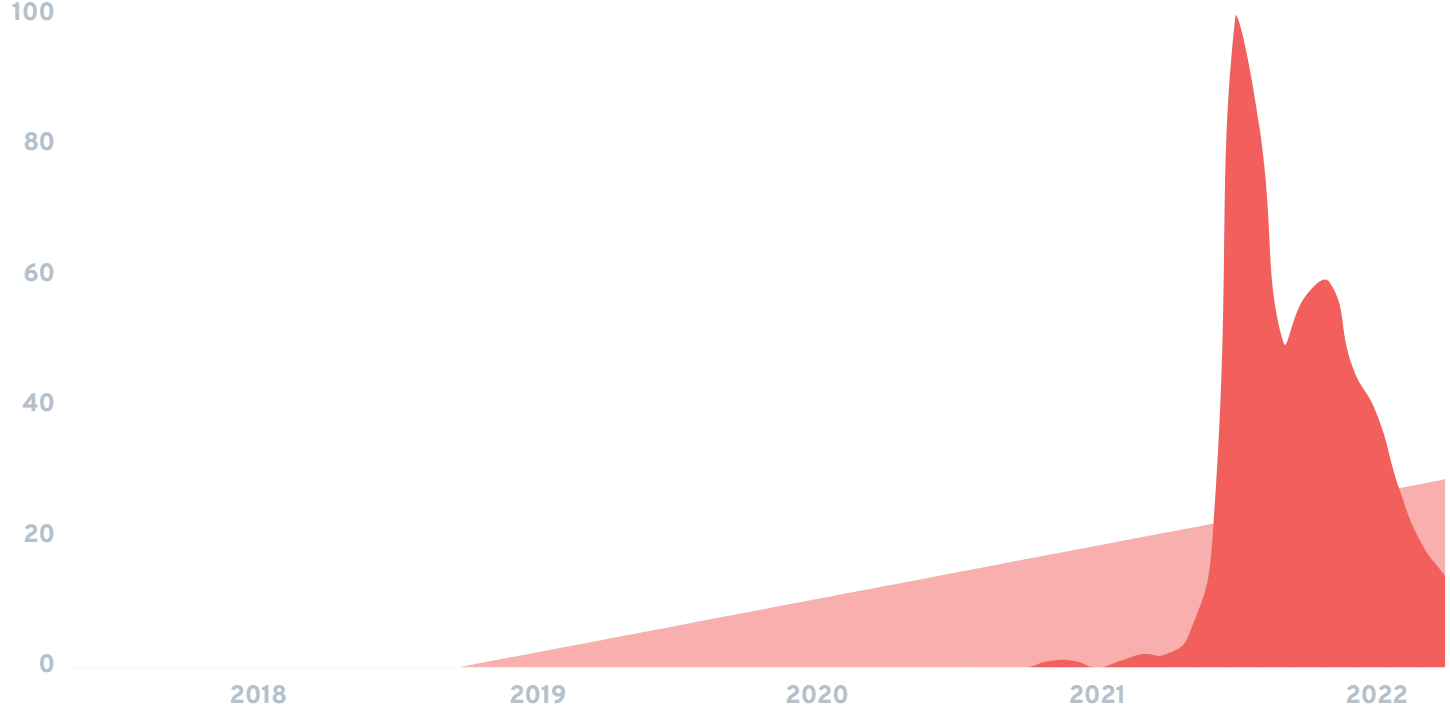

5-year search growth: 3500%

Search growth status: Peaked

ICO Year: 2019

Market Cap: $2.2B

What it is: Traditional wireless providers like AT&T, Verizon, and T-Mobile have long dominated the wireless market. Enter Helium. Helium incentives users to help build out Helium’s decentralized LoRaWAN hotspot infrastructure. Helium miners can set up nodes that grow Helium’s network while being rewarded with Helium coins.

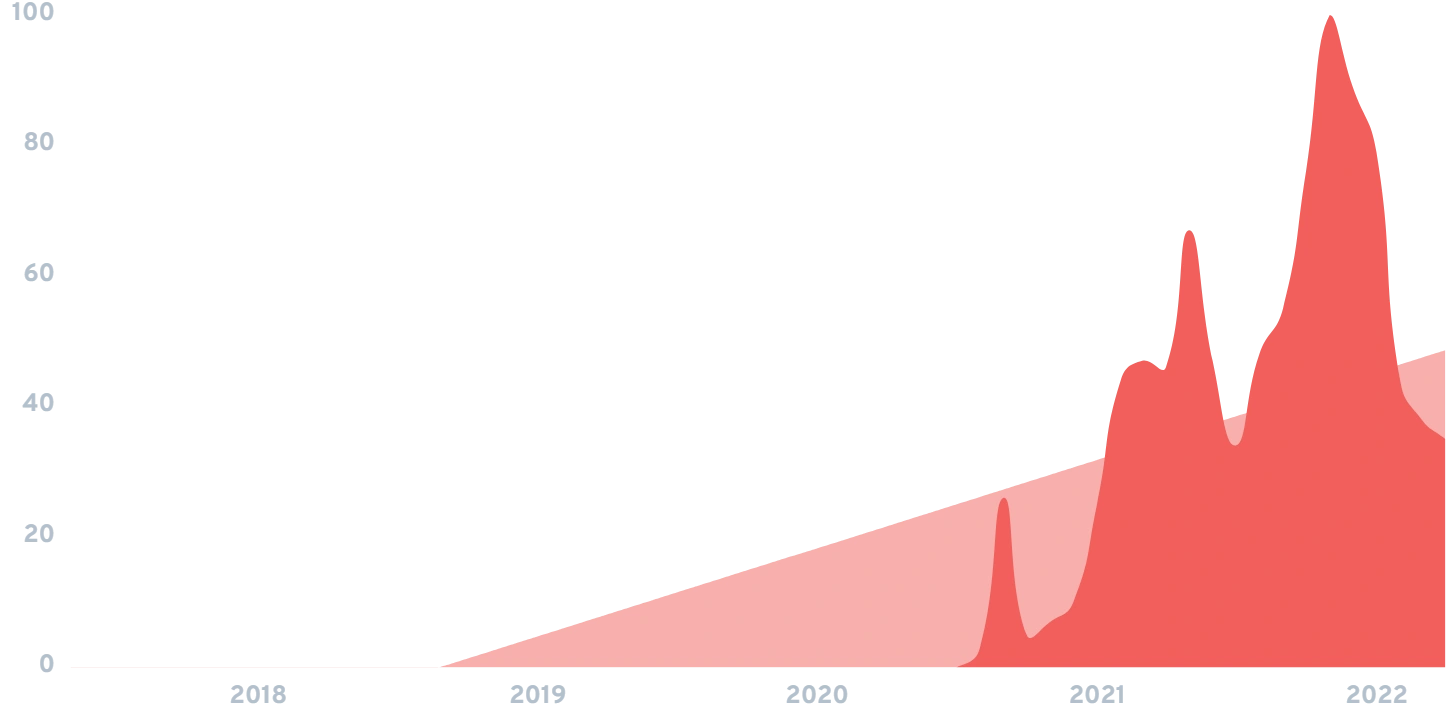

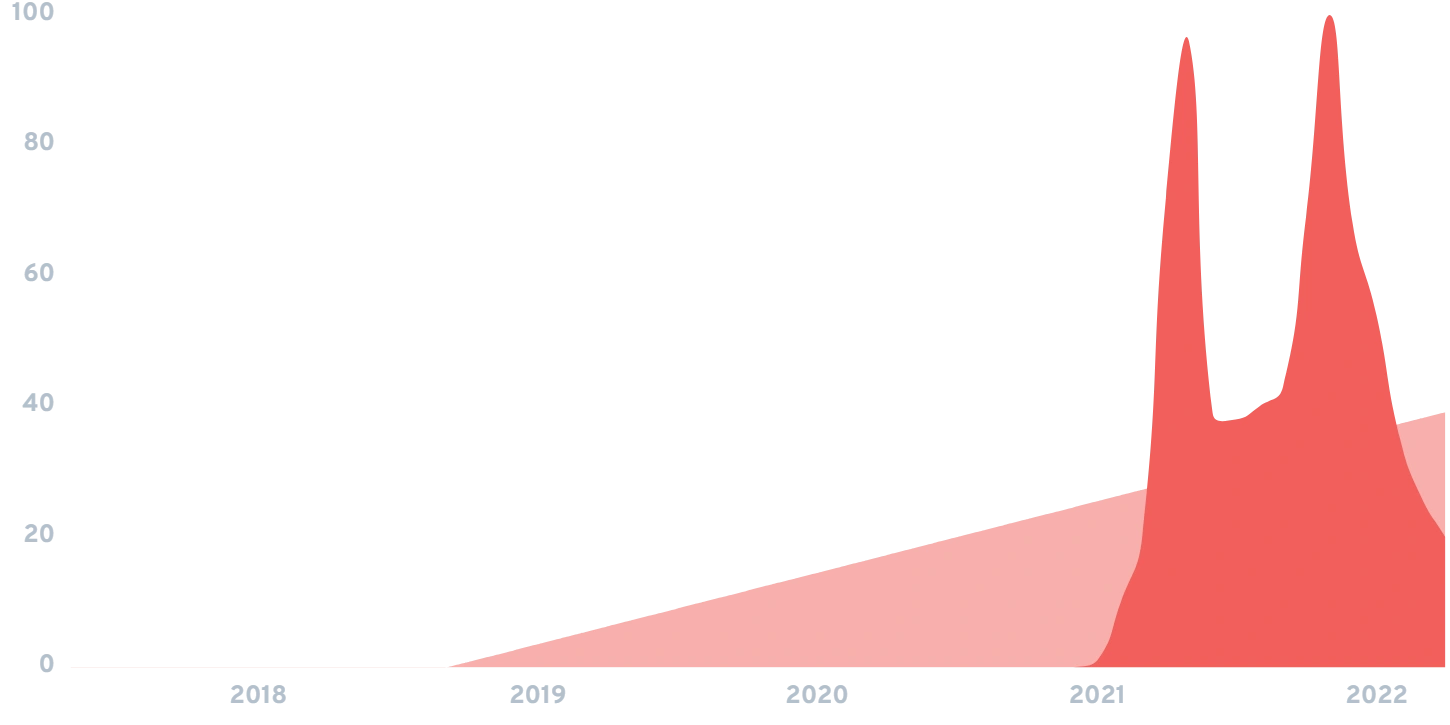

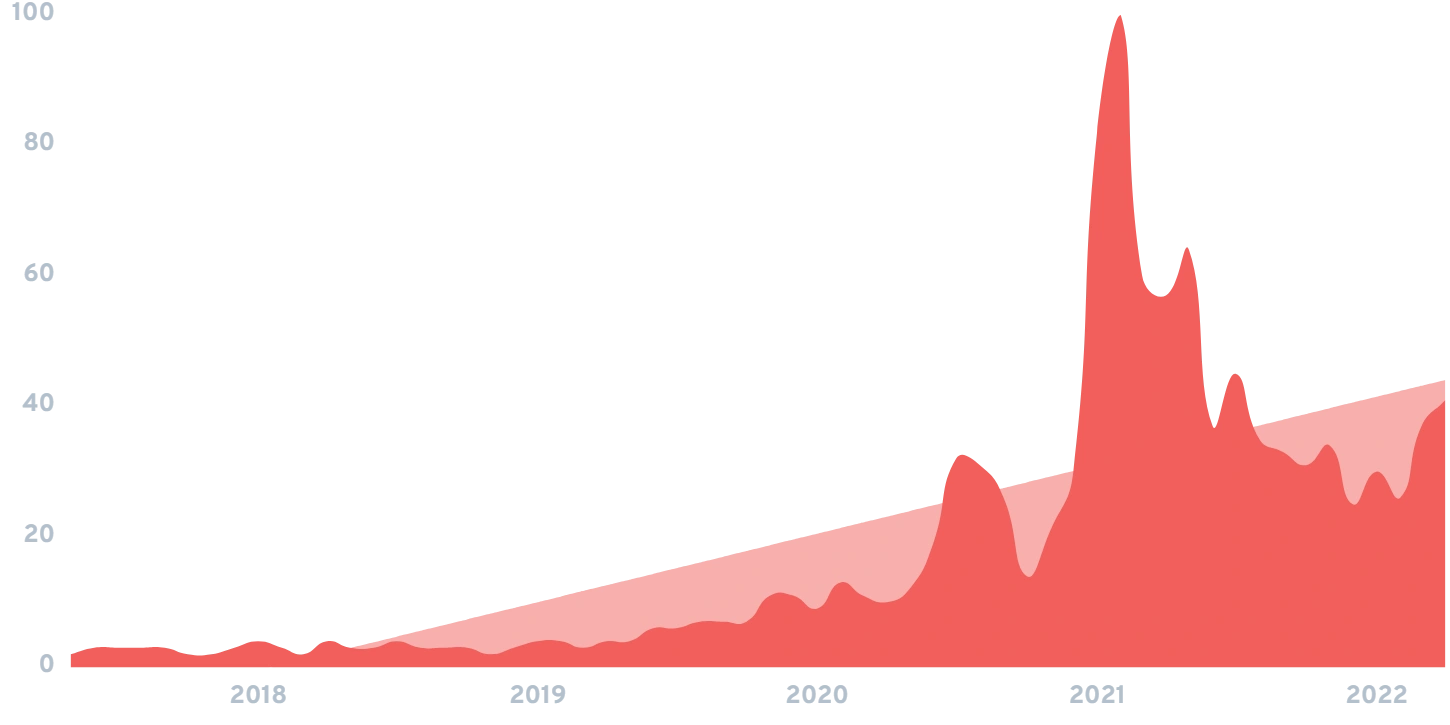

3. SushiSwap

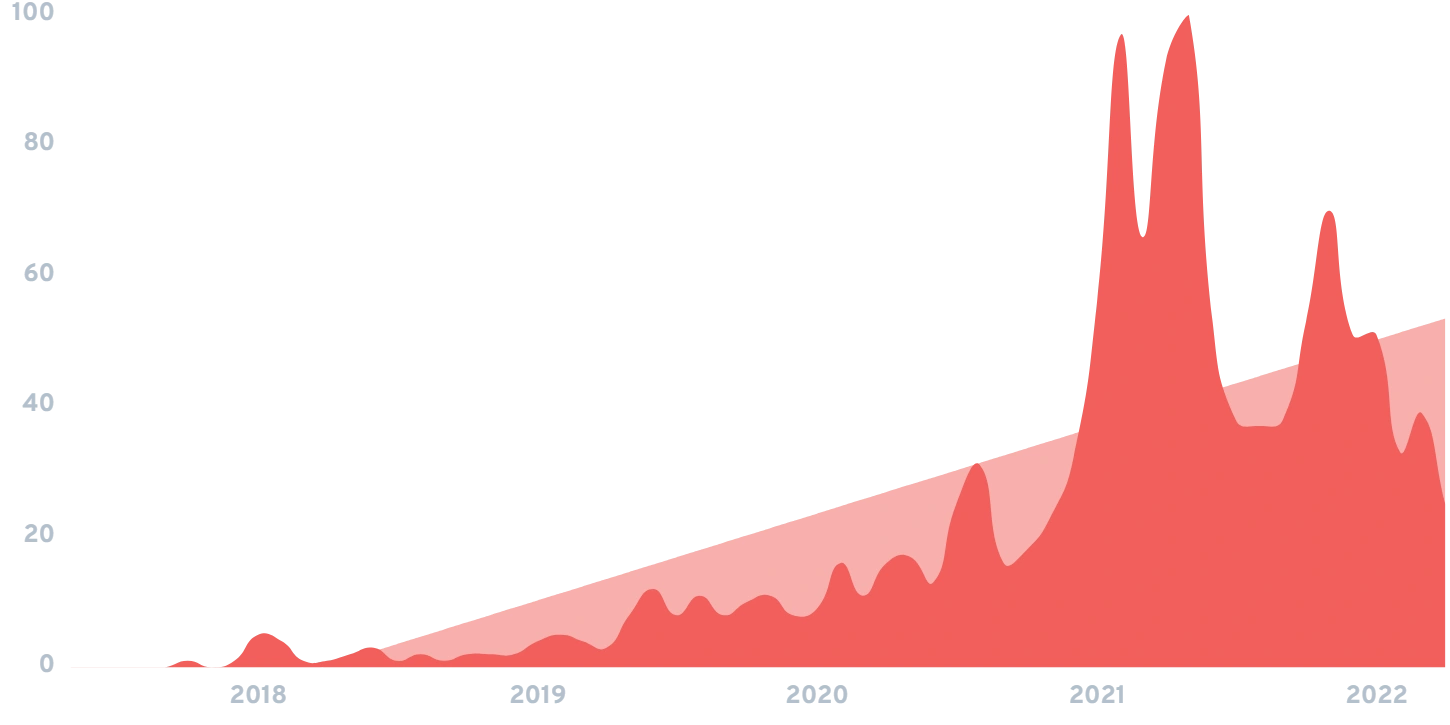

5-year search growth: 3400%

Search growth status: Peaked

ICO Year: 2020

Market Cap: $460M

What it is: SushiSwap is another AMM (automated market maker) that lets users trade crypto without any middlemen. The whole platform runs via mathematical formulas, smart contracts, and a smooth UX. Users can provide liquidity into pools and earn yield, borrow, lend, stake, and even seamlessly swap tokens.

SushiSwap has over 2,000 liquidity pairs, has done over $126B in volume, and provides over $4.7B in liquidity.

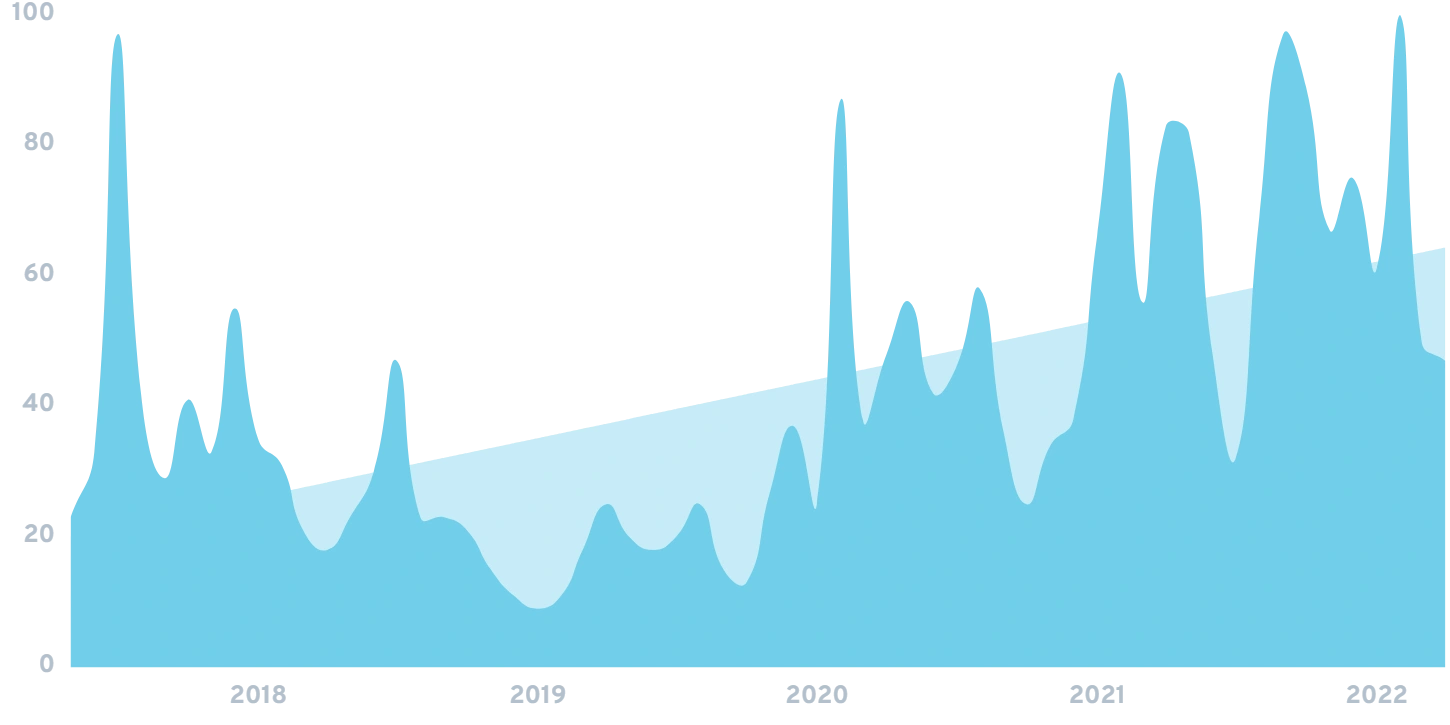

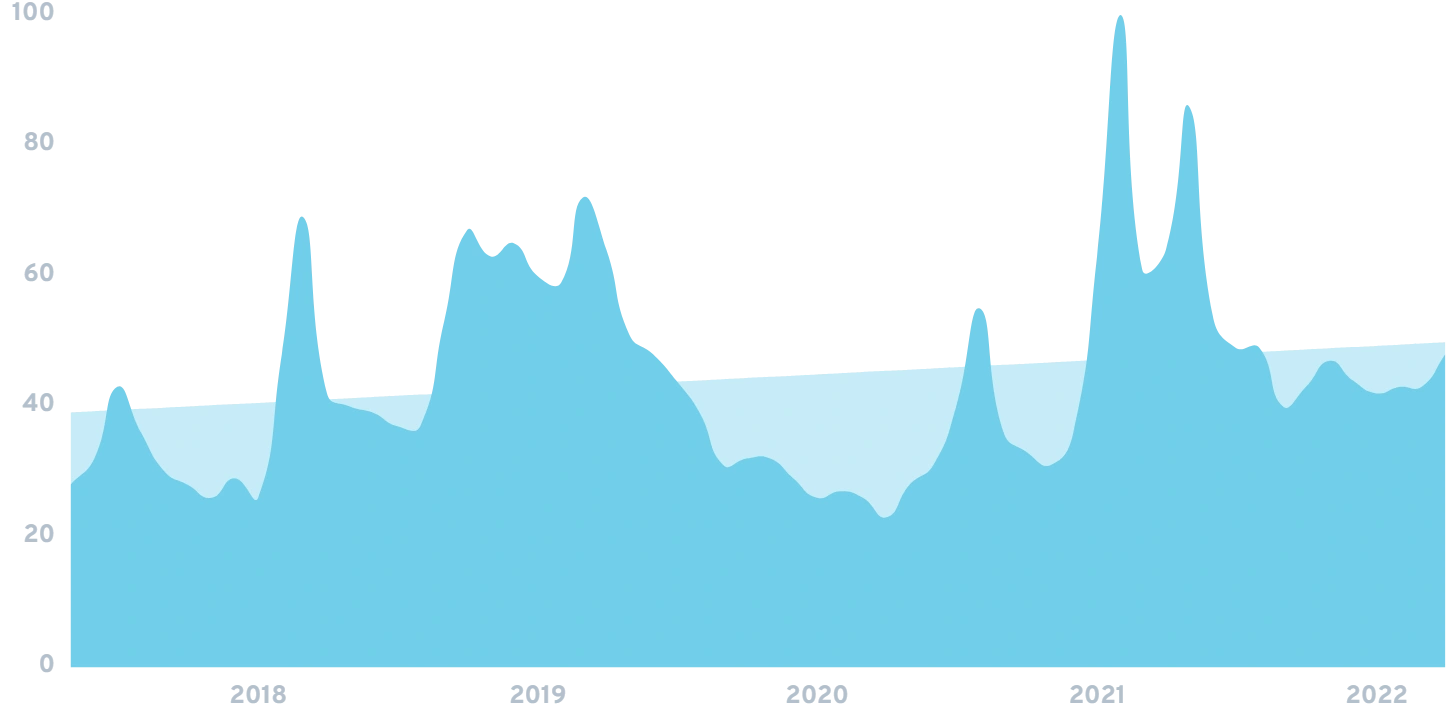

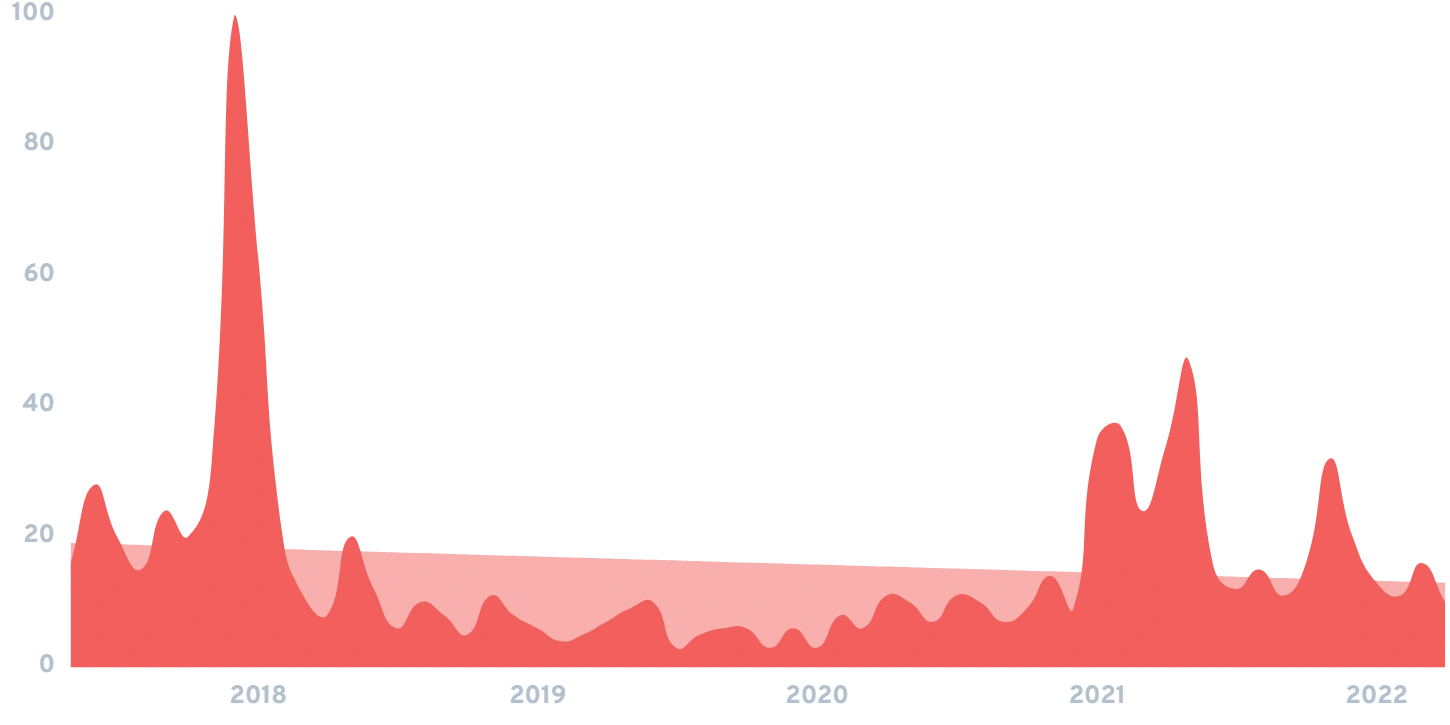

4. Tezos

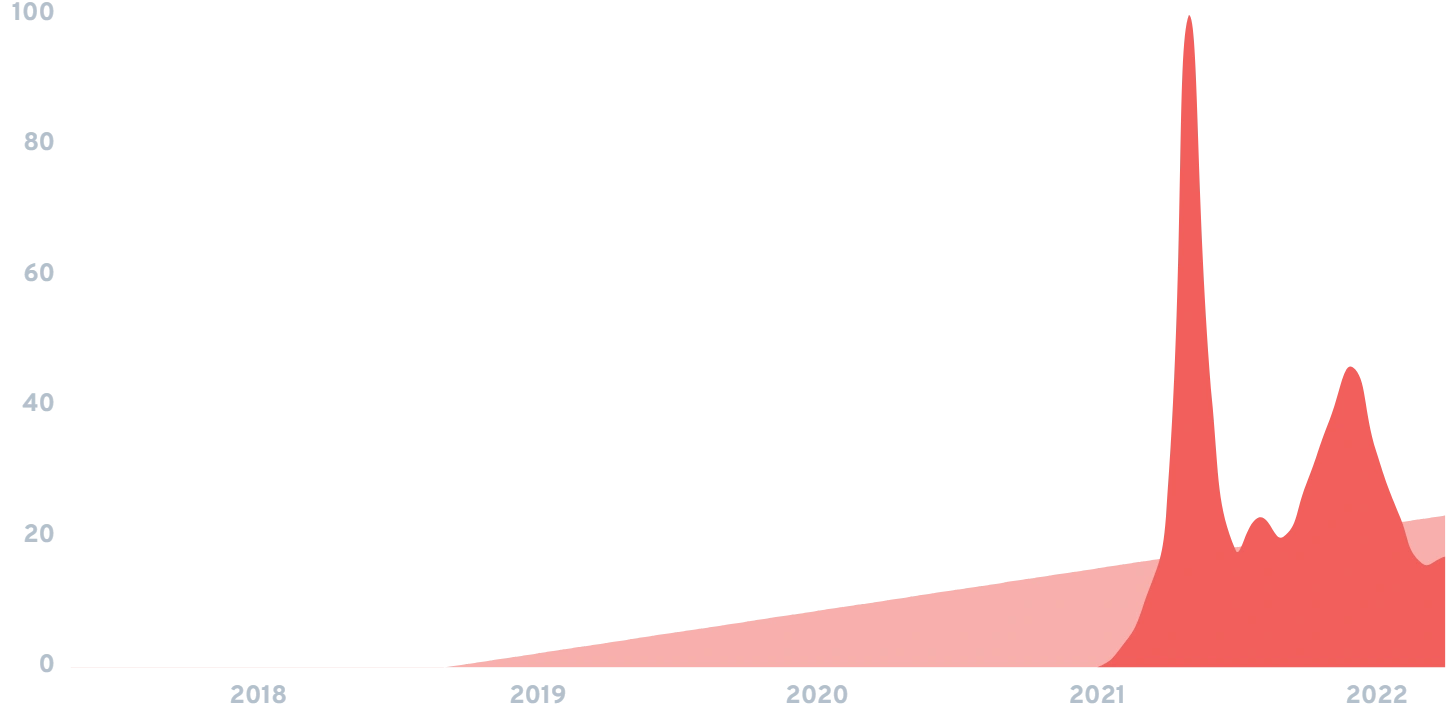

5-year search growth: 104%

Search growth status: Regular

ICO Year: 2018

Market Cap: $2.8B

What it is: As one of Ethereum’s biggest competitors, Tezos has made noise in the crypto market for already being a Proof of Stake blockchain, a state that Ethereum is aggressively trying to get to.

Tezos has gone the more corporate route by sponsoring Red Bull’s Formula 1 team, and hiring ad agencies to push their decentralized mission forward. In July 2017 the Tezos team raised over $200M in their ICO, backed by power player investors like Tim Draper.

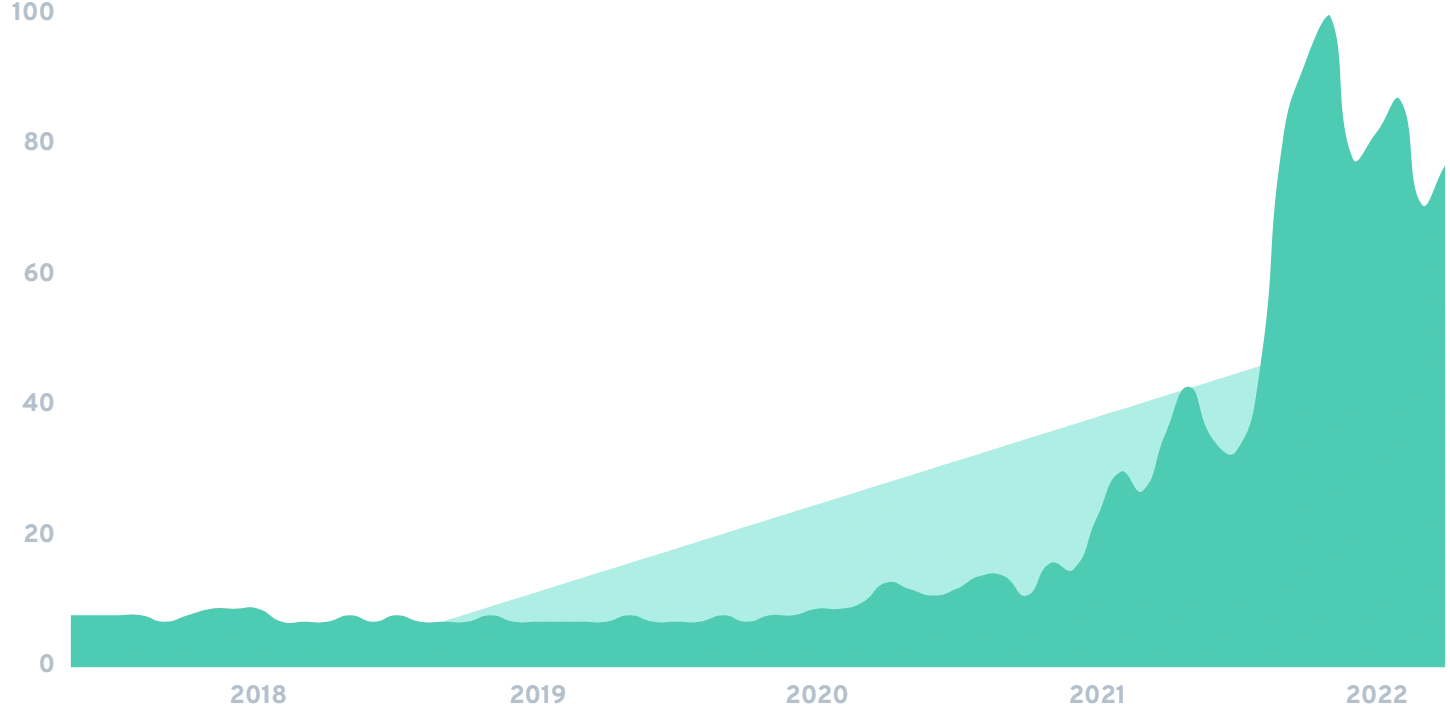

5. Celsius

5-year search growth: 458%

Search growth status: Exploding

ICO Year: 2017

Market Cap: $530M

What it is: Celsius is a “centralized” blockchain lending platform with a community of over 1M users. Each user can earn APRs up to 17% across a variety of coins. The concept is simple: Users deposit coins like BTC, ETH, or stablecoins which Celsius then lends out. Then, users are paid interest on their crypto weekly.

With $26.4B in assets as of October 2021, 109K BTC held on the platform, and $951M paid out to users since 2018, Celsius is one of the leading contenders for domination in the CeFi space, although regulators are taking a hard look at Celsius and other centralized crypto lending platforms.

6. 1Inch

5-year search growth: 138%

Search growth status: Exploding

ICO Year: 2020

Market Cap: $660M

What it is: Without diving too far down the crypto terminology rabbit hole, 1Inch is a DEX (Decentralized Exchange) aggregator, syncing various DEXs together to provide users with the most cost-efficient and secure transactions between exchanges. 120 different sources across 5 networks are supported by 1Inch.

Over 820K users call 1Inch home, and over $85.8B of volume has been transacted on their network so far.

7. PancakeSwap

5-year search growth: 1900%

Search growth status: Peaked

ICO Year: 2020

Market Cap: $2.7B

What it is: PancakeSwap uses an automated market maker (AMM) model. The total value locked in PancakeSwap is currently at $3.857B, which has grown by nearly 10x since February 2021.

8. AAVE

5-year search growth: 71%

Search growth status: Regular

ICO Year: 2017

Market Cap: $2.5B

What it is: AAVE is one of the original “DEX” (decentralized exchanges) where folks can either borrow or deposit funds on the platform. Users that deposit crypto provide critical liquidity to the market, and borrowers can take out over collateralized loans on the platform. The most interesting piece is that all of this is done without middlemen. Instead, AAVE’s DeFi features are done through smart contracts on Ethereum.

The total market size on AAVE is over $19B.

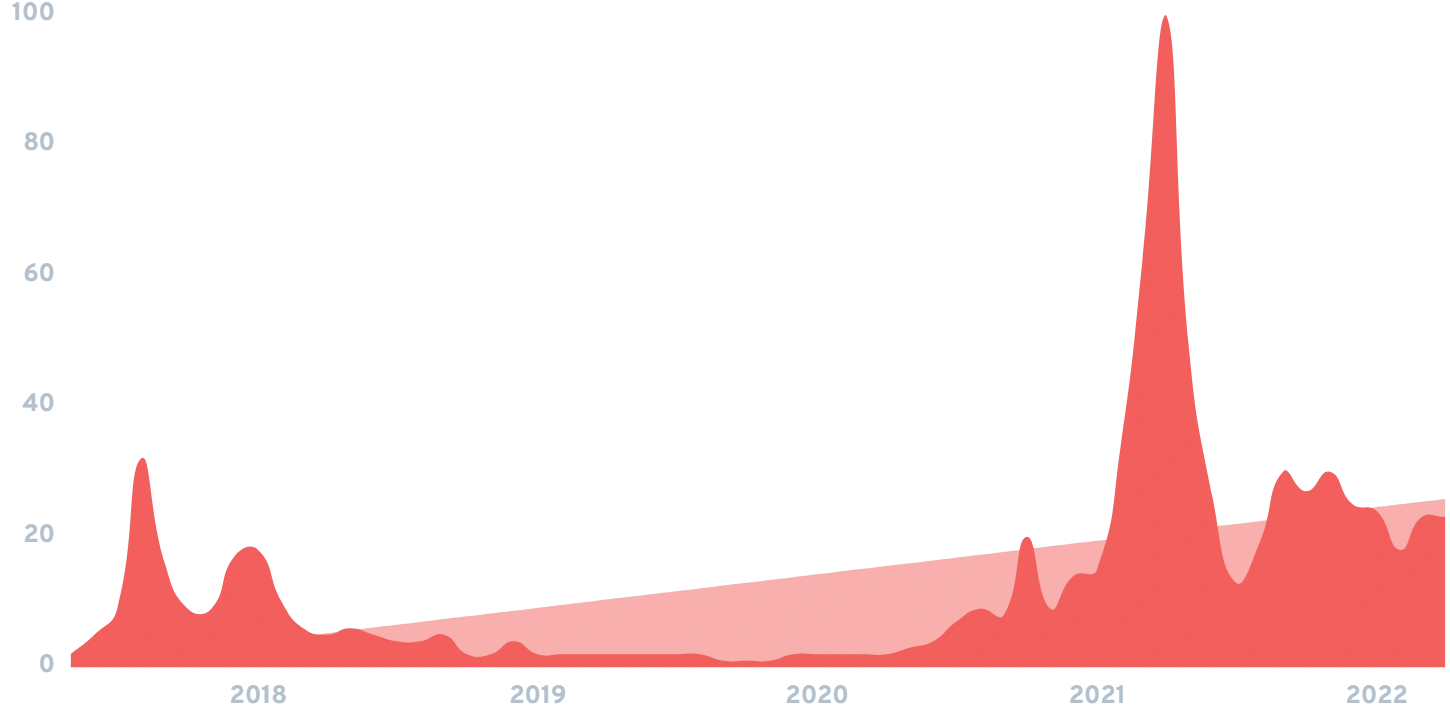

9. ChainLink (LINK)

5-year search growth: 360%

Search growth status: Peaked

ICO Year: 2017

Market Cap: $6.5B

What it is: Importing data from the outside world is critical to having a functioning blockchain, and that’s exactly what ChainLink accomplishes. LINK works as an “oracle” that facilitates the flow of trusted outside data onto the Ethereum blockchain, and vice versa.

The tokens themselves act like data vessels that feed the data onto smart contracts and reward node operators of LINK who hold large amounts of the token to help the oracles function.

10. Enjin

5-year search growth: 1700%

Search growth status: Peaked

ICO Year: 2017

Market Cap: $1.3B

What it is: Enjin has doubled down on the NFT craze, pivoting their coin to be entirely focused on making NFTs accessible for developers, individuals, and companies. The team behind Enjin started off in the gaming vertical and branched out from there. Forbes estimates that the Enjin Network has over 20M users across more than 250K gaming communities. The Enjin Wallet has been a sterling success with over 2.3 million downloads since its release.

The end goal is to have an entire environment living on the Enjin blockchain that allows users to trade, swap, develop, and create NFT projects in a climate-friendly, carbon-neutral way.

11. Dai

5-year search growth: 2400%

Search growth status: Peaked

ICO Year: 2017

Market Cap: $9.1B

What it is: Stablecoins, what are they and why do they matter? They are cryptocurrencies that are pegged 1:1 to the United States Dollar, offering stability in the incredibly volatile ecosystem that is crypto. Stablecoins like Dai are the oil of the DeFi system, facilitating lending, borrowing, and trading on a massive scale.

Maker is the community behind Dai. MKR token holders govern the Maker Protocol, which is responsible for the Dai smart contracts.

12. Polygon (MATIC)

5-year search growth: 1600%

Search growth status: Peaked

ICO Year: 2019

Market Cap: $11.1B

What it is: Polygon solves critical problems that have emerged on Ethereum, including high gas fees (what users pay to power transactions on Ethereum), uncertainty when sending transactions, among other issues.

Polygon solves this problem by connecting various ETH compatible blockchains together without sacrificing speed, scalability, while also drastically lowering gas fees and improving the user experience. Over 1200 DApps (decentralized applications) are live on Polygon’s Proof of Stake network.

13. Axie Infinity (AXS)

5-year search growth: 1300%

Search growth status: Peaked

ICO Year: 2020

Market Cap: $2.9B

What it is: Everyone loves Pokemon right? Imagine Pokemon on a blockchain, where users can own their creatures on a tamper-proof ledger for eternity as NFTs. The community that holds AXS (the native coin of Axie) benefits financially from Axie’s growing popularity and also gets to decide on the future roadmap of the project.

Andreeson Horowitz recently led a $152M Series B which values the Vietnam-based project at a staggering $3B.

14. Filecoin (FIL)

5-year search growth: 1050%

Search growth status: Peaked

ICO Year: 2017

Market Cap: $3.8B

What it is: Filecoin’s case for real-world utility might just be one of the most compelling out there, offering blockchain-based digital storage to users who rent out unused hard drive space from other users. Renting out unused hard drive space yields Filecoin, which has skyrocketed to a price of $62.76 per coin due to the project’s promise.

15. FTX Token (FTT)

5-year search growth: 862%

Search growth status: Exploding

ICO Year: 2019

Market Cap: $5.9B

What it is: FTX is one of the leading global cryptocurrency exchanges similar to Binance, with operations in most countries worldwide and subsidiaries in markets like the United States. FTX specializes in the derivatives market.

The FTT token offers discounts on trades and transactions to power users of the FTX exchanges, as well as the opportunity to participate in leveraged trades on the FTX platform.

16. Stellar (XLM)

5-year search growth: -11%

Search growth status: Peaked

ICO Year: 2014

Market Cap: $5B

What it is: Low-cost money transfers across borders are a massive obstacle for many. Western Union has been the de facto for years when it comes to remittances back to countries like Mexico, the Philippines, and other transfer hot spots.

Stellar, founded by former Ripple executive Jeb McCaleb, is a cryptocurrency that facilitates cross-border transactions between any currency pairs.

17. Monero (XMR)

5-year search growth: 0%

Search growth status: Peaked

ICO Year: 2014

Market Cap: $5B

What it is: Monero is a “privacy coin” similar to Zcash, using 3 privacy technologies to fully mask all transactions on the network. “Stealth addresses, ring signatures, and RingCT” block the sender, amount, and receive in every transaction. This makes Monero a potent blockchain that doesn’t ever compromise on complete privacy.

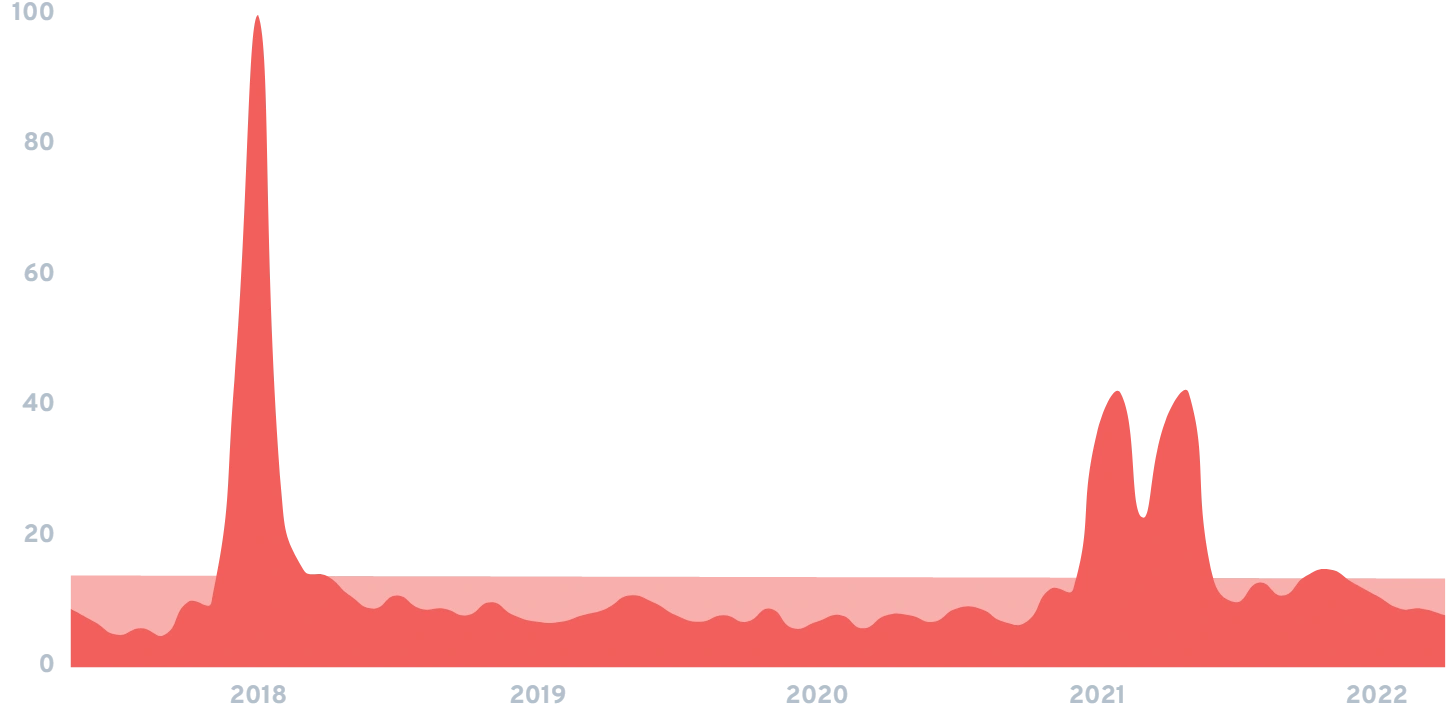

18. The Graph (GRT)

5-year search growth: 900%

Search growth status: Peaked

ICO Year: 2020

Market Cap: $1.8B

What it is: With all of the data being stored on blockchains like Ethereum, finding and organizing data is one of the biggest gaps that exists as blockchains rise in prominence. The Graph is a protocol that indexes and queries networks like Ethereum while making the data readily available to users.

Indexing is one of the costliest activities to perform from a resource and engineering standpoint, and The Graph aims to bring simplicity to indexing behemoth blockchains. Currently, only Ethereum is supported though The Graph is adding further chains in the future.

19. Synthetix Network Token (SNX)

5-year search growth: 1950%

Search growth status: Peaked

ICO Year: 2017

Market Cap: $721M

What it is: The total size of the derivatives market is estimated to be $1.2 quadrillion dollars, which is 10x the size of the world’s total GDP. The Synthetix team’s thesis is built around a crypto alternative to derivatives trading that is completely autonomous, describing itself as a “derivatives liquidity protocol”.

The total value locked in SNX is over $840M dollars as of October 2021.

20. Zcash (ZEC)

5-year search growth: -37%

Search growth status: Peaked

ICO Year: 2016

Market Cap: $2.3B

What it is: One of the hallmarks of cryptocurrency (and the bane of regulators everywhere) is the promise of true privacy for transactions). Zcash is based on Bitcoin’s codebase but contains some key differences, mainly “zero-knowledge” technology that shields key data from scrutiny.

Conclusion

There’s no doubt that cryptocurrency is one of the most, if not the most exciting areas of technology happening right now. With possible use cases ranging from gaming, music rights, creating a “metaverse” (a la Ready Player One), a new global financial system, and beyond, the possibilities are truly mind-boggling.

You’ll want to stay tuned on our expanding list of trending cryptocurrencies as they continue to make waves globally and disrupt new industries.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more