Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Features

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

8 Top Qualitative Market Research Companies (2024)

Qualitative data is an invaluable part of any market research initiative—from improving brand positioning to developing a new marketing strategy,

Whether you have a large customer base you plan to survey directly, or need some help assembling a research panel, these are the top qualitative market research companies right now:

1. GfK: Best For Retail Market Research

GfK, or Growth for Knowledge, is a global market research firm. They provide qualitative automotive, tech, media, and retail market research.

If you’re in charge of new product development for a large retailer, for example, you can use GfK’s reporting to better understand the influences and motivations behind your shoppers’ purchasing choices.

This includes reviewing data about:

- How different generations view economic changes

- The brand values that are most important to different demographics

- Consumer behavior and brand perception in specific markets

- Common consumer sentiment associated with your top competitors

GfK procures this data in a few different ways, including through:

- General population surveys

- Customized focus groups

- Lookalike audience interviews

- In-person retail mystery shoppers

You can get a taste of what GfK offers on their blog, which highlights changing consumer trends related to:

- Retail sales

- Technology innovation

- Omnichannel marketing

- Sustainable industries

If you’re interested in working with GfK directly to get customized insights about your market or audience, you’ll need to get in touch with the company and arrange a consultation.

2. QualtricsXM: Best For Corporate Research Initiatives

QualtricsXM is a suite of software tools that makes it possible for companies to conduct their own market research initiatives.

You can use Qualtrics to gather data from both internal and external audiences.

It's useful for exploring:

- Employee motivations and emotions

- Customer satisfaction levels before and after a support experience

- Brand reception and perception among a target market segment

- Website usability and users’ frustrations

- Factors influencing a target market’s decision-making process

This is possible thanks to built-in tools that facilitate:

- The creation of online focus groups

- Audience segmentation

- A/B testing

- Competitor benchmarking

If you have a large social media following, customer base, or email list, you might use QualtricsXM to survey your existing audience.

You can still use QualtricsXM if this isn’t the case, though. The company allows its users to purchase access to audience panels—and they’ll even help you run the related online surveys, too.

If you’re interested in using QualtricsXM at your business, you’ll want to get in touch with their team to arrange a demo and price quote.

3. Sago: Best For Researchers and Consultants

Sago delivers qualitative insights to businesses around the world.

Most Sago’s clients fall into one of four industries:

- Consumer packaged goods (CPG)

- Financial services

- Media technology

- Healthcare

However, you can also use Sago’s services to support your own consulting and market research work. If you provide such services to clients, and need additional qualitative data to back up your work, Sago may help.

Sago’s data comes from consumer panels, custom research groups, and online communities.

You can opt to work with the company directly, allowing them to conduct research for you, or take advantage of one of their self-service solutions.

This may make Sago a more accessible data solution for companies that aren’t ready to invest in a full end-to-end solution like that offered by GfK.

Regardless of how you choose to work with Sago, you’ll need to get in touch with their team to discuss options and get a price quote for a done-for-you or DIY solution.

4. Kantar: Best For New Product Development

Kantar is like Sago in that it offers both done-for-you and DIY qualitative research solutions.

You can use Kantar—and the self-service Kantar Marketplace—to collect data for your:

- CPG company

- Fashion brand

- Hospitality business

- Retail store

- Tech platform

- Healthcare network

While you can use Kantar’s data for a variety of marketing and business development initiatives, the company’s qualitative NeedScope solution makes it a good choice when working on brand or product development.

NeedScope measures emotion, which can help you uncover market intelligence insights around:

- What your customers consider to be their top needs and wants

- Consumer sentiment toward brands and products

- How media exposure influences buying decisions

- The emotional impact of branding changes

Access to the tools in Kantar’s DIY Marketplace solution starts at $50,000 per year. For customized, done-for-you research and access to NeedScope, you’ll have to request a quote from the Kantar team.

5. Savanta: Best For Public Affairs Market Research

Savanta is a combination market research agency and advisory firm—so they’re a good choice if you want actionable guidance about how to use data.

Like Ipsos, Savanta provides market research support for public affairs initiatives. Savanta takes this one step further, though, by giving its customers access to panels consisting of:

- Members of the U.K. Parliament (both House of Commons and House of Lords)

- Members of the Scottish Parliament

- Members of the Senedd (Wales)

- Town-level Councilors in the U.K.

- Members of the European Parliament

If your work could benefit from the insights of U.K. and European government officials, then Savanta is the clear choice.

It’s important to note that you can’t access these parliamentary panels on demand or with custom survey questions.

Instead, Savanta surveys government panelists on a regular schedule and produces reports that its clients can view.

The company’s services work the private sector, too, as Savanta offers solutions for:

- Agencies

- Consulting firms

- B2B companies

- Financial groups

- Consumer-facing brands

Savanta does put together audience panels for custom private sector research, and can help you explore things like:

- How consumers feel when interacting with a digital ad

- What drives high-income consumers to purchase luxury products

- Emotions experienced by restaurant patrons

- What’s important to Gen Z consumers

A selection of Savanta's reports are available for download on their website. To get access to custom private sector solutions or data gathered from public officials, you’ll need to contact the Savanta team for a price quote.

6. Discuss: Best For Customer Surveys

Discuss is similar to Qualtrics—it’s another online research tool that makes it easy to conduct your own surveys.

The company’s software helps you:

- Collect real customer feedback

- Conduct real-time, in-depth interviews

- Get feedback submitted asynchronously by your consumers

- Organize your video and text findings

That said, you won’t be completely on your own when using the Discuss platform. The company offers support for an array of administrative functions related to your research, including:

- Project management

- Interview scheduling

- Question writing

- Response translation

- Panel moderation

- Transcription

- Report creation

- Tech troubleshooting

This flexibility makes it a nice option for smaller teams that may not have the in-house resources to manage every aspect of a qualitative research project—or the budget to outsource the work entirely.

Unlimited access to the Discuss technology starts at $2,500 per month. Hands-on help from the Discuss team bumps this price up—you’ll need to request a demo and a price quote to learn more about your available options.

7. User Interviews: Best For Research Panel Development

User Interviews helps companies build paid survey panels for various market research projects.

If you like the do-it-yourself nature of QualtricsXM and Discuss, but don’t have easy access to panelists or survey respondents, then User Interviews may be a suitable solution.

You can use the platform’s Recruit feature to find participants based on their:

- Work industry

- Job title

- Location

- Age

- Marital status

- Education level

You can also narrow lists of participants further based on the technology they’re using, such as Android phone vs. iPhone users.

The company provides support in the form of project coordinators who can help you assemble the best panel for your research. From there, though, the process is self-directed.

You’ll need to have a survey or test prepared, and have a way of organizing and interpreting the results.

Access to User Interviews’ database of panelists starts at $45 per session, plus any incentives you pay out to the participants.

And if you do have your own audience base to survey, you can use the platform’s Research Hub tool to survey 100 people for free.

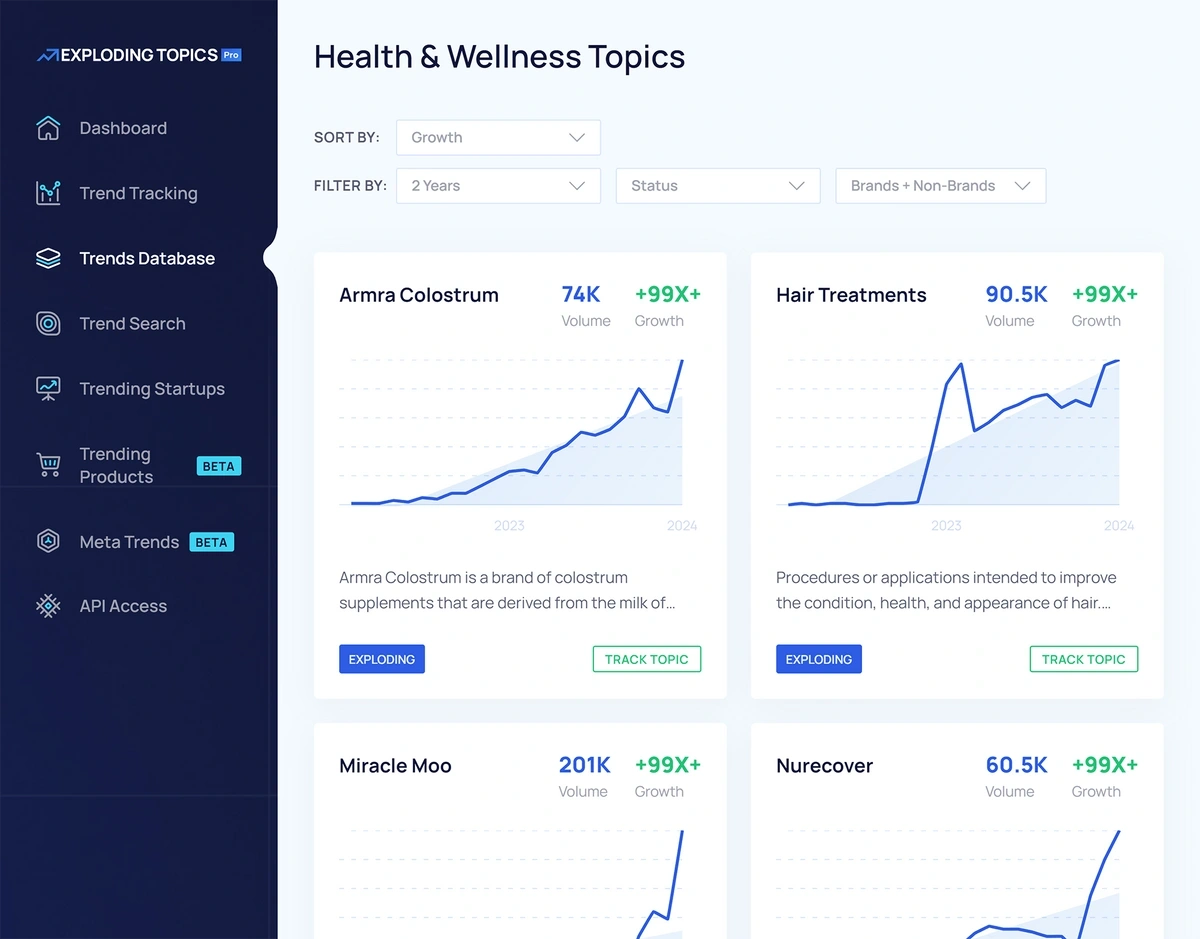

8. Exploding Topics: Best For Preliminary Research

Exploding Topics is another self-guided solution that can help you round out your market research initiatives.

It’s not a done-for-you service like Savanta or a tool to facilitate qualitative interviews, like Discuss. Exploding Topics is, at its core, a trend spotting tool—and provides valuable insights that can help you figure out what kinds of research you should conduct.

You can use Exploding Topics to see data about:

- How popular an app, product, or company is

- Industry verticals that are rising and falling in popularity

- Fast-growing startups in your industry—and how much funding they’re getting

- Which social media platforms attract audiences interested in a specific topic

These insights can help you better focus your attention on the platforms, groups, and trends that are most relevant to your business. You’ll have a better understanding of which audiences to target, how to craft your segments, and what things to ask panel respondents about.

This makes Exploding Topics a useful companion tool for anyone running their own research studies using a platform like Discuss, User Interviews, or Qualtrics.

You can begin exploring the Exploding Topics database for free—and access to all our insights, plus additional tools, starts at just $39 per month. Plus, it’s just $1 for your first two weeks of Exploding Topics Pro, so you can try it out with no risk.

Conclusion

For small market research projects, or limited budgets, start by surveying your existing customers or tap into a database like Exploding Topics to gather insights. From there, you can build lookalike audience panels with tools like User Interviews and Discuss.

As your research needs grow, you may want to consider exploring some of the more robust market research services on this list—like GfK, Kantar, and Savanta. These companies can provide more guided insights and done-for-you solutions that allow your team to focus on other work.

The key is choosing a reliable service—whether DIY or full service—that will help you gather insights from the most important audience: your customers, and people like them.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more