Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

What does post-pandemic consumer behavior look like in 2025?

The COVID-19 pandemic turned society upside down.

Lockdowns and restrictions radically changed consumer behavior, and experts predicted that things would never go back to the way they were before.

Now, more than 2 years on from the day the World Health Organization declared the pandemic over (May 5, 2023), I can assess the impact on consumer behavior with a little more distance.

In 2025, which consumer behaviors has the pandemic truly influenced long-term? Which have bounced back to something closer to the pre-pandemic norm? And what entirely new behaviors have emerged post-pandemic?

E-commerce thrives post-pandemic

Consumer behavior was shifting toward E-commerce even before the pandemic hit. In February 2019, online shopping overtook physical “general merchandise” sales in the US for the first time.

But Covid certainly caused a major shift. E-commerce as a percentage of all retail sales in the US stood at 11.9% in March 2020, but had jumped to 16.3% by June.

That stabilized down to 14.9% in September 2020, but it has been creeping back up. In 2025, E-commerce as a percentage of total retail is now almost at the peak levels seen early in the pandemic.

Here’s how E-commerce has changed as a percentage of total commerce in the US since December 2019:

| Date | E-commerce as % of total commerce in the US |

| December 2019 | 11.2% |

| March 2020 | 11.9% |

| June 2020 | 16.3% |

| September 2020 | 14.9% |

| December 2020 | 15.0% |

| March 2021 | 14.9% |

| June 2021 | 14.6% |

| September 2021 | 14.5% |

| December 2021 | 14.6% |

| March 2022 | 14.4% |

| June 2022 | 14.2% |

| September 2022 | 14.5% |

| December 2022 | 14.6% |

| March 2023 | 15.0% |

| June 2023 | 15.3% |

| September 2023 | 15.4% |

| December 2023 | 15.5% |

| March 2024 | 15.9% |

| June 2024 | 16.1% |

| September 2024 | 16.2% |

| December 2024 | 16.2% |

| March 2025 | 16.2% |

Globally, E-commerce sales are expected to hit $7.4 trillion this year. Clothing and shoes are the two most popular E-commerce categories in the US.

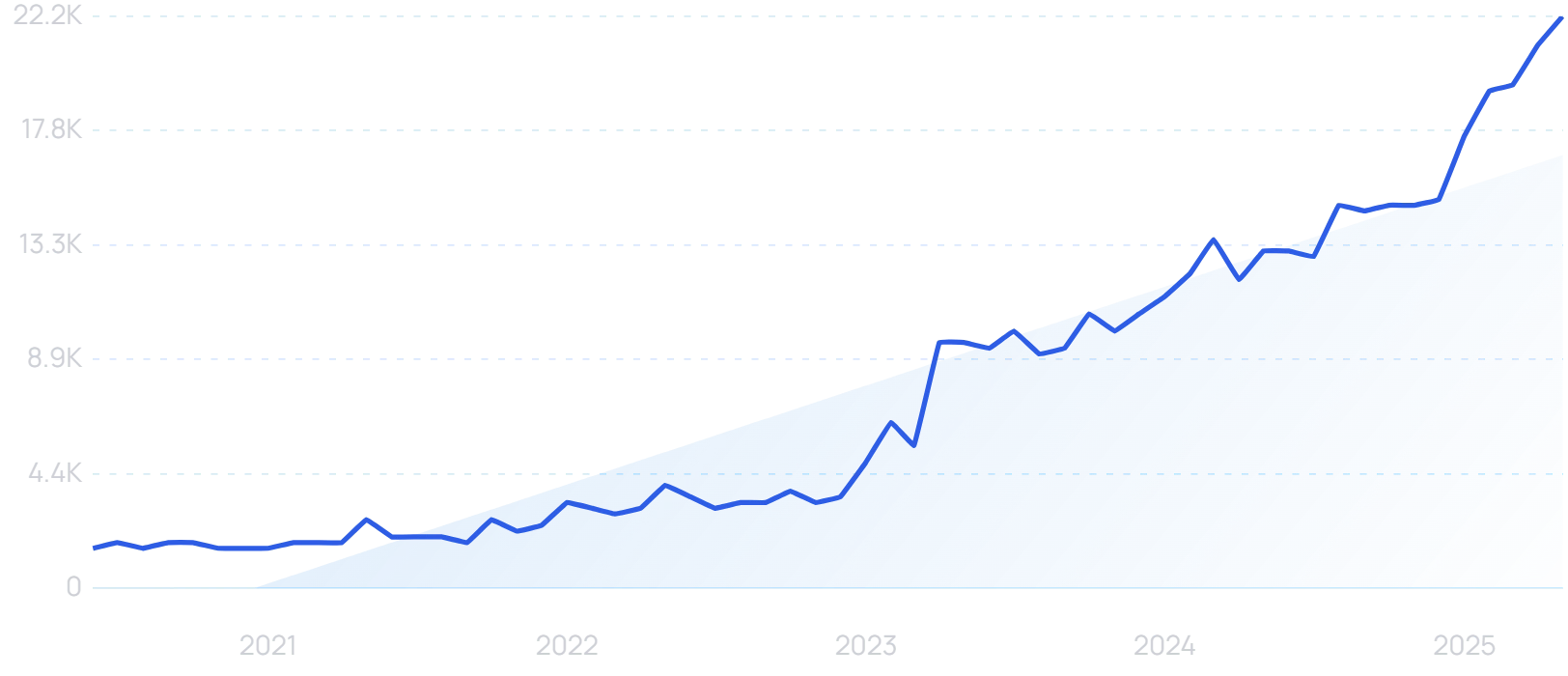

The continued rise of E-commerce has led to a significant rise in E-commerce SEO.

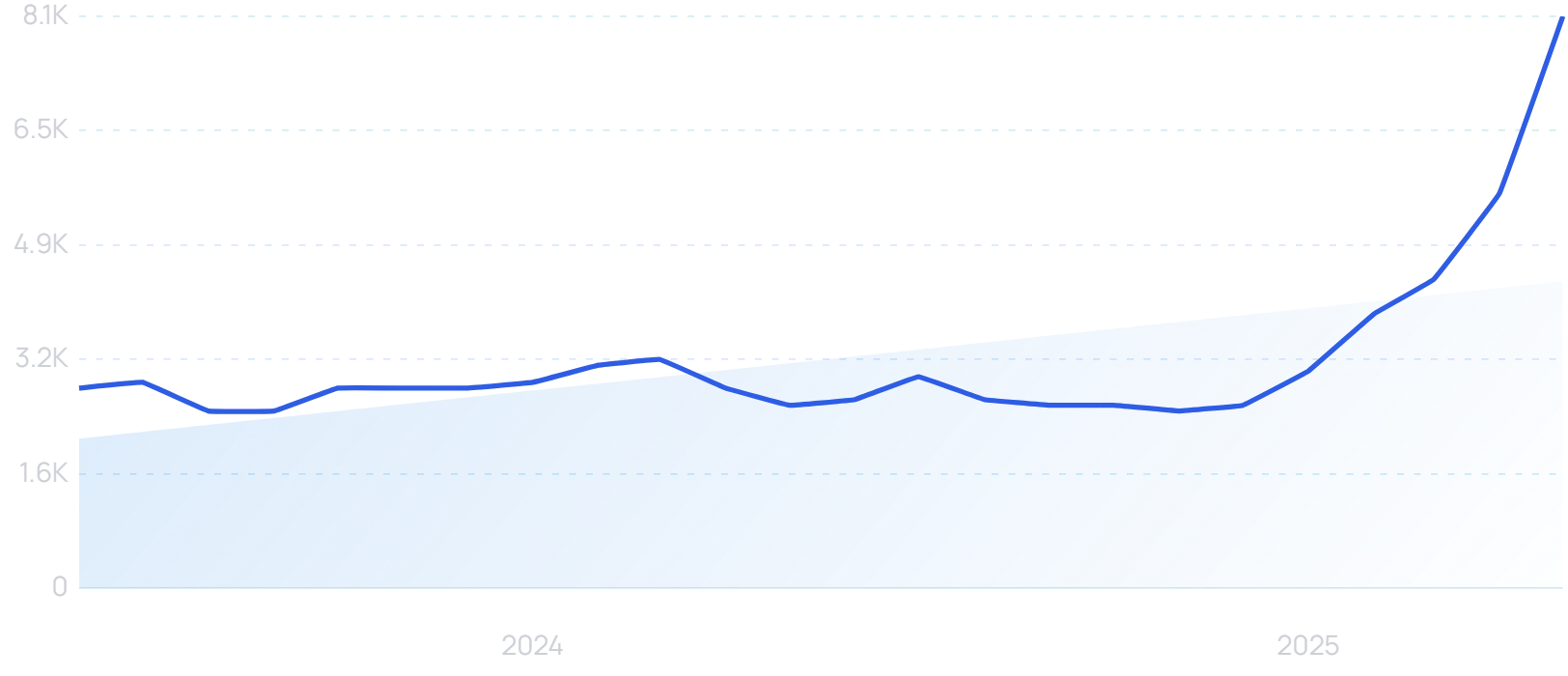

“E-commerce SEO” searches are up by 186% in the last 2 years.

In February 2020, “E-commerce SEO” received around 2,300 searches per month. That figure is now above 8,000.

The Semrush Keyword Magic Tool is really useful for E-commerce SEO. Starting from a root keyword, it generates hundreds of related terms, with data on search volume and competitiveness.

Meanwhile, Exploding Topics Pro is one of the most valuable tools in your E-commerce SEO toolkit.

Unlike something like Google Trends, you can find thousands of trending products without even requiring a starting point for your search. It’s a goldmine of inspiration.

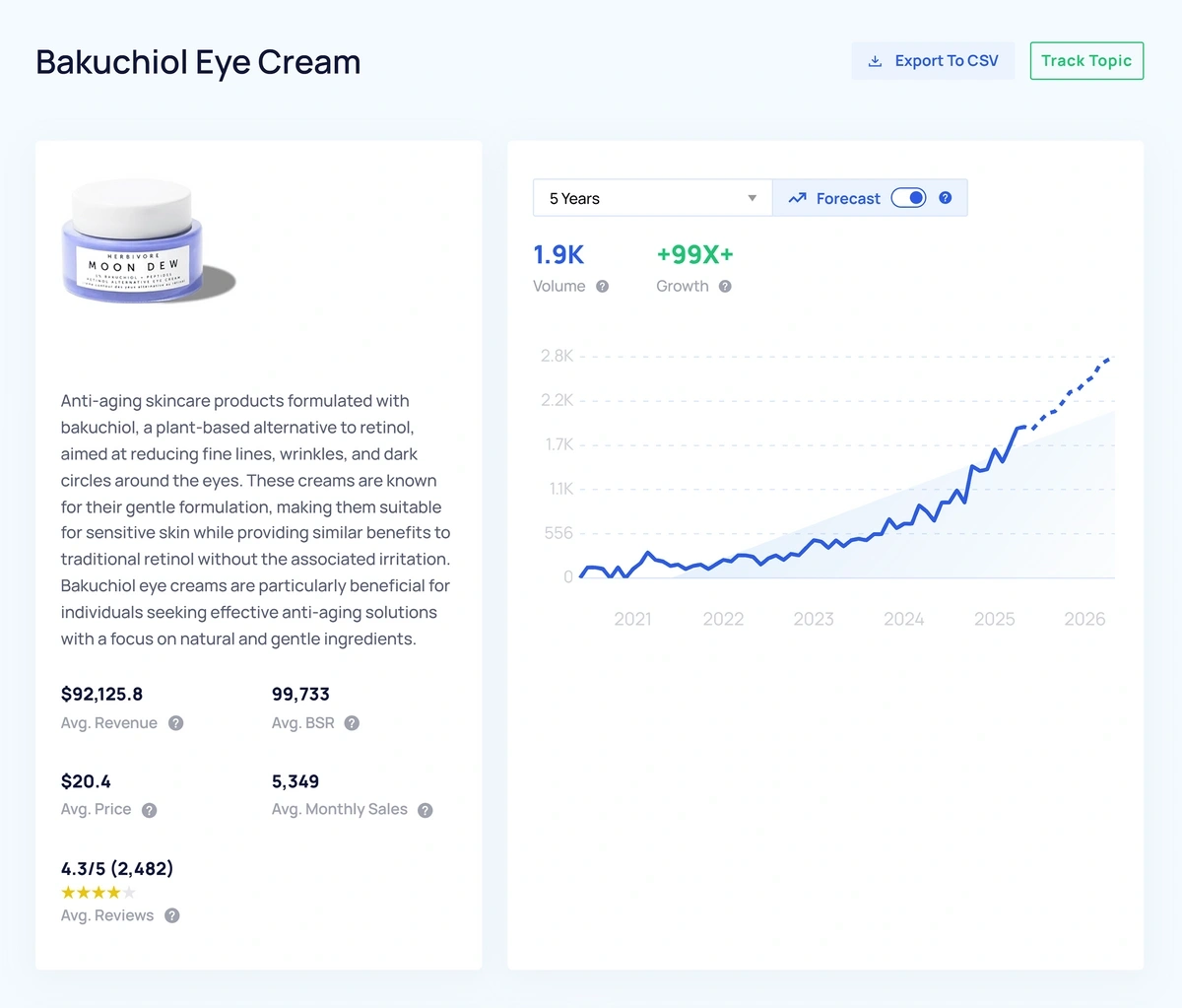

Exploding Topics Pro even gives you helpful product details like average monthly sales and revenue for the top sellers on Amazon.

Product details for “bakuchiol eye cream” within Exploding Topics Pro.

And you can use the Exploding Topics E-commerce Keyword Tool for free.

With E-commerce clearly here to stay post-pandemic, it’s time to invest in the best possible tools.

Remote work changes home consumer behavior

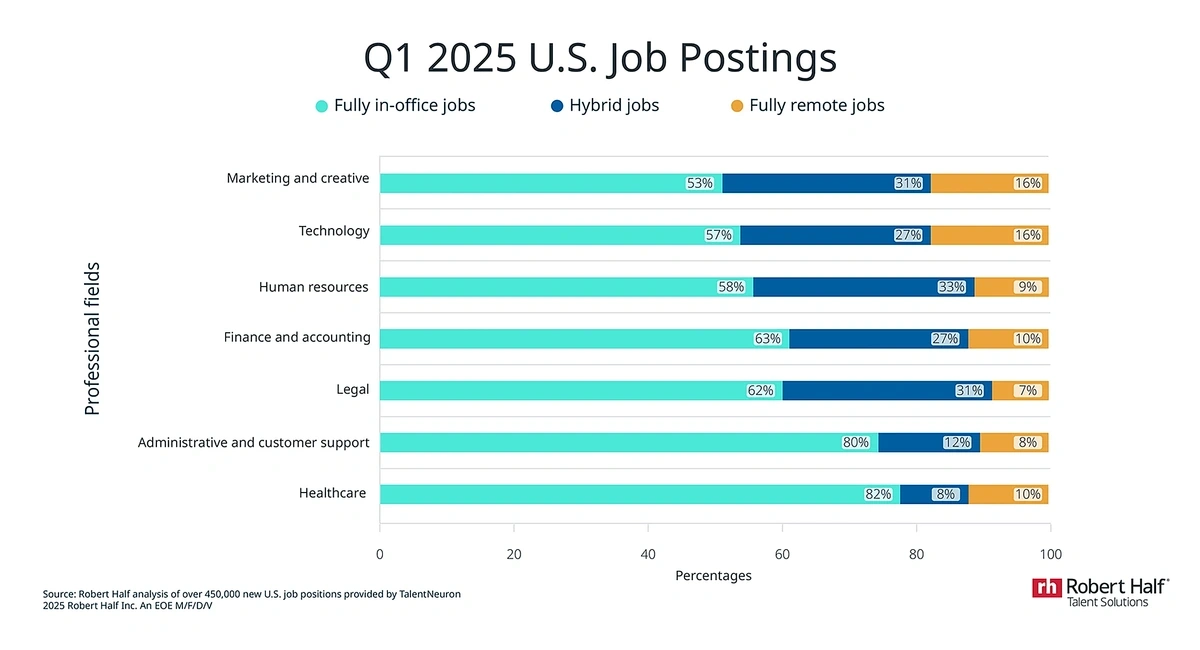

Fully remote work looked set to become the “new normal”, but the post-pandemic reality is rather different. While these jobs do exist in greater quantities than before Covid, they remain the exception rather than the rule.

In a Q1 2025 analysis, even the most heavily remote sectors (marketing/creative and technology) were found to still only offer 16% of openings on a fully remote basis. That figure drops to 7% in the legal field.

However, many jobs do now offer some sort of hybrid element. The average American employee works from home 1.4 days per week, and fewer than 1 in 3 employers insist that workers are in the office every day.

And despite some major organizations issuing return-to-office (RTO) mandates, only 12% of firms that currently offer remote or hybrid work intend to reverse course within the next 12 months.

As a result, consumers continue to spend more time in the home than they did pre-pandemic. That is reflected in their buying habits.

For example, there has been a spike in “renter-friendly” products, as even non-homeowners have invested in their living spaces.

“Renter friendly wallpaper” searches are up by 1186% in the last 5 years.

Overall, the average US consumer spends $1,599 on home decor per year, and $5,635 on renovation and remodeling. Back in 2019, the average annual remodeling spend was $3,000.

Kitchen, decor, appliances and rent-to-own furnishings all saw spending growth in Q1 2025.

As well as general improvements to living spaces, home workers are also continuing to invest in their home office setups.

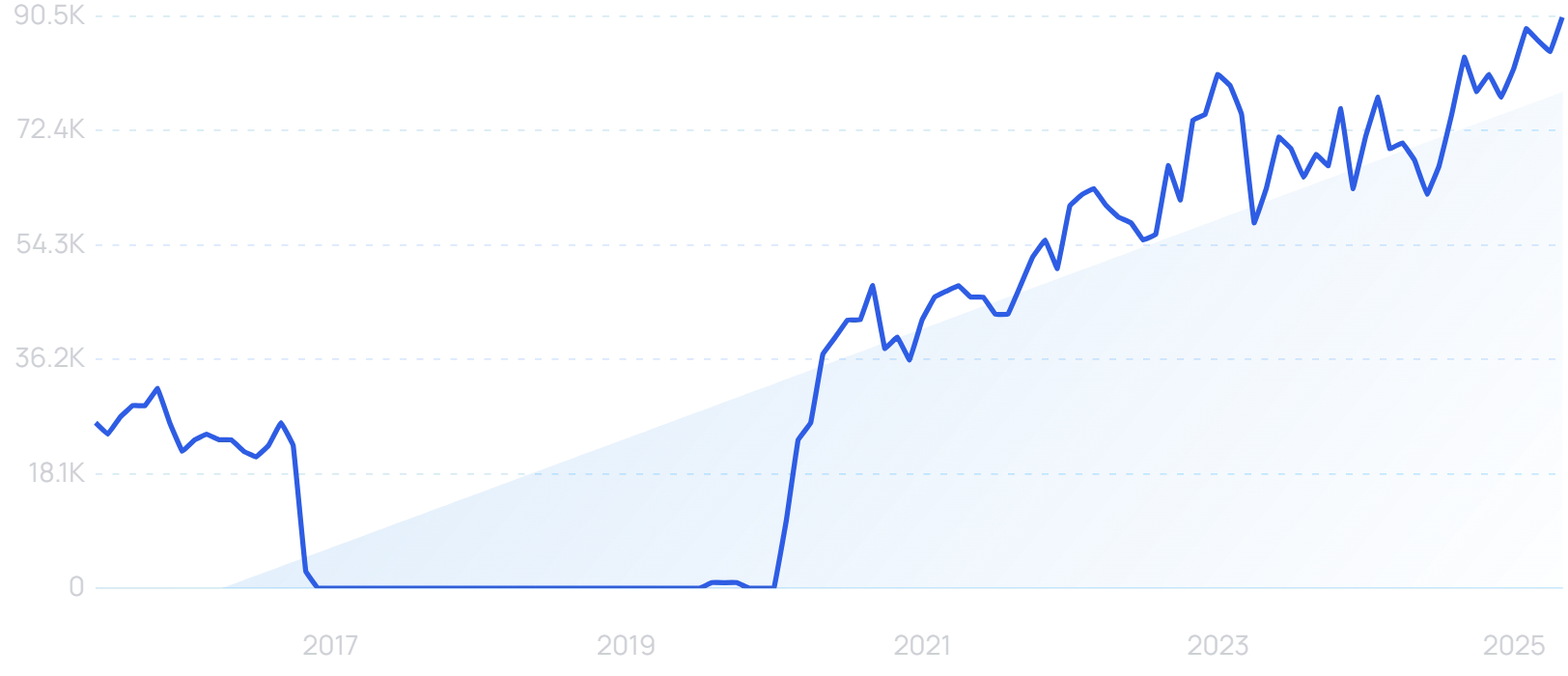

For instance, “ergonomic mouse” searches are significantly higher now than they were at any point during the pandemic.

Searches for “ergonomic mouse” have increased by 245% in the last 10 years.

And when it comes to real estate, space for a home office has remained a significant priority for consumers. 79% of buyers would prefer a home with at least one home office.

Among Gen Z, 90% of buyers want a home office.

Consumers shop across multiple brands and channels

Brand loyalty was wavering pre-pandemic, but Covid effectively severed the link for much of Gen Z.

As of December 2024, 81% of Gen Z and Millennial consumers had switched brands within the past year. Only 63% of Boomers had done the same.

For instance, fast delivery went from desirable to essential almost overnight. That consumer mindset has not entirely reset post-pandemic.

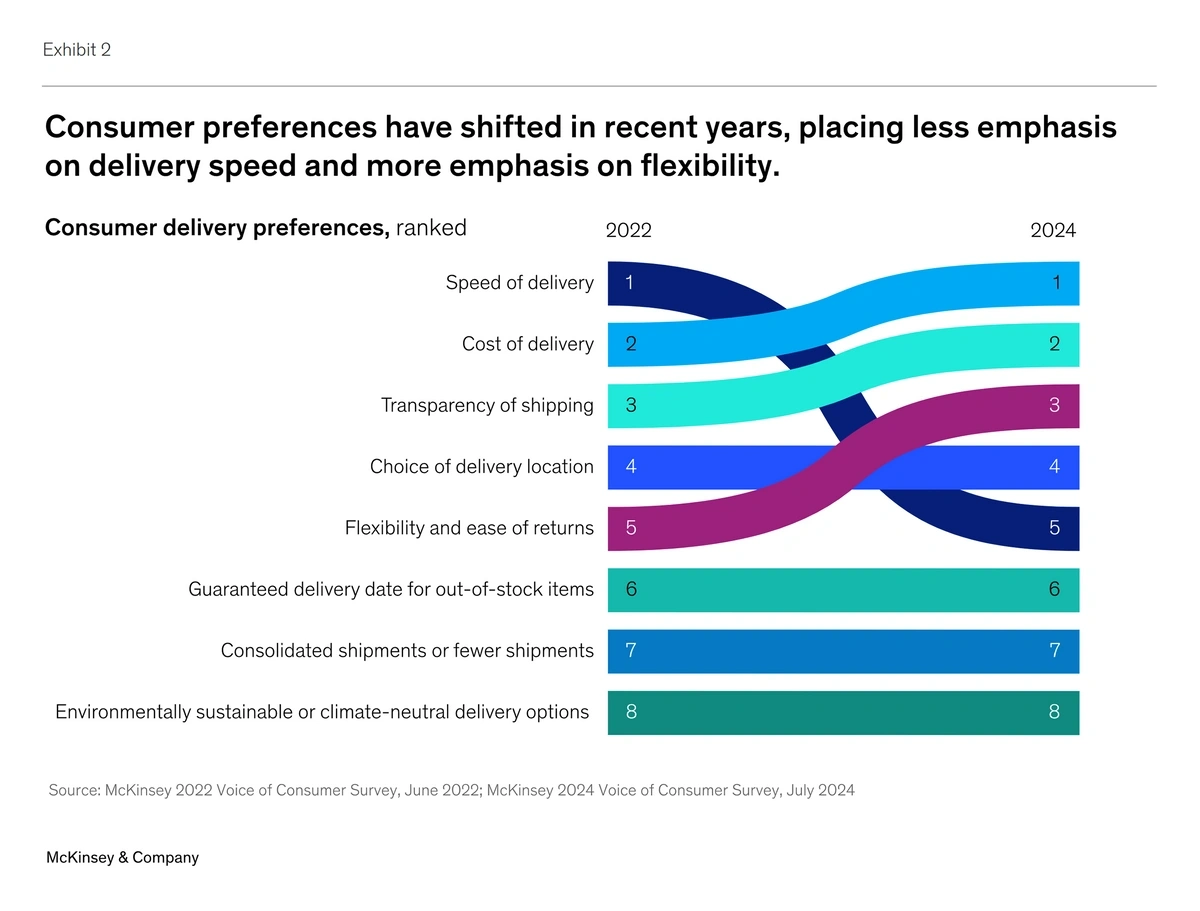

Cost has overtaken speed as the top consideration for consumers in North America and Europe. But fast delivery is still considered the most crucial aspect of delivery service by nearly 25% of shoppers.

On the other hand, a recent McKinsey study found that speed of delivery has actually fallen to 5th among consumer priorities. Cost is key, while flexibility and ease of returns is a rapid riser.

This increasing emphasis on returns tells us something else about post-pandemic consumer behavior. E-commerce is less of a firm commitment than it once was, with more shoppers buying large “hauls” and reserving the right to change their minds on what they have bought.

That has proved to be a big test for brands. In the UK, major fashion retailer ASOS had to update its “fair use” terms last year, charging a £3.95 (roughly $5.35) returns fee to users who regularly make returns without keeping at least £40 ($54) worth of product.

But as E-commerce retailers try to accommodate post-pandemic consumer behavior without harming their bottom line too much, they also run the risk of losing shoppers to entirely new channels.

The pandemic truly ushered in the era of social commerce in the US.

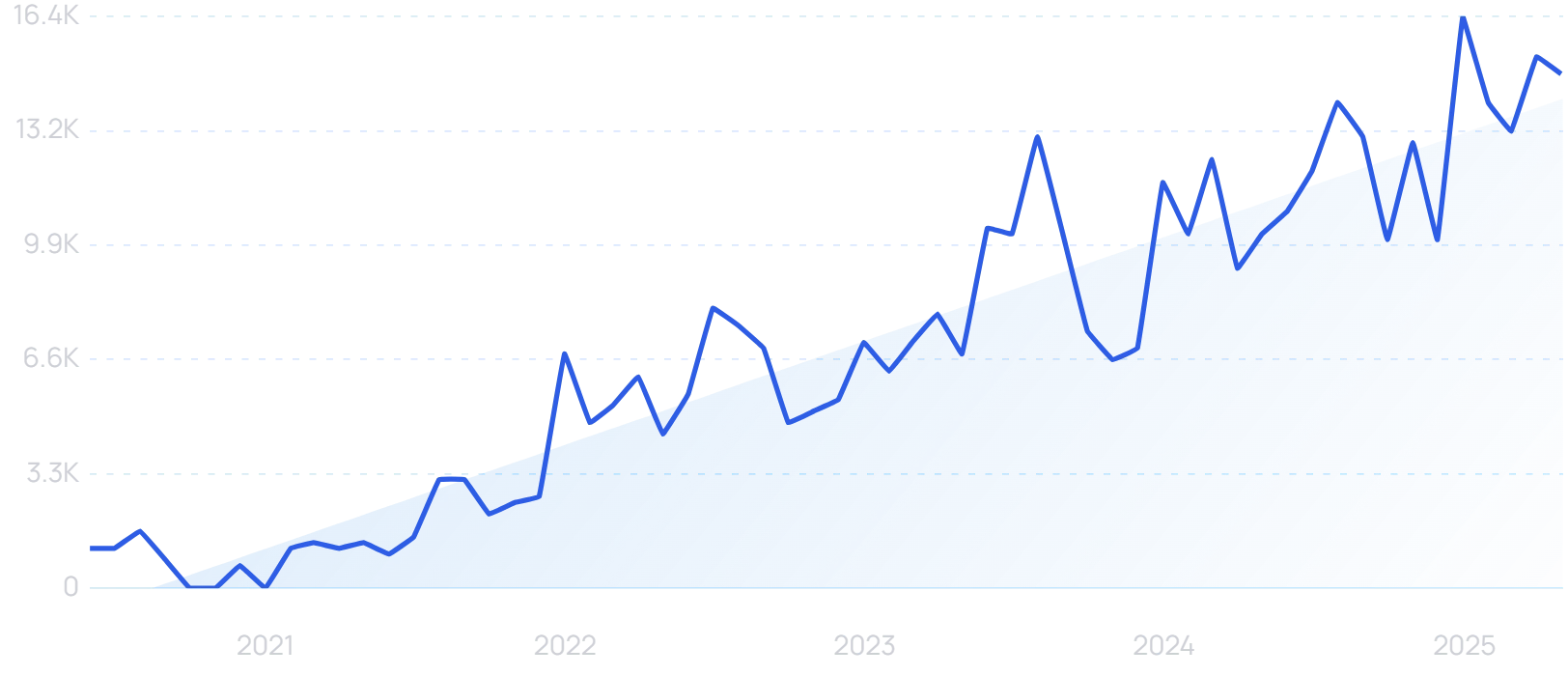

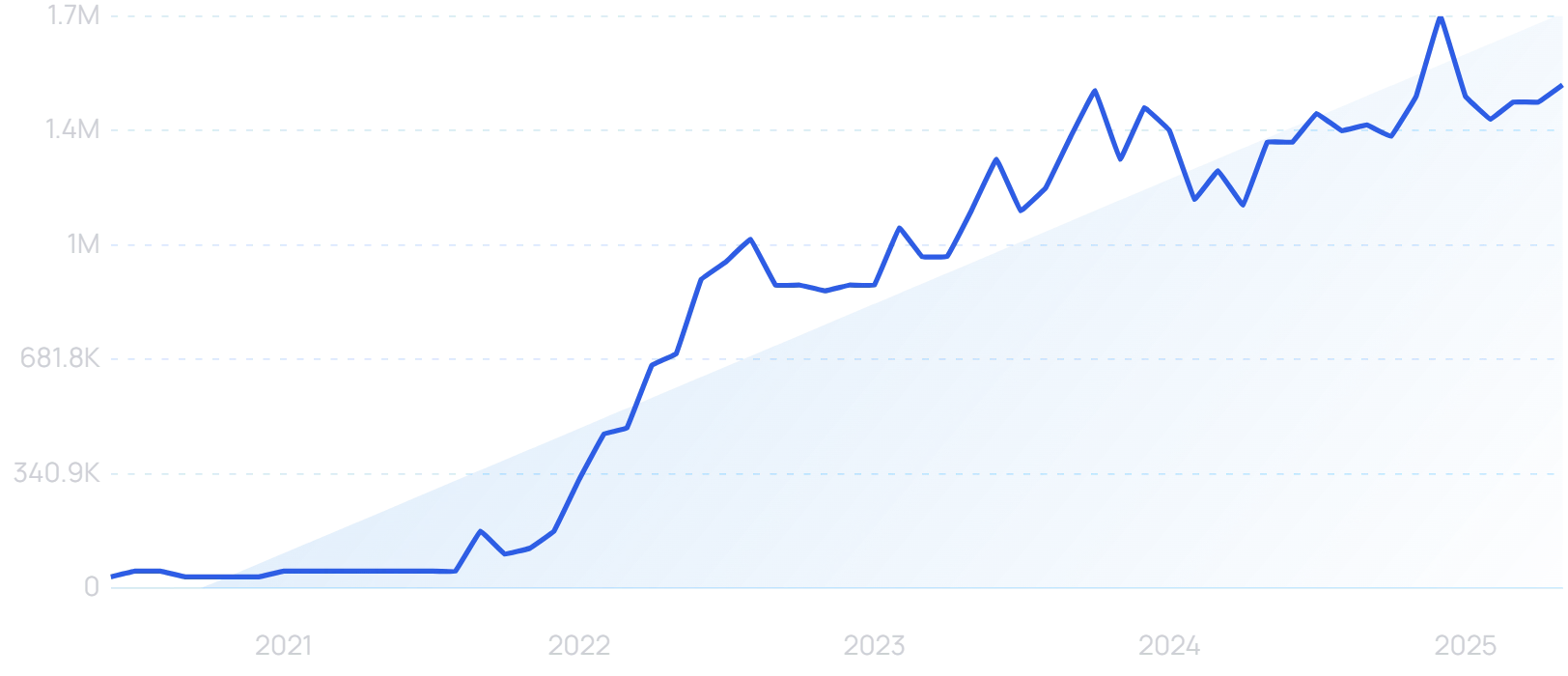

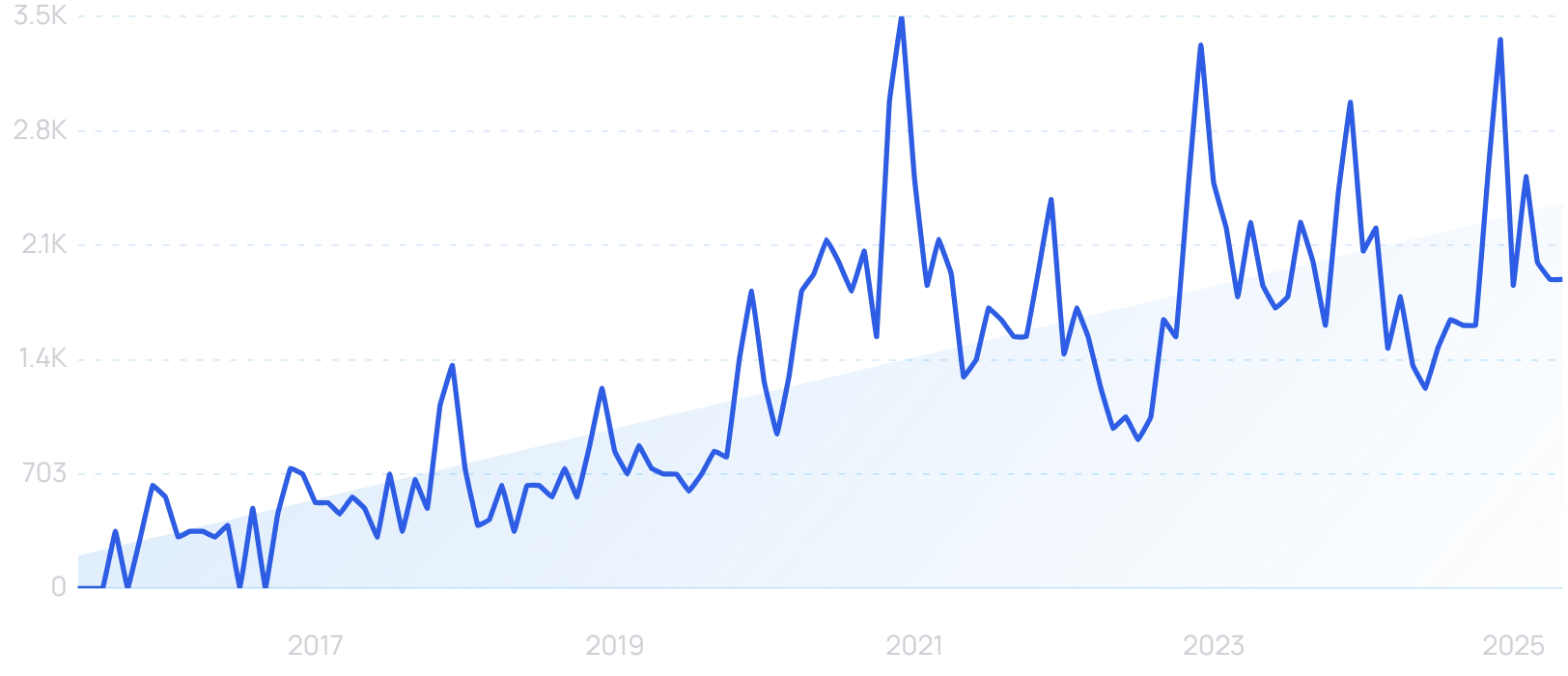

“TikTok Shop” searches are up by 4300% in the last 5 years.

TikTok received 315 million installs in Q1 2020, which is thought to be the most single-quarter downloads of a social media app of all time. It was undeniably a major winner of Covid lockdowns.

And once it had a captive audience, TikTok began to introduce the social commerce elements that have worked so well in China and other Asian markets.

(Douyin, the Chinese version of TikTok, processed over $200 billion in social commerce in 2023.)

TikTok Shop officially launched in the US in September 2023. Suddenly, almost 1 billion brand-agnostic users could shop directly from the app where they had begun to spend almost 44 hours per month, with product suggestions put straight into their feeds by powerful algorithms.

The results have been significant. Estimates from last December suggested that TikTok Shop would end 2024 with a Gross Merchandise Value (GMV) of $50 billion.

Consumers turn to home healthcare and AI solutions

Healthcare was already facing a crisis before the pandemic. The Association of American Medical Colleges forecasts a shortage of 124,000 physicians by 2034.

But Covid acted as a catalyst for an industry-wide efficiency drive. Appointments moved online by necessity, and many of them never moved back.

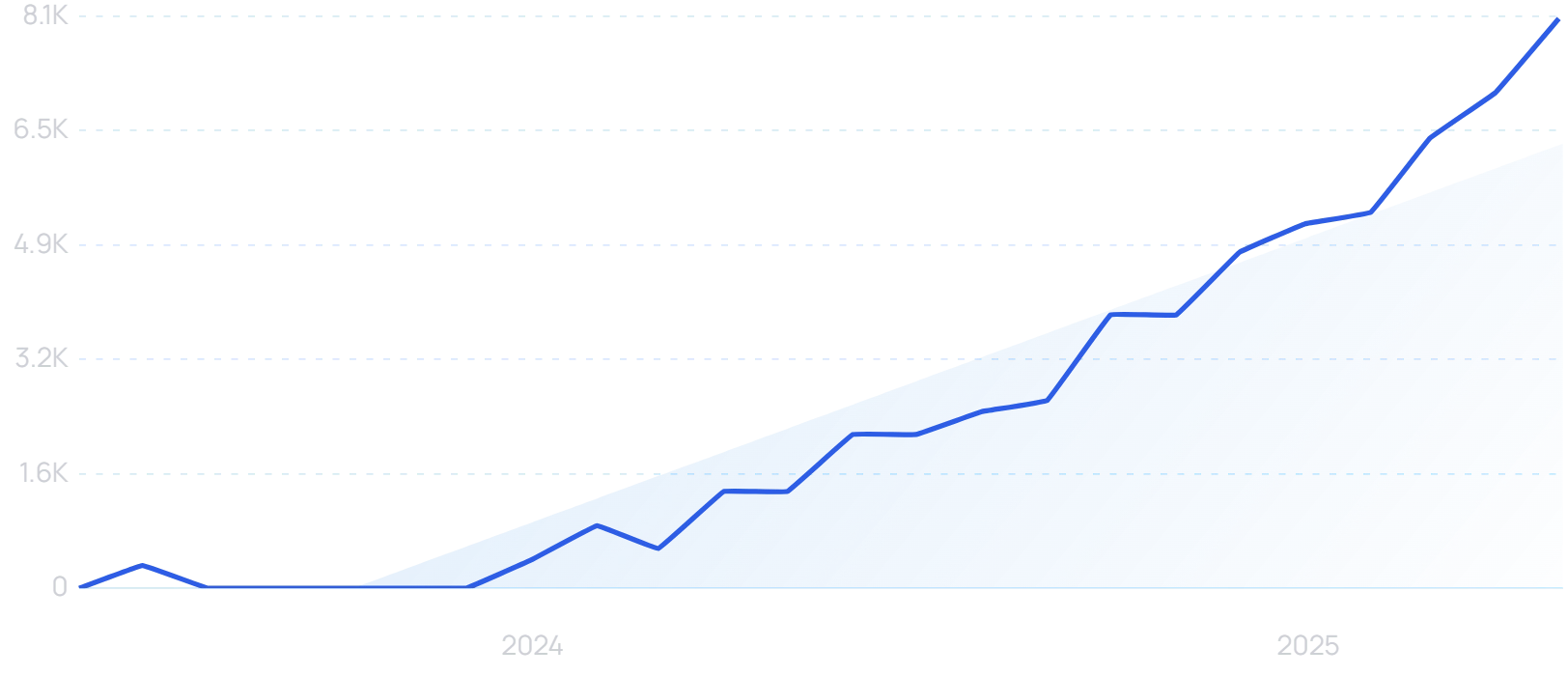

“Remote healthcare” searches are up by 279% in the last 5 years.

Many consumers prefer the speed and practicality of remote appointments. Almost 1 in 4 would switch doctors to access virtual health options.

And 94% of all patients who have had a virtual visit would be willing to have another.

Post-pandemic, efficient remote healthcare has been supercharged by AI.

The time and cost savings of virtual appointments are amplified many times over by consulting with an AI agent as a first point of contact.

The technology is advancing at such a pace that an “AI doctor” of sorts is already a reality.

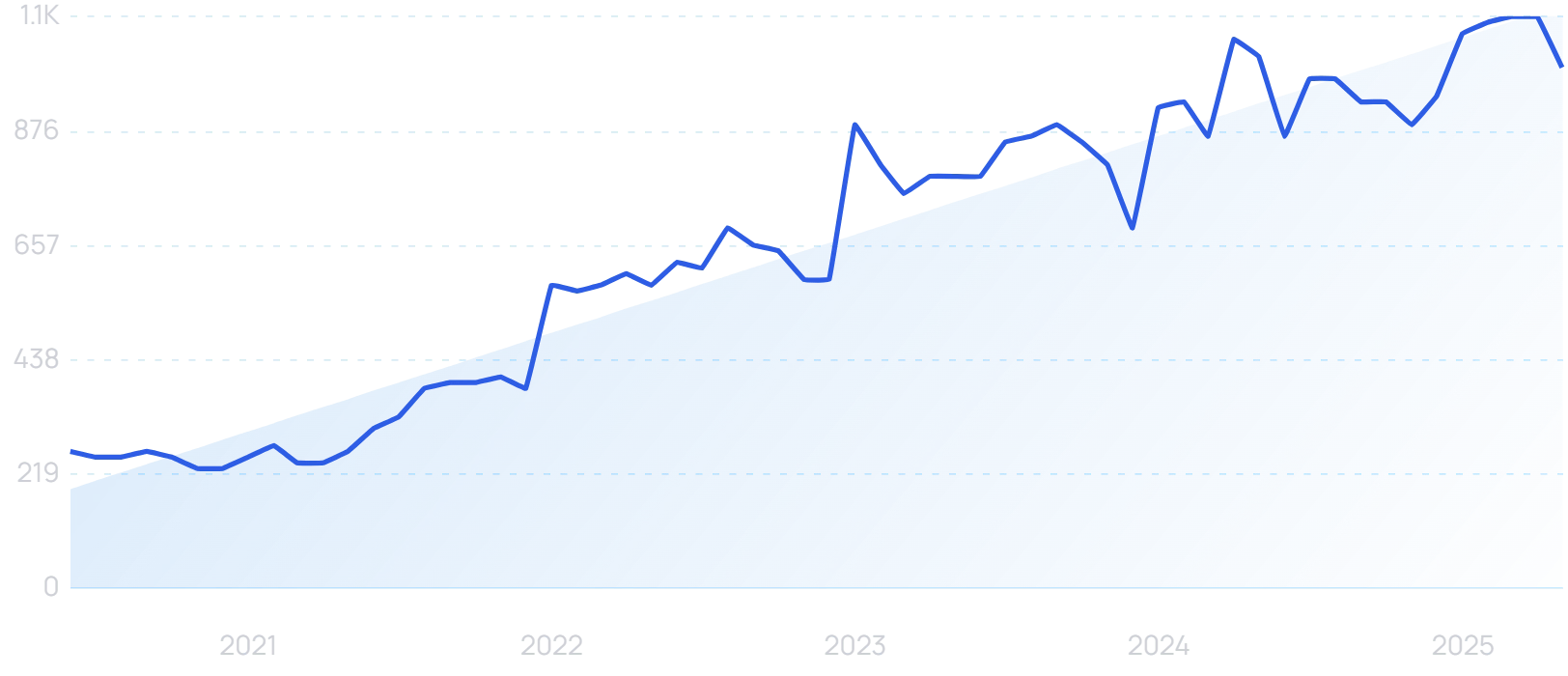

“AI doctor” searches are up by 1329% in the last 5 years.

In May 2025, Akido raised a $60 million funding round to develop ScopeAI, an artificial intelligence agent that generates diagnoses and treatment plans.

There is still oversight from a healthcare professional. But this human input is from a trained Medical Assistant rather than a doctor, reducing the strain on resources.

Stopping short of medical appointments, many consumers have also continued to take their health into their own hands (and homes) post-pandemic.

Certain trends, like garage gyms, were ultimately destined to peak at the height of the pandemic. Interest fell when “real” gyms fully opened up again.

But consumers have shown a continued appetite for home health devices.

Electric neck massagers spiked in popularity as more people began working from home, often in suboptimal office setups.

“Electric neck massager” searches are up by 5300% in 10 years.

Searches went from 950 per month in February 2020 to 3,500 by December of the same year. Interest has remained high since then.

And consumers continue to turn to new home health devices. Red light therapy belts, cold plunges and posture correctors are just three of the many recent home health trends identified by Exploding Topics.

Again, this market has been accelerated post-pandemic by AI. Consumers can easily access reasonably accurate recommendations for exercises and treatments based on their symptoms and goals, actioning them without any need for professional involvement.

One thing I’ve noticed is the same trend extending into the world of pharmaceuticals.

Armed with prior knowledge or an AI diagnosis, consumers often have a very good idea of what medication they need before visiting a doctor. Platforms are springing up that allow patients to make specific requests, which are then approved by a physician and delivered directly to the home.

TelyRx is an online pharmacy in the US.

“TelyRx” searches are up 99X+ in the last 2 years.

Crucially, prescriptions still have to be approved by a doctor based on consumer responses to questions, and the available drugs are all relatively “low-risk”.

But cutting out the trip to the doctor and getting medication delivered efficiently is typical of the post-pandemic consumer.

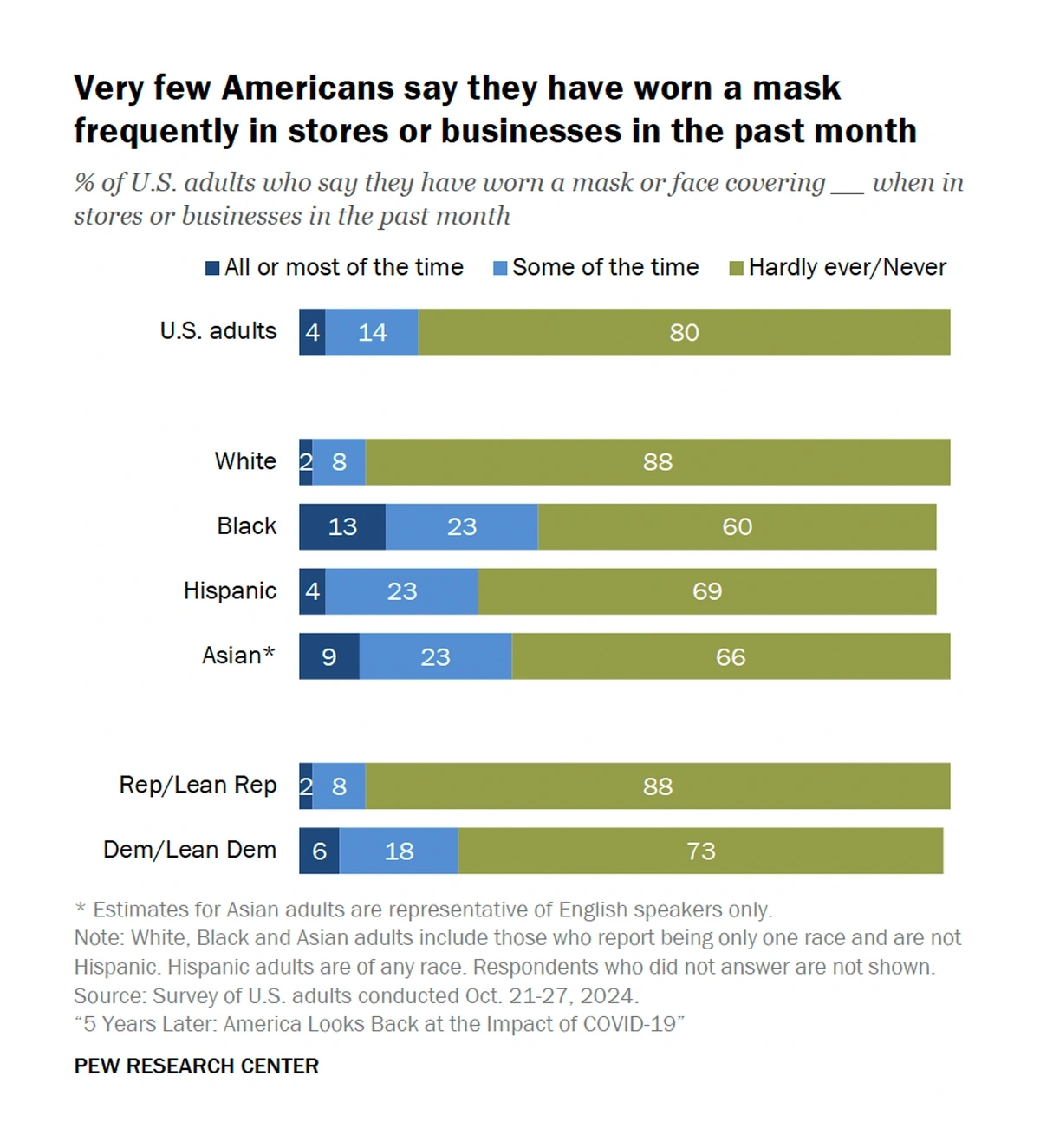

How many people still mask following the Covid-19 pandemic?

“Masking” was always likely to be an aspect of consumer behavior that faded in the months and years after the pandemic. But there was certainly a time when it felt as though people would never be truly comfortable again in large crowds without some kind of Personal Protective Equipment (PPE).

After all, masking in public has been the norm for years in many Asian countries. Rising to real prominence as a result of the SARS outbreak in the early 2000s, consumers in China and neighboring states simply never stopped wearing face masks.

But in the US, most consumers have already abandoned masking. Whereas 88% of people wore a mask in stores “all or most of the time” in 2021, 80% now do so “rarely or never”.

On the other hand, 69% of Americans still say they consider it at least “somewhat” important to wear a mask in crowded settings, with 43% classing it as very or extremely important.

And the top-selling face masks on Amazon still sell more than 20,000 units per month.

Keep on top of consumer behavior trends

There’s a good way to think about post-pandemic consumer behavior: trends that were already developing before Covid have continued to grow at an accelerated rate, but behaviors that were entirely in response to the pandemic have started to fade away.

Hence, the difference in something like E-commerce versus mask-wearing.

But one clear thing is that the legacy of the pandemic is still having a profound impact on consumer behavior. Meanwhile, other factors like AI and social commerce continue to drive further evolution, creating a rapidly shifting landscape.

It’s vital to be able to keep up with consumer behaviors. With Semrush, you can create unlimited buyer personas for free.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

James is a Journalist at Exploding Topics. After graduating from the University of Oxford with a degree in Law, he completed a... Read more