Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Features

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

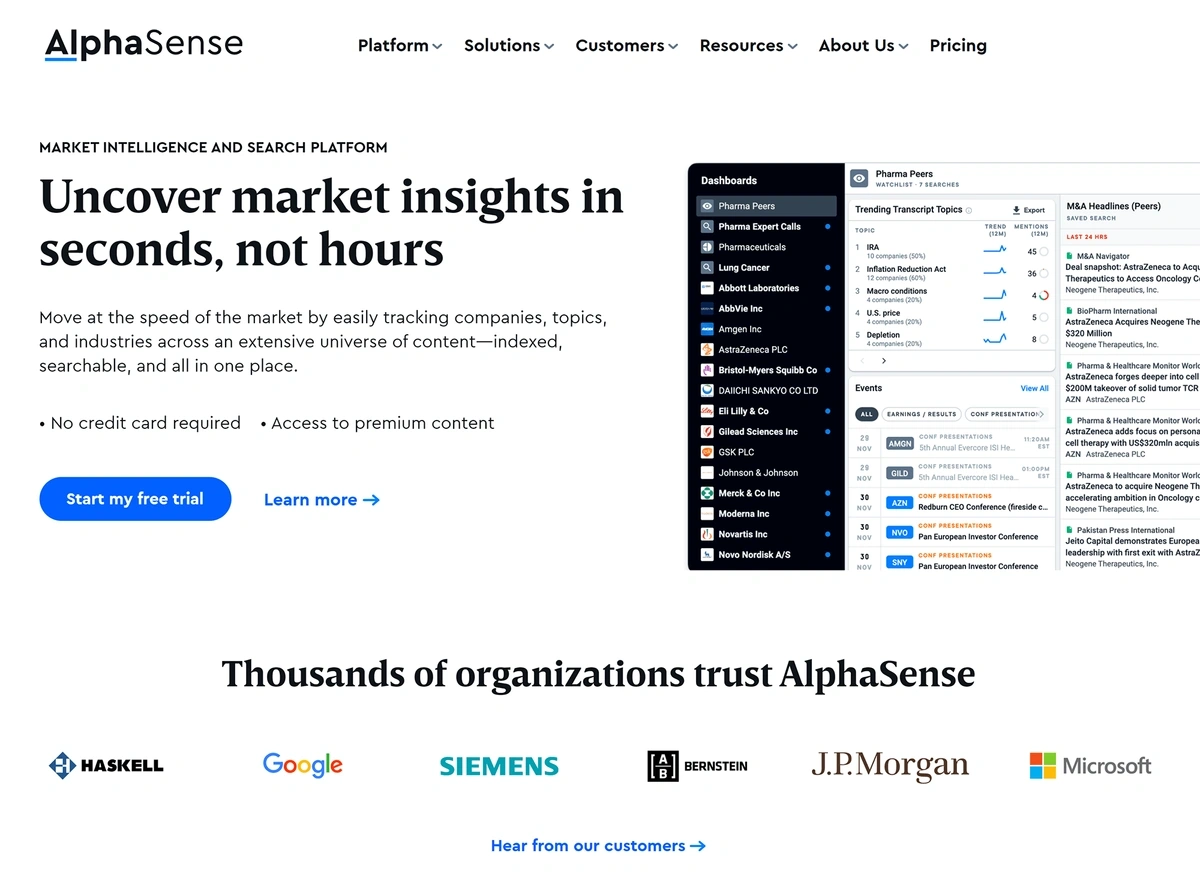

Top 9 AlphaSense Alternatives & Competitors (2025)

Reliable data is essential when you’re making financial decisions—and when large investments are in play, this becomes more critical than ever.

Financial experts and investors keep a close eye on changing markets with the help of tools like AlphaSense. A market intelligence and research platform, this tool helps its users understand what companies, experts, analysts, and journalists are saying about financial markets.

You can use AlphaSense to help guide a number of decisions with large financial impact, such as:

- Corporate strategy

- Investor relations

- Corporate development

- Mergers and acquisitions (M&A)

- Asset management

- Hedge fund management

- Private equity and venture capital investments

- Investment management and banking

The company pulls its data from more than 10,000 sources including broker research, earnings reports, and company documentation.

With the help of artificial intelligence (AI) and natural language processing (NLP), AlphaSense organizes this vast library of data and makes it easier to browse. One of its most unique features is Stream, a library of transcribed interviews between investors and financial experts.

While it does provide access to a large library of financial documentation and data, AlphaSense isn’t the perfect tool for everyone.

Whether you’re interested in more transparent pricing (AlphaSense requires a call with the sales team before getting a quote) or are interested in different kinds of financial data, it’s worth taking a look at the nine best alternatives to AlphaSense.

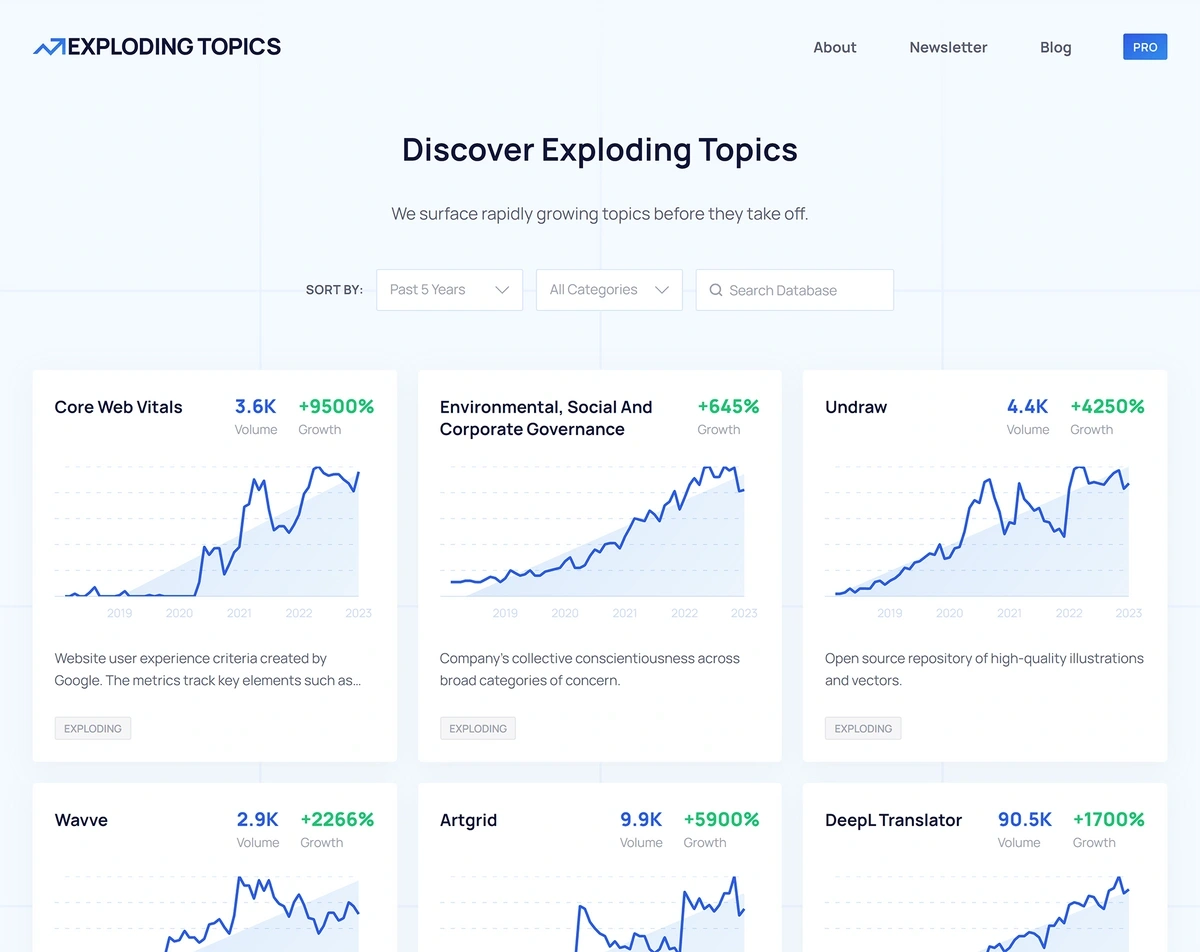

1. Exploding Topics

Exploding Topics is a trend spotting tool that helps corporate leaders and investors keep an eye on trending topics in finance and the startup world.

Our data goes beyond changes to the stock market and company filings. Unlike many finance-focused trend tracking tools, Exploding Topics gives you a holistic overview of what’s popular among other businesses, investors, and consumers by looking at what they’re discussing online. This can include chatter across:

- Search engines

- Blogs

- News outlets

- Social media posts

Our data analysis process allows us to identify industry trends far earlier than other services, including up-and-coming companies and opportunities in:

- Finance

- Crypto

- Legal

- Sales

- Technology

- Startups

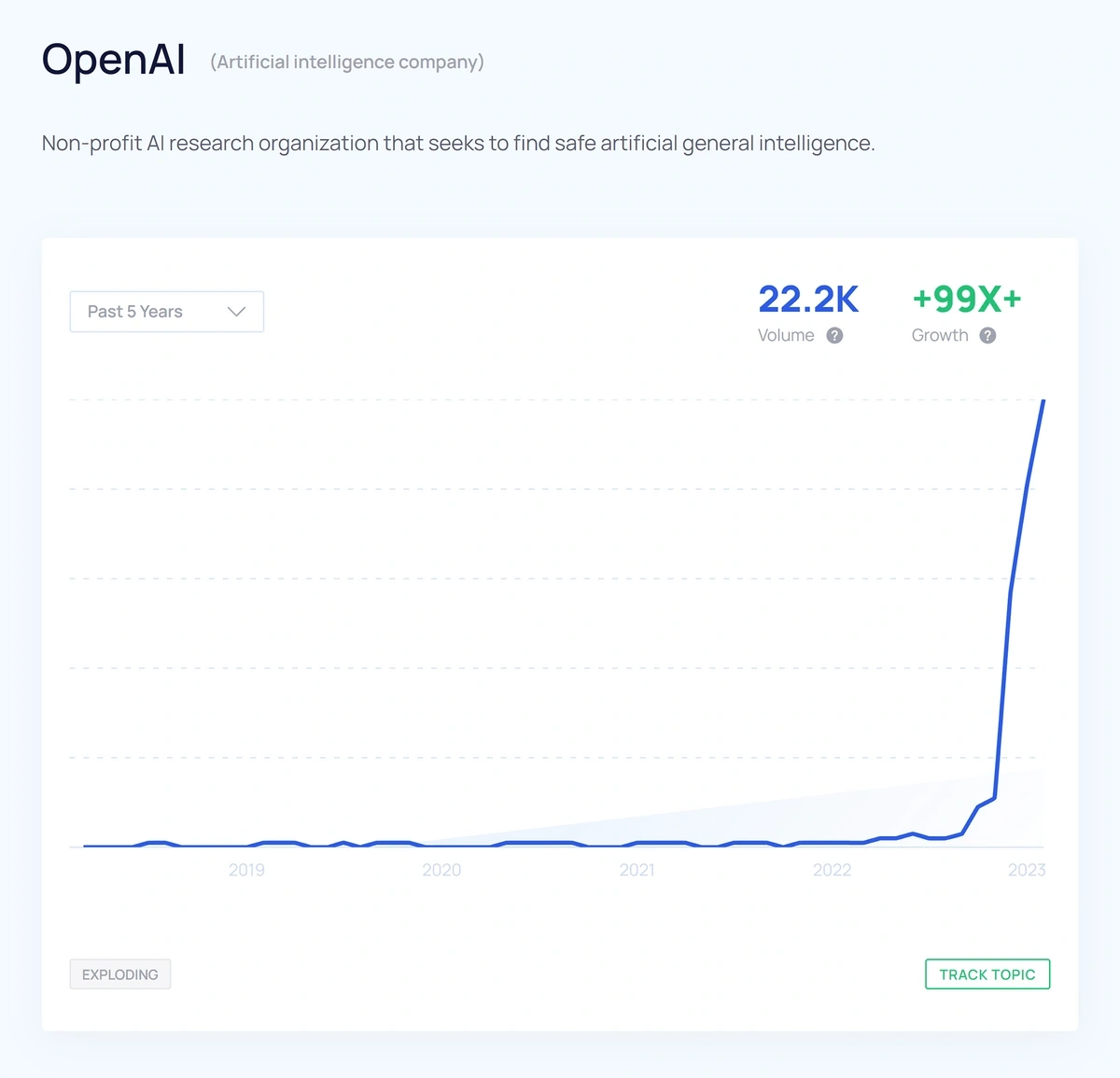

Chances are, you're now familiar with OpenAI—the company behind ChatGPT, and the focus of countless news stories (not to mention a lucrative investment from Microsoft). However, if we'd asked you about OpenAI three years ago, would you have known who they were?

Exploding Topics users did—because we pinpointed OpenAI as a trending startup to watch back in May 2020, nearly two years before interest in the company really took off.

Whether you're interested in discovering new industries to invest in or watching up-and-coming companies for M&A potential, Exploding Topics' early trend predictions can give you a uniquely competitive edge.

How Does Exploding Topics Get Its Data?

We use a trend spotting AI to monitor and gather data, listening to online conversations across a wide array of online sources. This data is then reviewed by an experienced data analyst before it’s published in our database.

You can search our high-quality data—which goes back 15 years—by browsing entire industries or searching for specific terms and company names. Plus, we update our database every day, so our trend data is always up to date.

How Much Does Exploding Topics Cost?

You can start using Exploding Topics for free right now, and keep it that way forever, if you choose.

If you’d like more insight into trending financial topics, though, you can sign up for Exploding Topics Pro—it’s just $1 for the first two weeks. After that, a Pro membership costs as little as $39 per month (billed annually) for a single user.

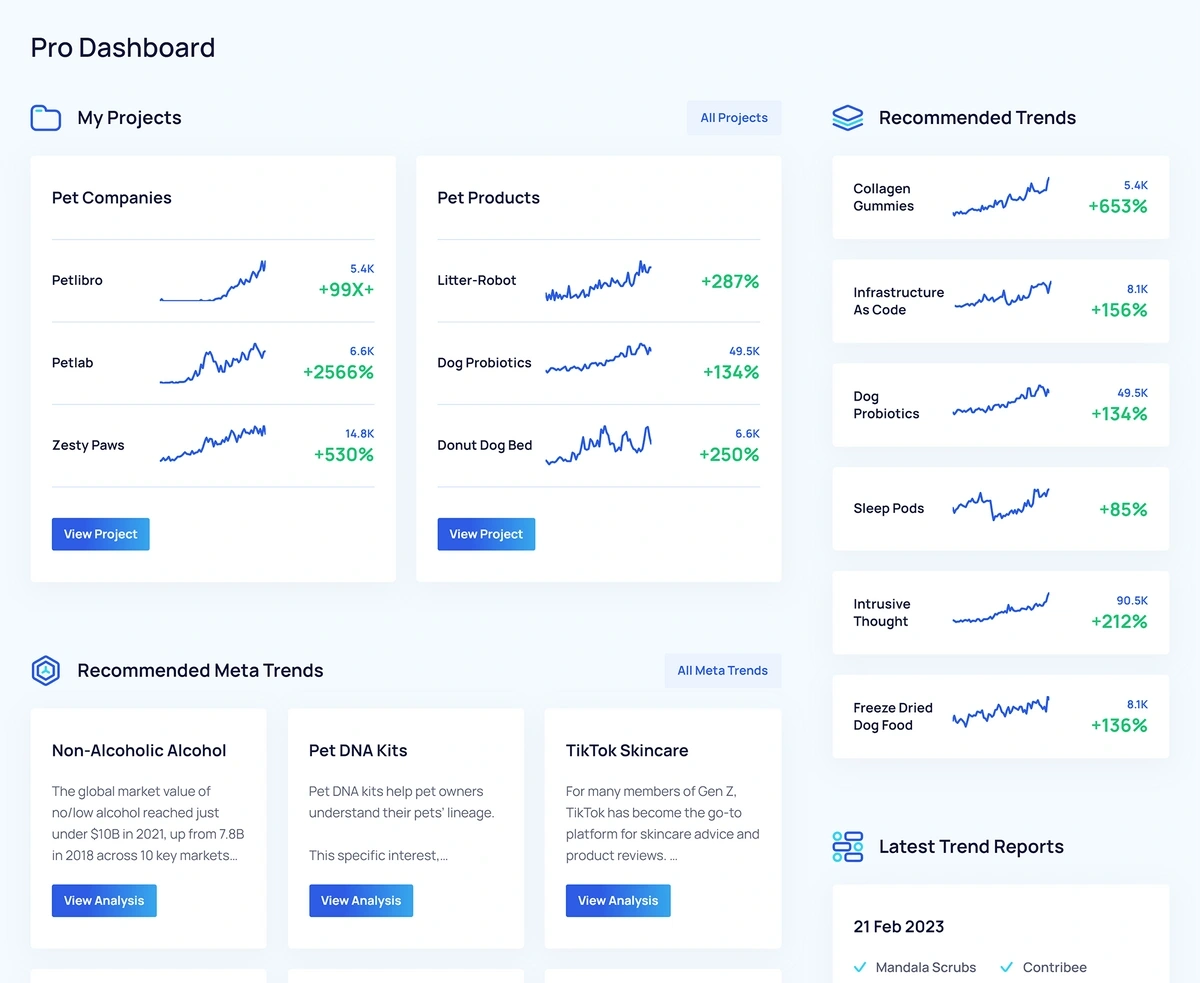

Pro subscribers get access to:

- Weekly reports with advance insights on high-potential trends—up to a year before anyone else sees them

- Our full trends database and reports library

- Additional trend search tools

- Instant trend alerts

- An API to integrate Exploding Topics into your workflow

We've also made it easier than ever for Exploding Topics Pro users to track growing businesses with our trending startups feature. It's a singular dashboard that gives you an at-a-glance daily overview of how online conversations around startups are evolving.

At a Glance: Exploding Topics vs. AlphaSense

| Exploding Topics | AlphaSense | |

| Free plan | Yes | No |

| Paid plans start at | $39 | Custom quotes only |

| Covered industries | 30+ | 7 |

| Sources | All online chatter | Broker research, earnings reports, interviews |

| Unique features | Advance trend data, 15 year overview, growth predictions, instant trend alerts | Stream interview transcripts, Wall Street Insights® reports |

2. Pitchbook

Pitchbook is a financial research reporting platform for capital market professionals. Its data can be used for decisions regarding:

- Private market valuations

- Venture capital investments

- Private equity investments

- Hedge funds

- Investing in startups

The platform uses a mix of automated tools and human data analysis to collect and verify data on:

- 3.5 million companies

- 1.9 million business deals

- 457,000+ investors

- 112,000+ funds

- 39,000+ limited partners

- 3.2 million people

This data can then be used to predict the impact of financial trends, identify M&A opportunities, and get information on corporate debt, lending, and investments.

Pitchbook also provides analysis tools, chart builders, and an Excel plugin that make it easy for users to download and format data. It's not as strong as some other AlphaSense competitors when it comes to tracking trends across multiple industries—but if your job entails compiling data into compelling presentations, Pitchbook may be a good choice.

How does Pitchbook get its data?

Pitchbook uses algorithms to curate financial information from corporate documents, investor profiles, and other financial resources. Human data researchers also reach out to financial entities to verify corporate and investor information within the Pitchbook database.

How much does Pitchbook cost?

You can't sign up for Pitchbook on the company's website—you'll need to reach out and request a free trial first. From there, you can get a price estimate for using Pitchbook's desktop app.

Pitchbook customers can also opt to add on a customer relationship manager (CRM) tool

At a Glance: Pitchbook vs. AlphaSense

| Pitchbook | AlphaSense | |

| Free plan | No | No |

| Paid plans start at | Custom quotes only | Custom quotes only |

| Covered industries | 5 | 7 |

| Sources | Corporate documentation, investor profiles | Broker research, earnings reports, interviews |

| Unique features | Chart-building tools, Excel plugin, optional CRM | Stream interview transcripts, Wall Street Insights® reports |

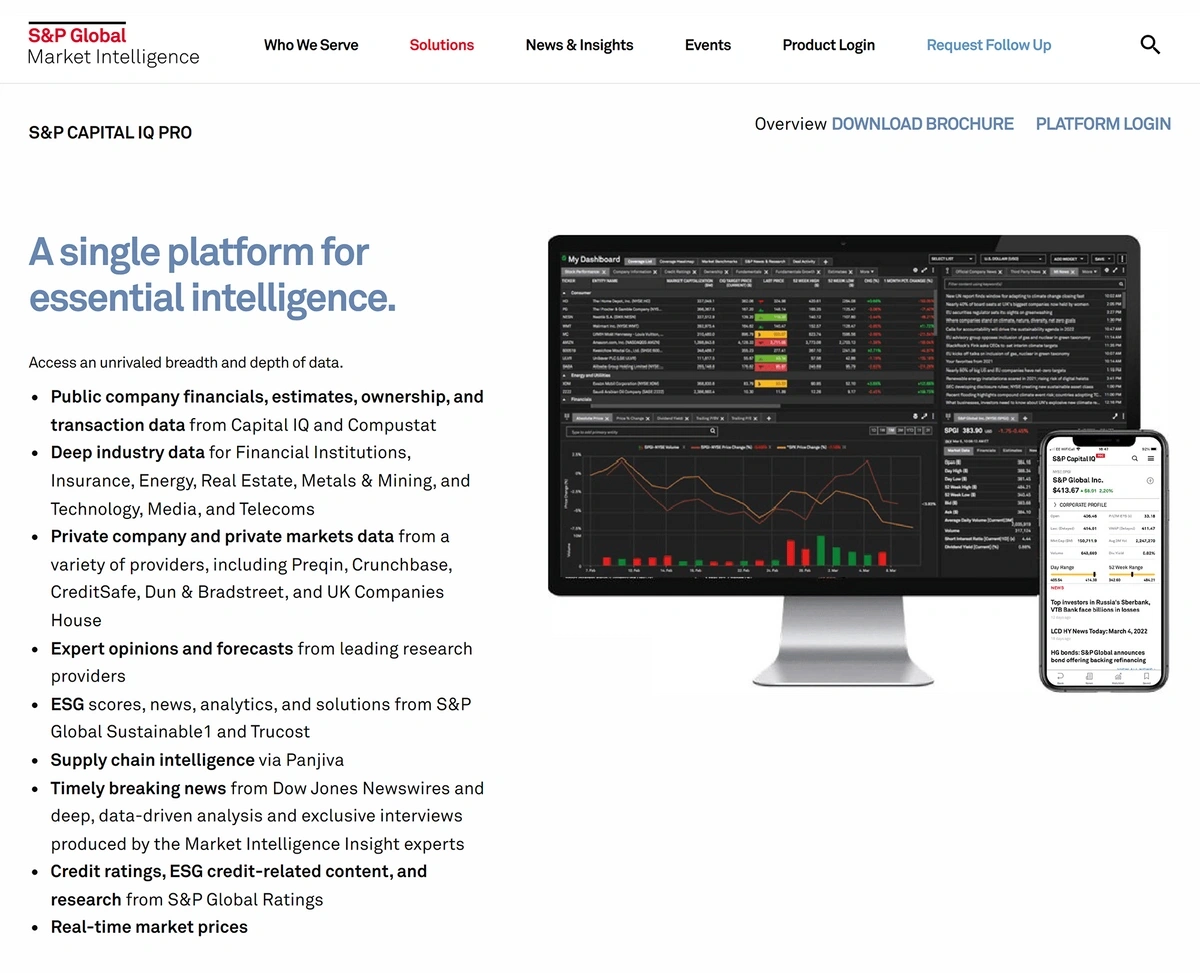

3. S&P Capital IQ Pro

S&P Capital IQ Pro is a financial intelligence platform that’s part of S&P’s Global Market Intelligence software solutions. It shows real-time market prices, meaning it could be a good option for anyone interested in monitoring stock trends.

You can also use S&P Capital IQ Pro for research—and in this capacity, it holds its own as an AlphaSense competitor. S&P's data management system is rich in details about public and private companies in several sectors:

- Supply chains

- Financial institutions

- Insurance companies

- Energy markets

- Real estate trends

- The metals and mining industry

- Technology, media, and telecom companies

One of S&P Capital IQ Pro’s most unique features is its M&A visualization tool. This map-based interface allows you to predict potential M&A opportunities and outcomes. As such, S&P’s offering could also be a sound choice for users primarily interested in acquiring new and established businesses.

This tool's data is exclusively focused on seven specific corporate and finance sectors, though, so you'll want to keep that in mind when selecting the right tool for your use.

How Does S&P Capital IQ Pro Get Its Data?

S&P Capital IQ Pro pulls its data from:

- Public company records

- The Dow Jones NewsWire

- Panjiva, another S&P tool focused on supply chain intelligence

How Much Does S&P Capital IQ Pro Cost?

S&P doesn’t reveal how much access to Capital IQ Pro will cost. You’ll have to request a meeting with an S&P sales representative in order to get a price quote.

At a Glance: S&P Capital IQ Pro vs. AlphaSense

| S&P Capital IQ | AlphaSense | |

| Free plan | No | No |

| Paid plans start at | Custom quotes only | Custom quotes only |

| Covered industries | 6 | 7 |

| Sources | Dow Jones NewsWire, public records, Panjiva | Broker research, earnings reports, interviews |

| Unique features | S&P analysis, M&A mapping tools | Stream interview transcripts, Wall Street Insights® reports |

4. Harmonic

Harmonic is a startup intelligence and discovery platform that focuses heavily on early-stage startup data. It's primarily used by VC firms and investors to source startup information and uncover key details, such as:

- Funding rounds and investor details

- Team composition and hiring momentum

- Company headcount growth over time

- Website traffic and digital footprint

- Executive moves and leadership changes

- Industry/category tracking for emerging markets

As a research tool, Harmonic really stands out when it comes to tracking startup growth signals, such as hiring momentum, web traffic spikes, funding rounds, and executive changes. If you're looking to discover new breakout companies or trying to stay up to date in fast-moving industries, Harmonic can provide visibility that traditional financial databases often miss.

If your work leans more toward deep research on public companies (SEC filings, broker reports, detailed earnings transcripts), AlphaSense or another competitor may still be a better fit.

How Does Harmonic Get Its Data?

Harmonic aggregates data from millions of companies worldwide, pulling in signals like:

- Headcount growth and team composition

- Website traffic and digital presence

- Funding events and investor details

- Market expansion and hiring trends

This makes it especially valuable for investors and corporate strategy teams who want an early look at high-growth startups.

How Much Does Harmonic Cost?

As with AlphaSense, you’ll have to contact Harmonic for a demo to request a custom quote.

At a Glance: Harmonic vs. AlphaSense

| Harmonic | AlphaSense | |

| Free plan | No | No |

| Paid plans start at | Custom quotes only | Custom quotes only |

| Covered industries | 10+ | 7 |

| Sources | 30M+ companies, 190M+ profiles, public web data | Broker research, earnings reports, interviews |

| Unique features | Real-time startup data, Scout AI, market mapping, API integrations | Stream interview transcripts, Wall Street Insights® reports |

5. Refinitiv Eikon

Refinitiv Eikon (formerly Thomson Reuters Eikon) is a financial analysis and trading software platform that makes it easy to search corporate data and track news updates.

You can use the Refinitiv platform to:

- Search through data about company deals

- Review corporate actions data

- Track changes to prices and financial markets

- Evaluate stock performance with indices data

- Build Reuters financial news feeds on key topics

Its most unique feature is a collaboration and messaging tool that lets users connect with contacts in more than 30,000 financial firms worldwide. This toolset makes Refinitiv Eikon useful for users actively working in the financial industry, including these sector:

- Asset management

- Central banks

- Corporate treasury

- Investment banking

- Islamic finance

- Market data

- Risk & Compliance

- Technology

- Trading

- Wealth management

If you're trying to research other industry trends that can lead to good investment opportunities, though, the Eikon platform may not include a broad enough data set for your needs.

How Does Refinitiv Eikon Get Its Data?

Refinitiv Eikon is part of the London Stock Exchange Group of companies, so it’s no surprise that the company pulls data from a variety of stock exchanges around the world, including:

- Beijing Stock Exchange

- Australian Stock Exchange

- NASDAQ US

This stock market information is complemented by additional data sets from resources such as:

- China Financial Futures Exchange

- Corporate profit and loss (P&L) statements

- Corporate disclosure filings

- Moody’s ratings

- Reuters and over 10,000 other media outlets

How Much Does Refinitiv Eikon Cost?

Refinitiv Eikon is available as both a desktop and web app. Like many AlphaSense competitors, Refinitiv requires a sales call in order to get a price quote for either version of the Eikon software.

At a Glance: Refinitiv Eikon vs. AlphaSense

| Refinitiv Eikon | AlphaSense | |

| Free plan | No | No |

| Paid plans start at | Custom quotes only | Custom quotes only |

| Covered industries | 10 | 7 |

| Sources | Reuters, stock exchanges, corporate disclosures | Broker research, earnings reports, interviews |

| Unique features | Communication tools to reach stakeholders at global financial firms | Stream interview transcripts, Wall Street Insights® reports |

6. Dow Jones Factiva

Dow Jones Factiva is a business intelligence tool and news database.

You can use Factiva to read news and analysis about financial markets—and potential impacts.

For example, your Factiva feed might display news about:

- New types of Amazon product delivery

- Actions taken by the Federal Reserve

- Housing market fluctuations

- Regulations affecting energy suppliers

You can filter and search this news based on your industry, products, concerns, and more. Factiva's information might help you conduct research related to:

- Financial crime compliance

- Third-party risk management

- Due diligence

- Asset management

- Investor activity

- Online trading

- Portfolio management

- Sustainability

Plus, they pull the data from over 33,000 sources in 32 languages—so it's very comprehensive.

Dow Jones allows Factiva users to mine text and data from its library of information. There's API access available as well—allowing you to find, log, review, and report on relevant data in a variety of ways.

How Much Does Factiva Cost?

Factiva's pricing plans aren't public, and can be customized based on your needs and goals.

If you're interested in using Factiva in your research, you'll need to get in touch with the Dow Jones team in order to get more information.

Factiva vs. AlphaSense: At a Glance

| Factiva | AlphaSense | |

| Free plan | No | No |

| Paid plans start at | Custom quotes only | Custom quotes only |

| Covered industries | 11+ | 7 |

| Sources | News media | Broker research, earnings reports, interviews |

| Unique features | Data mining, API access | Stream interview transcripts, Wall Street Insights® reports |

7. Bloomberg Terminal

Bloomberg Terminal is a portal that allows users to access data around investments and financial markets.

The information available through Bloomberg Terminal includes:

- Financial markets news from 2,700 Bloomberg journalists in 120 cities

- Research reports from 1,500+ sources

- Company earnings reports and estimations

- M&A history

- Regulatory filings

- Analyst recommendations

- Portfolio metrics, data, and risk

- Charts and graphs

- High-level market analysis

You can also use tools within the Bloomberg Terminal to help you perform trading activities and build portfolio reports.

If you like the information available to you in AlphaSense, but want to be even more directly connected to your portfolio and relevant financial markets, then Bloomberg Terminal is a good choice.

How Much Does Bloomberg Terminal Cost?

Bloomberg keeps their pricing private—you have to start with a demo session provided by the company.

However, Investopedia reports that a standard Bloomberg Terminal license can be about $2,000 per month.

Bloomberg Terminal vs. AlphaSense: At a Glance

| Bloomberg Terminal | AlphaSense | |

| Free plan | No | No |

| Paid plans start at | Custom quotes only | Custom quotes only |

| Covered industries | 11+ | 7 |

| Sources | Earnings reports, Bloomberg news, stock markets | Broker research, earnings reports, interviews |

| Unique features | Proprietary news reports | Stream interview transcripts, Wall Street Insights® reports |

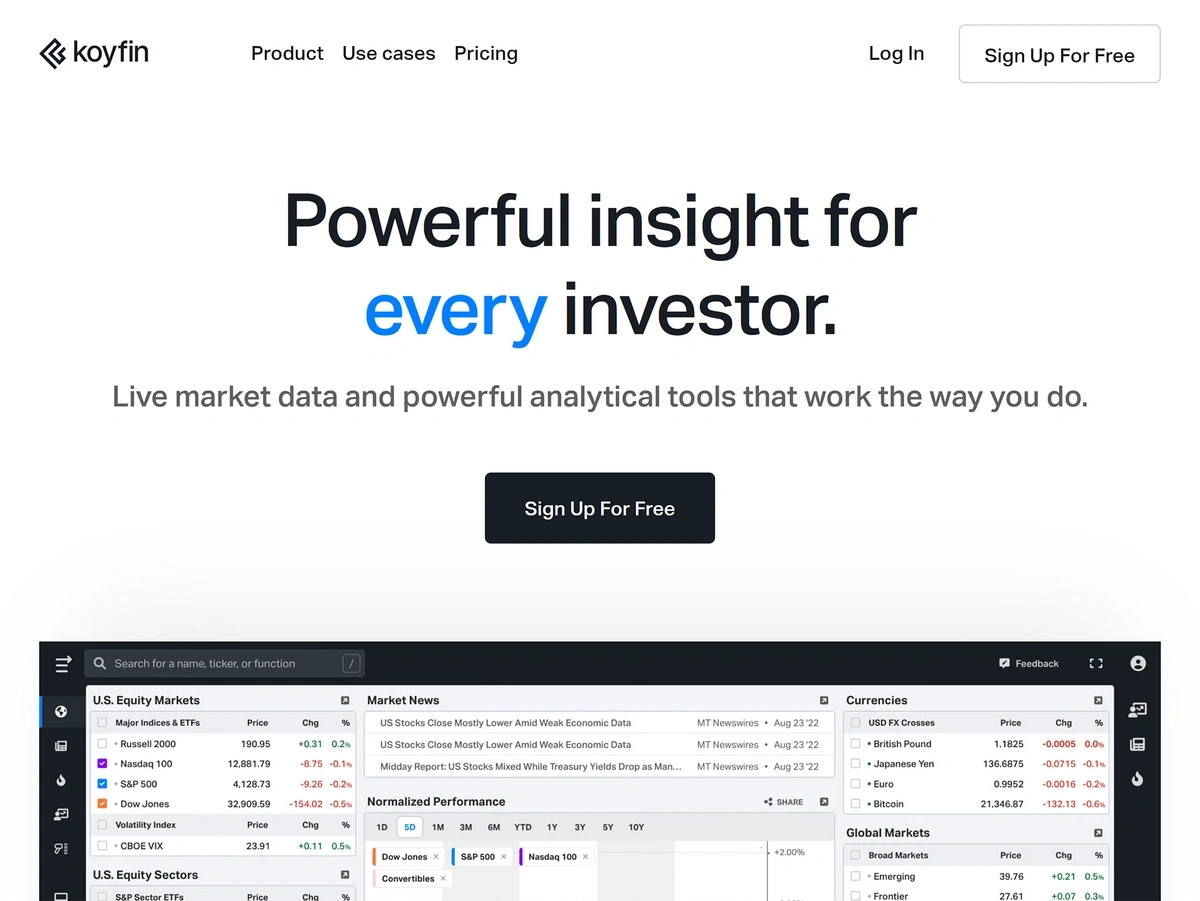

8. Koyfin

Koyfin is an investment research tool that provides access to live market data.

Financial professionals, investors, and corporations can use Koyfin to access over 1 million financial data points and 30 years of historical statements.

Available information includes:

- Stock prices

- Cryptocurrency prices

- Commodity futures data

- Mutual fund performance

- Economic data

- Financial news

- Earnings call transcripts

The Koyfin platform also allows you to:

- Unify investment portfolio data

- Track all investments in one spot

- Create investment watchlists

- View live news feeds

- See the stocks currently leading on an exchange

- Analyze industry sentiment based on news articles and Tweets

- Generate graphs and reports

- Monitor competitors' market performance and updates

Koyfin is a possible alternative for AlphaSense as well as other competing platforms like S&P Capital IQ Pro.

It can be useful for monitoring markets that you're already invested in as well as finding new markets or funds for a portfolio.

How Much Does Koyfin Cost?

Unlike many of the services on this list, Koyfin publishes their pricing publicly.

You can start using the platform for free. You'll be able to see up to one year of financial estimates and two years of company financials, establish two watchlists, and read related news.

To see more historic and project data, customize the Koyfin platform, and dig deeper into data sets, you'll need a paid plan.

Options start at $49 per month, or $39 per month when billed annually.

Koyfin vs. AlphaSense: At a Glance

| Koyfin | AlphaSense | |

| Free plan | Yes | No |

| Paid plans start at | $39 per month billed annually | Custom quotes only |

| Covered industries | 11+ | 7 |

| Sources | Stock markets, financial reports, news outlets | Broker research, earnings reports, interviews |

| Unique features | 5,900 search filters, reporting tools | Stream interview transcripts, Wall Street Insights® reports |

9. EDGAR

EDGAR is a corporate filings database maintained by the U.S. Securities and Exchange Commission.

If you're primarily interested in AlphaSense because of its filing and earnings call info, then you might be able to get the data you want for free through EDGAR.

Information found in EDGAR includes:

- Corporate overviews

- Incorporation data

- Quarterly (10-Q) and annual (10-K) reports

- Up-to-date 8-K reports

- Annual proxy statements issued to shareholders

- Insider transaction records

- Beneficial ownership reports

You can also use EDGAR to look up information about mutual funds, variable annuities, and exchange-traded funds (ETFs).

How Much Does EDGAR Cost?

There's no charge to use EDGAR.

EDGAR vs. AlphaSense: At a Glance

| EDGAR | AlphaSense | |

| Free plan | Yes | No |

| Paid plans start at | N/A | Custom quotes only |

| Covered industries | 11+ | 7 |

| Sources | Corporate filings | Broker research, earnings reports, interviews |

| Unique features | Copies of 8-K, 10-K, and 10-Q reports | Stream interview transcripts, Wall Street Insights® reports |

Conclusion

If you're strictly in need of access to corporate filings or stock market charts, then EDGAR and Koyfin could be good options.

When you need more in-depth information, reporting, and analysis, though, you'll want to stick with AlphaSense or try an alternative based on what you want to do with the data.

For tracking trends related to the markets you have an interest in, Exploding Topics is a great choice. And to dig deep on M&A activity, you might want to try S&P Capital IQ Pro.

Regardless of the platforms you choose, having access to up-to-date trend, stock market, and SEC data will help you make the smartest possible financial decisions around your business and investments.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes

Written By

Josh is the Co-Founder and CTO of Exploding Topics. Josh has led Exploding Topics product development from the first line of co... Read more