Get Advanced Insights on Any Topic

Discover Trends 12+ Months Before Everyone Else

How We Find Trends Before They Take Off

Exploding Topics’ advanced algorithm monitors millions of unstructured data points to spot trends early on.

Keyword Research

Performance Tracking

Competitor Intelligence

Fix Your Site’s SEO Issues in 30 Seconds

Find technical issues blocking search visibility. Get prioritized, actionable fixes in seconds.

Powered by data from

How to Instantly Perform a Competitor Analysis and Find Key Gaps

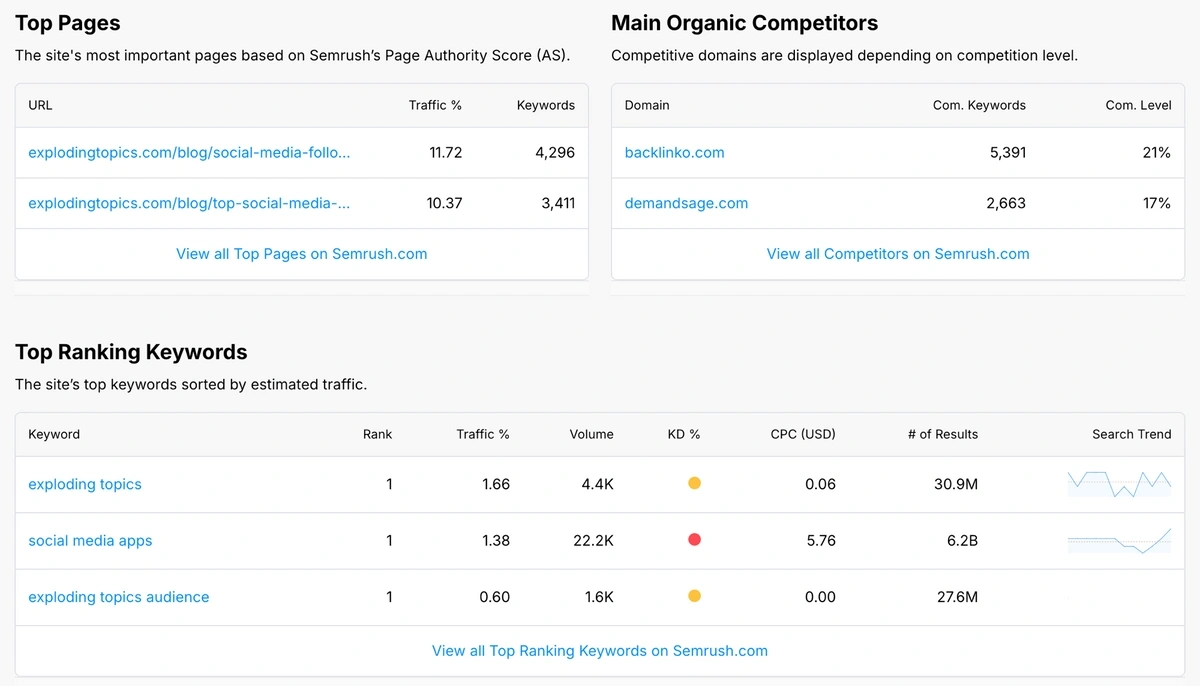

This competitor analysis tool reveals valuable insights about your main competitors such as:

- Authority Score

- Backlinks

- Organic traffic

Just type the competitor's website URL at the top of the page and hit enter to start gathering intel on your competitors.

After reviewing the competing site’s metrics, scroll down to review top keywords with volume, keyword difficulty, and search trend details to enrich your analysis.

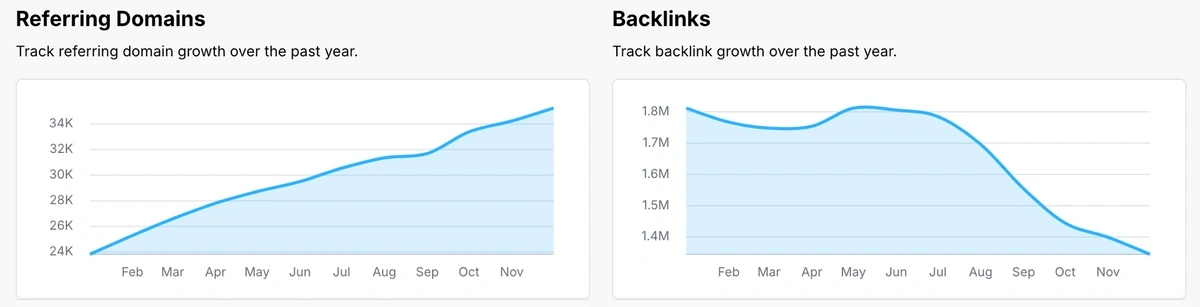

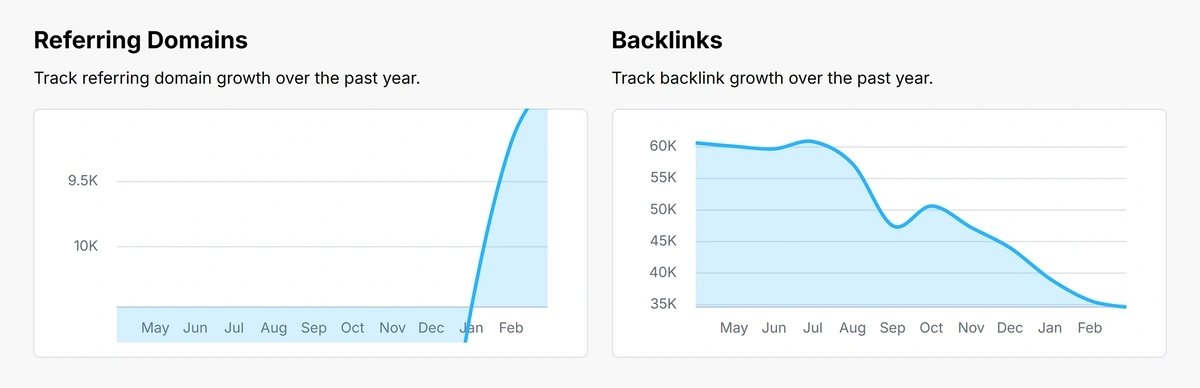

Below that, you’ll see an updated 12-month trend for backlinks and referring domains as well.

The information is split into tables for easy review.

You can uncover a fascinating level of detail about each competitor and discover meaningful content gaps by creating a free Semrush account to expand the data.

Although the free competitor research tool is much simpler than the full version, it still gives you powerful bits of information for reverse-engineering competitor strategies.

Use Case 1: Identifying Content Gaps

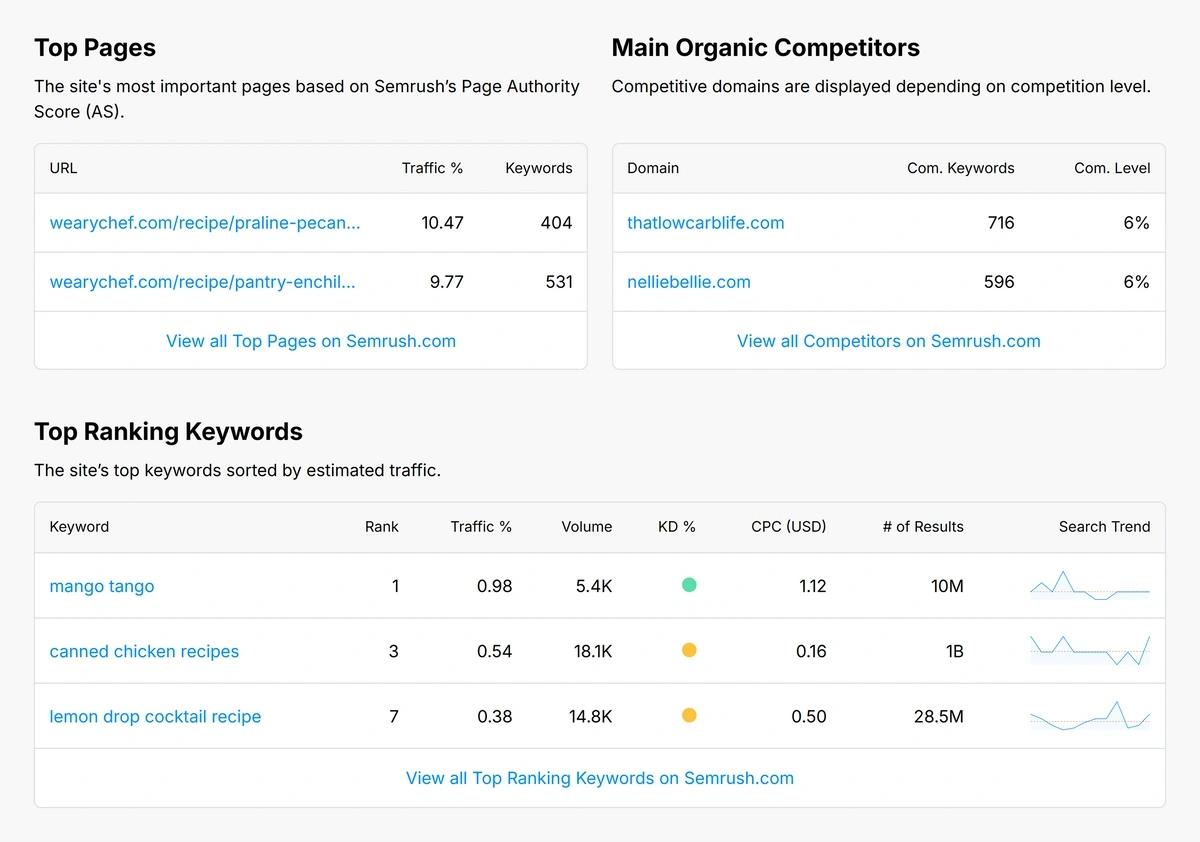

There are two handy tables inside this tool that reveal what’s working well for your competitors: Top Pages and Top Ranking Keywords.

The info inside these tables helps you find topic ideas with strong traffic potential that you might have not covered yet. The Top Pages table also shows you the traffic percentage and total keywords of the competitor's top-performing pages.

Once you're aware of the page driving the most traffic for your competitor, you can visit it and read through the content as an average consumer.

Ask yourself: what is it about this page that’s driving so much content?

Does it have a catchy title? Is the content helpful and free from needless padding? Maybe it has great UX with structured elements like tables and bullet lists, and high-quality, purposeful images.

Addressing these questions can help you think of ways to target the same keywords in unique ways.

Simply copying the top-ranking result won’t work.

Add something new to the conversation and follow good foundational SEO practices. Soon, you may begin capturing a share that traffic your competitors are enjoying.

Often, the best SEO strategies are built on a series of small wins like these. And that’s why this competitor analysis tool can be so valuable.

Use Case 2: Evaluating Keyword Difficulty vs. Traffic Potential

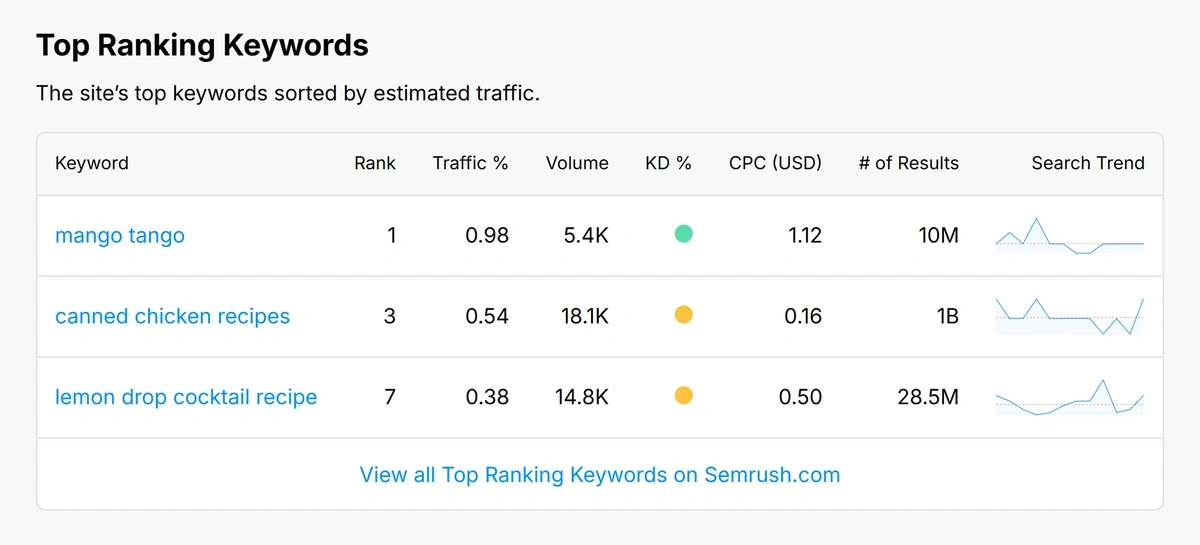

The Top Ranking Keywords table shows you key metrics like Traffic %, Volume, KD% (keyword difficulty), and CPC.

These help you make strategic decisions about the right keywords to prioritize.

Example: "canned chicken recipes” has 18.1K volume and moderate difficulty. But "mango tango" is a more logical keyword choice despite its lower volume. That's because it’s less difficult to rank for, and it also has a higher traffic share (which could be due to reasons like driving clicks, ranking high for a greater number of related keywords, etc.).

So don’t let the less impressive volume of a low-difficulty keyword misguide you. Traffic is a metric that compounds over time. The trick is to rank multiple low-difficulty keywords at the top, so their combined effect is substantial.

Speaking from personal experience, most of my SEO successes have come from doubling down on easier, achievable keywords.

Use Case 3: Spotting Backlink Trends for Competitive Advantage

Competitors with a stronger backlink profile than you are really powerful. You could have well-optimized and helpful content but still struggle to rank if there’s a competitor beating you based on backlinks.

The Referring Domains and Backlinks charts in our competitor analysis tool gives you a clear picture of how far ahead (or behind) a competitor is in terms of their backlink growth or decline in the past 12 months.

When you spot competitors with declining backlink profiles, you have a great opportunity to take advantage. Here’s how:

- Analyze which of their link sources no longer point to them

- Reach out to those sites with your own content

- Develop a targeted outreach strategy to grow your backlinks while competitors are losing theirs

This was the go-to link building strategy that paid off tremendously for a team I was working with as their guest posting writer. So I know it works.

You can see tips for implementing this strategy along with other link building methods in our detailed guide on the subject.

Use Case 4: Analyzing Traffic Distribution

The Traffic % column in the Top Pages section tells you which pages are getting the lion’s share of traffic. In my experience, websites usually exhibit the 80:20 rule, with only 20% of the pages driving 80% of the traffic.

But it’s always a good idea to diversify your traffic so that you’re not over relying on just a few high-performing pages.

You can check your own domain to see what your traffic % distribution between your top pages looks like with our competitor research tool.

You can also enter your competitors in the tool to check their traffic distribution.

It’s a good way to find ideas for creating a more balanced traffic profile to reduce risk from Google algorithm updates.

Advanced Competitor Research

The free competitor analysis tool is a good starting point. The ability to see a competitor's top ranking keywords and their backlink trends allows you to anticipate how wide the gap between you and your competitor is.

But in the long-term, you need to make competitor analysis a regular component of your strategy.

It's how you understand what's working for your competitors and highlight gaps in your content.

That's when you need to invest premium competitor analysis tools.

The good thing is that many of the top competitor research tools offer a free trial, so I recommend trying them out yourself first and pick one that gets the job done most effortlessly for you.

| Competitor Analysis Tools | Best For | Top Features | Free Version Limits |

| Semrush | Professional marketers and agencies | Keyword gap analysis, backlink gap research, traffic benchmarking for organic + other common sources. | Limited to 10 rows of data per analysis tool. 14-day free trial unlocks full access with a time limit. |

| ChatGPT | Comparing content at the page level | Identify missing subtopics and content gaps, get suggestions for improvements | GPT-4o access is limited in the free version |

| Spyfu | Small businesses without marketing staff | Find newly ranked keywords with a date picker for your competitors | Limited to 5 rows of data per free analysis |

| Moz | Beginner marketers | List of top competitors and keyword opportunities with expected traffic list if you also rank for these | 3 reports per day |

| SE Ranking | Mid-level marketers | Search visibility trends for your domain and top competitors | 14-day free trial with limited historical data |

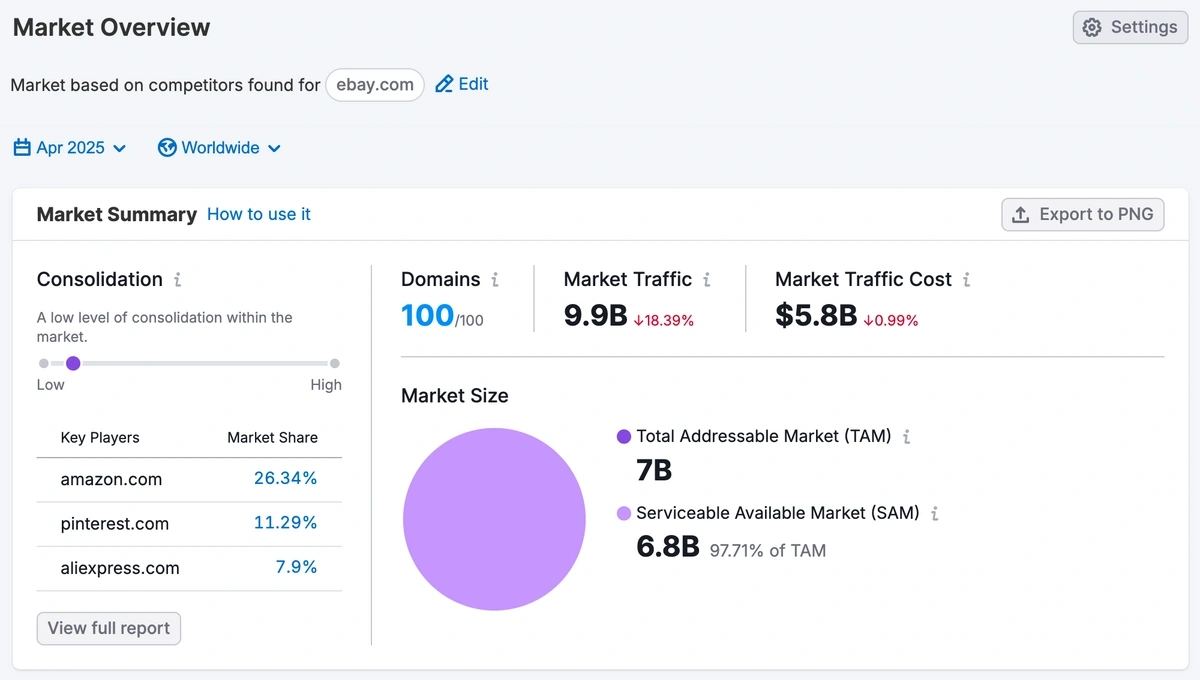

How Do I Expand My Competitive Analysis Beyond SEO?

A full competitive analysis compares:

- Market position and share

- Revenue (when available)

- Recent growth patterns

- Pricing strategy

- Product tiers

Depending on your industry, there may be other things you’ll want to examine as well.

The Semrush Market Overview offers deep insights about key players in your market and views traffic distributions between competitors.

It’s an excellent way to familiarize yourself with the market dynamics of your industry and uncover recent growth patterns.

With reports showing a breakdown of customer demographics along with channel distribution, you'll have all the competitive insights you need to lay down a solid foundation for your overall marketing strategy.

Also read: How to Analyze Competitors Sites

Know Your Competitor Types

Some businesses are in direct competition with you by offering very similar products. Others might be a little less direct.

Let's take an example.

A project management company like Asana might compete with Monday.com for business customers. But they also face competition from simpler solutions like spreadsheets or email systems that solve the same problems differently.

Market competitors break down into three subcategories:

- Direct Competitors provide similar products or services and target the same audience. If you run a meal kit service, other brands like Blue Apron or HelloFresh are your direct competitors. Analyzing their pricing, marketing, and product features helps clarify how you can stand out.

- Indirect competitors offer products or services that solve your customer’s problems in different ways. For example, Google Sheets would be an indirect competitor to a project management tool like Asana. Indirect competitors attract budget-conscious customers who want simple solutions.

- Substitute competitors solve the same problem through different means. For example, bread making machines are a substitute for store-bought artisan bread.

| Direct Competition | Indirect Competition | Substitute Competition |

| Same audience | Same audience | Same audience |

| Similar products | Different products | Different methods |

| May have different pricing and features | Attracts budget-conscious consumers | Attracts customers with different lifestyles, resources, or values |

Understanding which brands compete with you in the marketplace is critical. You want to build sufficient differentiation to current and potential customers that your brand is better than these other brands.

How to Perform Competitor Analysis for Any Industry

Competitive research isn’t a rigid science. The process that I’m sharing below is a generalized approach but you can adopt these general ideas and refine them over time based on your experience and expertise in your niche.

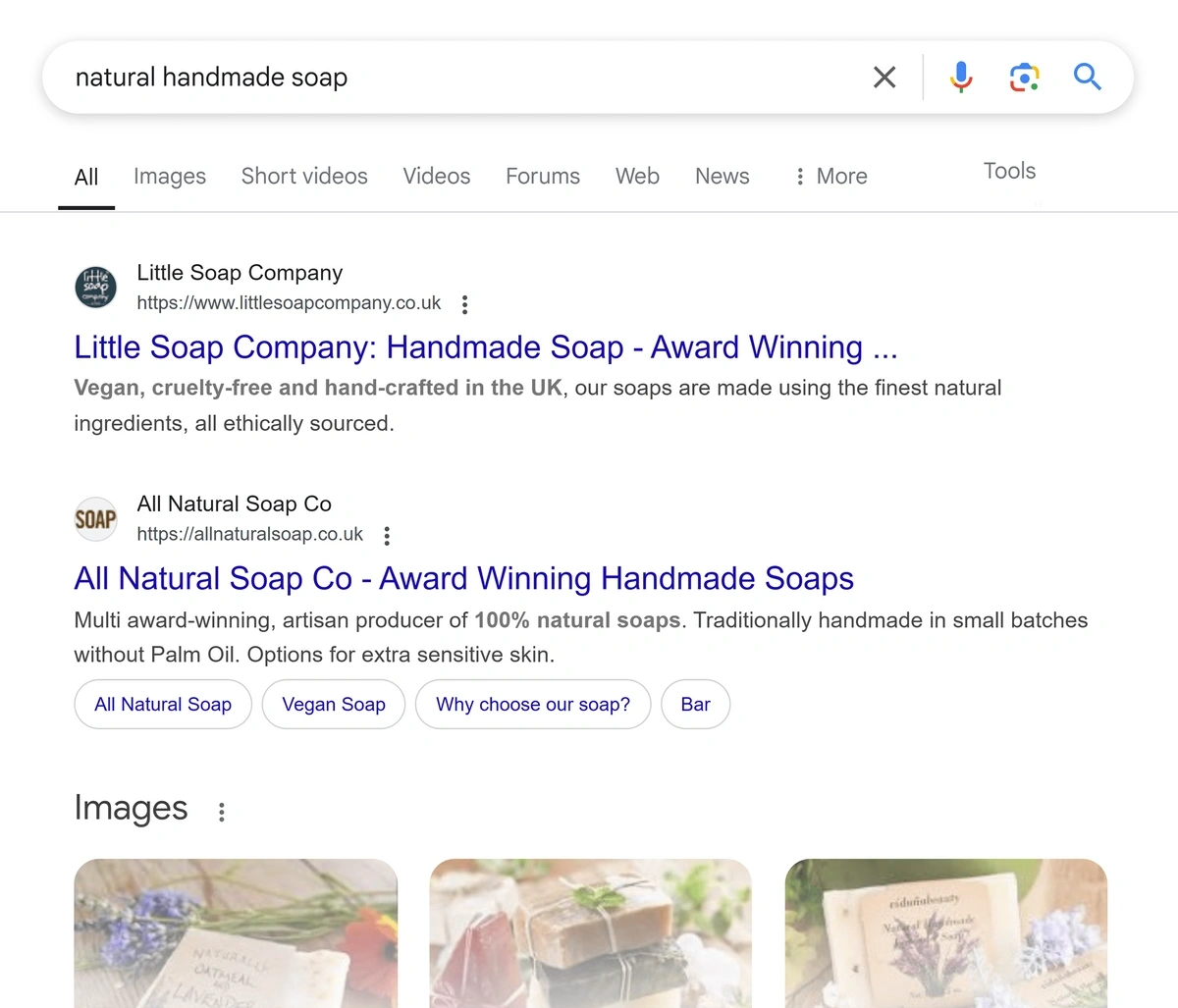

1. Find Your Competitors

The first step is knowing who your competitors are in the first place. There are many ways to do this, but it’s easiest to type in a core keyword for your main product or offering and see what comes up.

Here’s an example for the query “natural handmade soap”.

The results on the first page are likely to be your strongest competitors with good SEO (or they wouldn’t be ranking high).

Note them down.

Then, go beyond the first page and see which other brand websites are ranking.

This can give you an idea of more niche competitors. You can then create a list (a simple spreadsheet would also do).

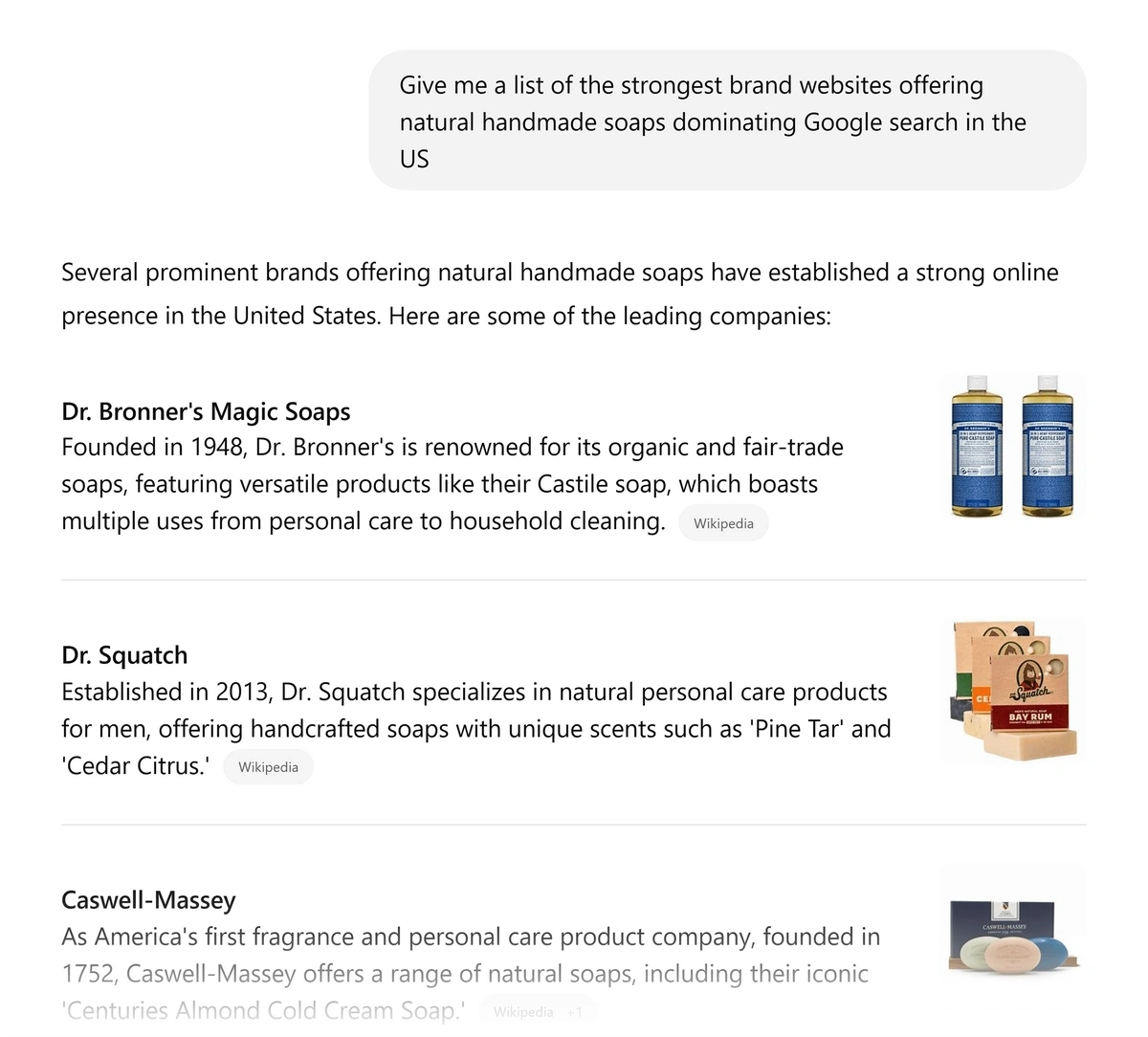

Another way to discover competitors is just by asking an AI tool with online search features, like ChatGPT or DeepSeek.

You can find your competitors and important stats about their positioning in relation to you using the Semrush Organic Research tool as well.

Using Semrush is my preferred way of performing competitor research since it’s faster and reveals actionable details like common keywords, traffic, and more.

2. Discover Customers Competitors Are Targeting

You know who your competitors are. Your next step is to understand who your competitors are serving.

Off the top of my head, a good example is the mattress company Casper.

Just by going through their homepage, you can develop a fairly good idea of what kind of problems they’re trying to solve.

So they have:

- 10-year limited warranty (that’s not unique but important)

- 100-night-risk free trial (pretty smart and less common)

- Optional white glove delivery (adds extra convenience)

Based on this information, what can we learn about Casper’s target audience?

Well, it’s easy to see they’re very focused on addressing buyer anxiety by offering free trials to make returns easy.

Now, you can put all of that together to create a reasonably good profile for Casper’s ideal customers: people that are willing to spend premium money for good quality sleep but only once they have carefully compared their options and considered reliable guarantees.

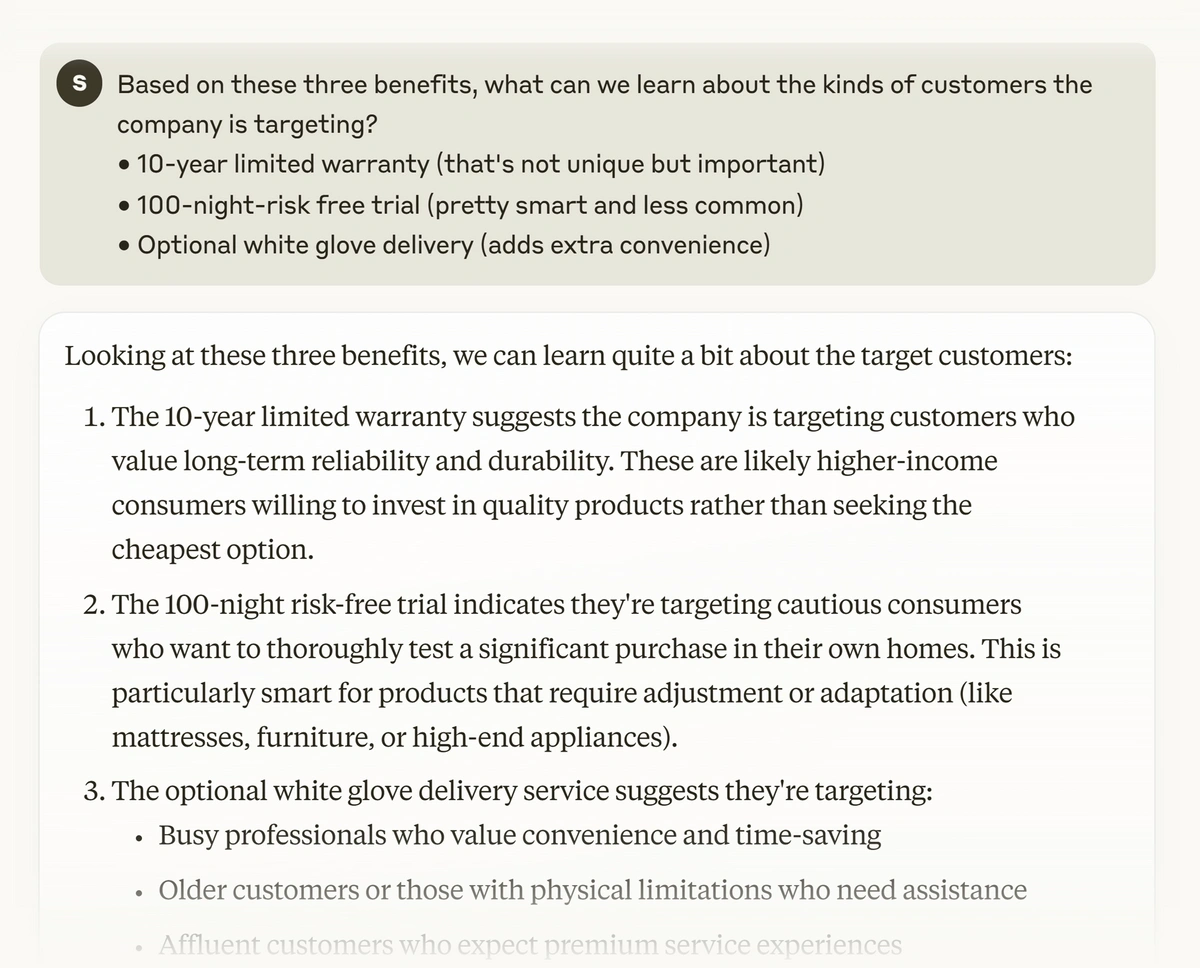

You can also use AI to analyze customer segments based on the benefits a company is offering. Here’s what Claude thinks:

With ChatGPT or Claude, you can uncover some marvelous info, revealing the likely segments Casper is marketing to.

And I got all that just by taking a quick look at their homepage.

But you can go even deeper if you use specialized tools like the Semrush Audience Demographics.

With that, you can dig out less obvious details like the age and sex breakdown of your a business's audience.

Why does this matter?

Everything from pricing strategy to your messaging needs strong alignment with the people you’re speaking to. Miss that alignment and your target audience will have no reason to choose you over your competitors.

That’s why a deep understanding of your target audience can be such a huge differentiator for all your marketing initiatives.

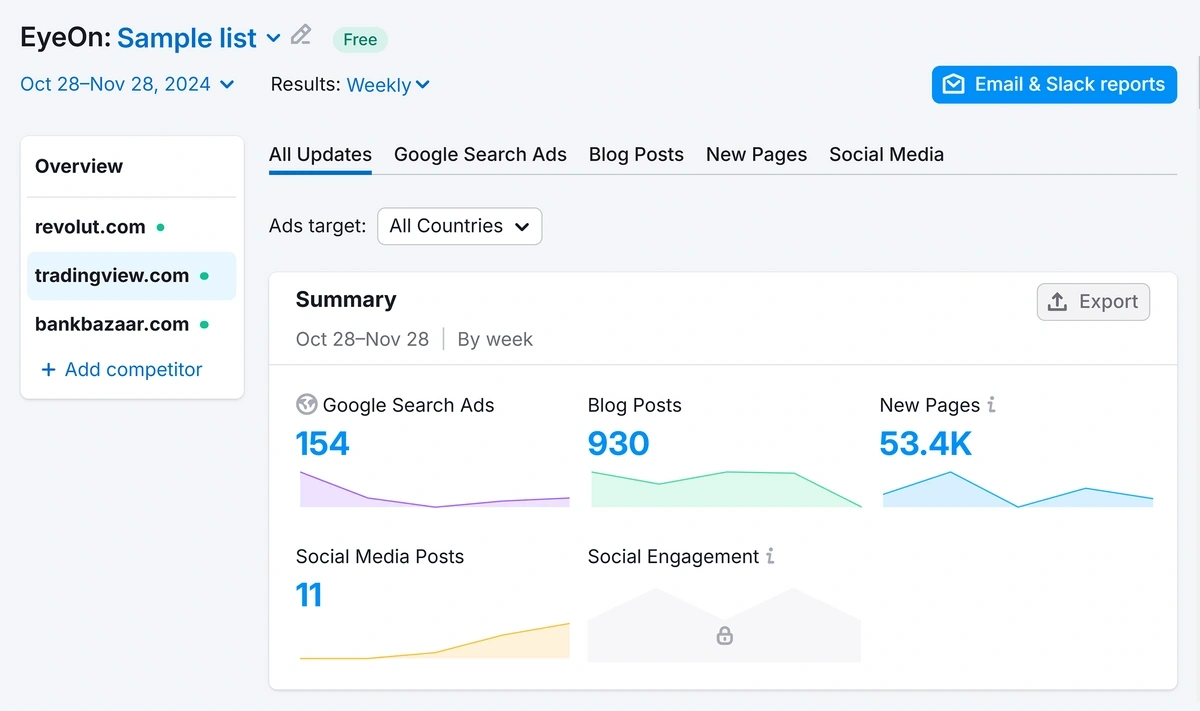

3. Build a Monitoring System

A mistake that many brands make is that they perform competitor analysis as a one-off act. Smart companies create systematic ways to track competitive changes, as they happen, over time.

Monitoring is an absolute pain to do manually. You need an automated system to track trends without much manual intervention.

The Semrush EyeOn tool solves that problem by tracking:

- Blog posts

- Social media activity

- Google ads

- New webpages.

And it does that for your entire competitor list, with weekly reports summarizing updates sent to your email inbox.

Beyond that, it’s equally important that relevant teams in your company are up to speed about this competitive intel.

Share competitor insights through regular briefings and keeping teams aligned on market changes. Remember that different teams have different requirements. For example, product teams may need technical details, while sales teams may need benefits, features, and pricing data.

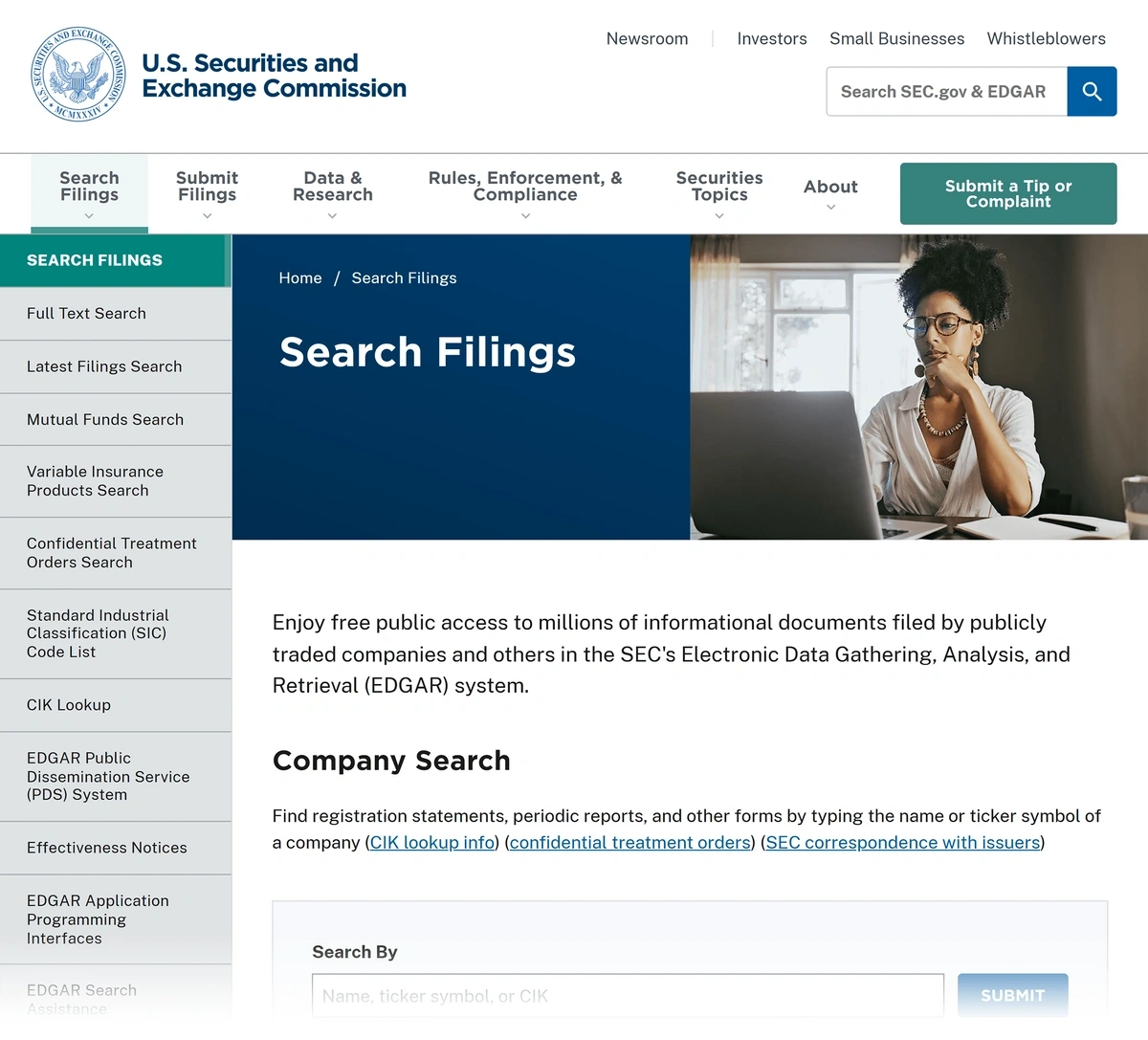

Public sources of competitive intelligence include:

- Annual reports and SEC filings

- Patent applications

- Press releases and news coverage

- Social media posts

- Product documentation

- Customer reviews and forums

Set up a way to easily gather and share relevant materials across your team or company. For example, use a shared drive or cloud storage account to save source materials for analysis.

Remember to stay within legal and ethical boundaries when gathering information.

4. Identify Emerging Trends

Markets change constantly. Yesterday's main competitor might focus on different segments today. Keeping an eye on emerging trends helps you anticipate where your competition is heading.

New startups might lack market share, but they bring innovative approaches that could reshape the industry. Meanwhile, established companies entering adjacent markets might take advantage of existing customer relationships to gain traction.

Regular analysis helps you spot shifts early. Schedule quarterly deep dives into competitor activities, supplementing your ongoing monitoring.

- Review assumptions

- Track three clear metrics over time

- Build results into planning

- Document the impact of changes

- Share insights regularly

- Update strategies accordingly

Track changes in:

- Messaging and positioning

- Product features and updates

- Target market focus

- Pricing strategies

- Partnership announcements

- Marketing channels

Monitor these potential disruption sources:

- Innovative startups

- Adjacent market entries

- Technology shifts

- Customer behavior changes

- Regulatory changes

- Market consolidation

Efficient companies track potential disruptions before they become existential threats.

The free competitor analysis tool on this page shows search trends for important keywords. This can help you to see which topics are building organic traffic for competitors.

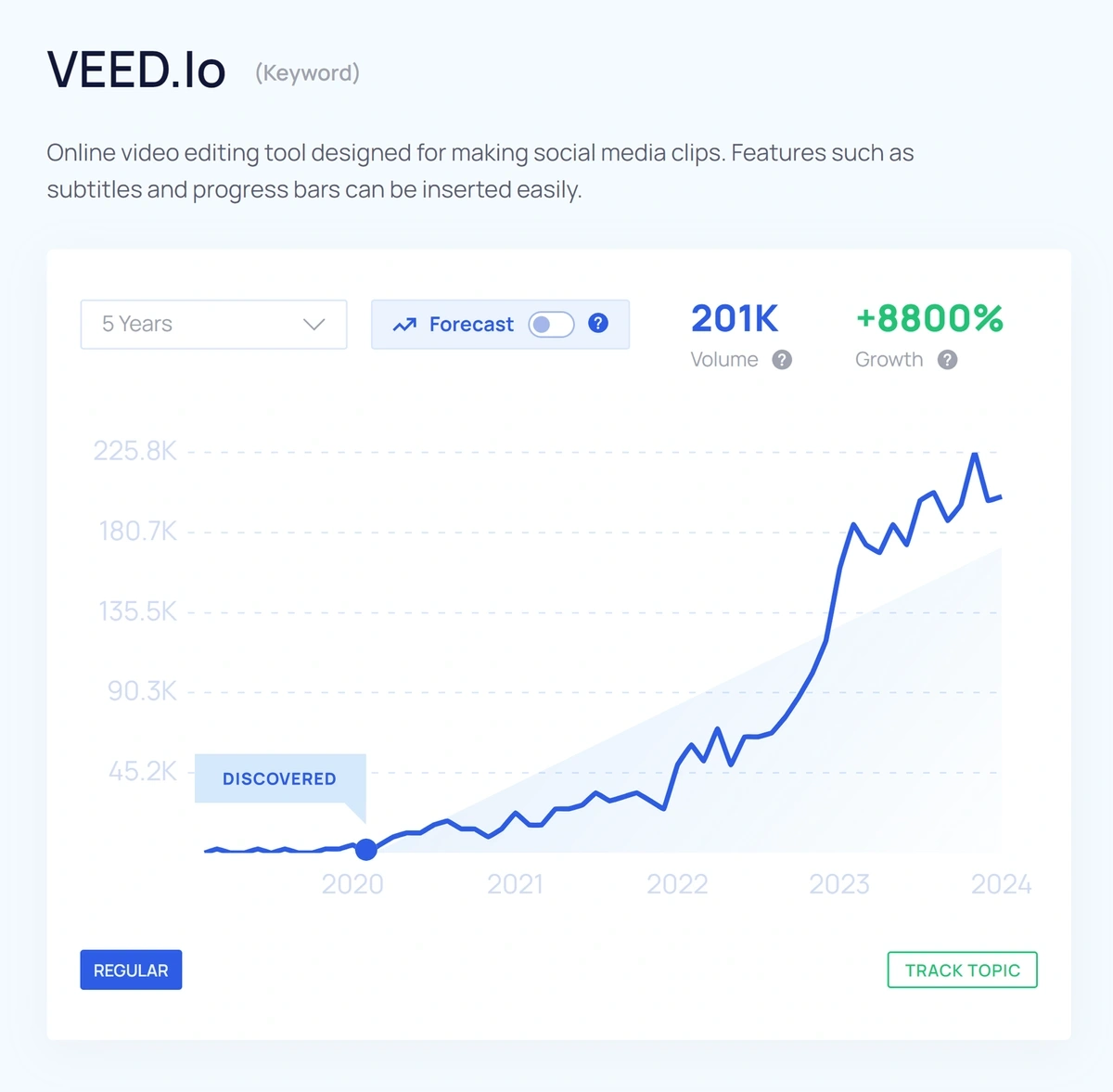

You can also use trend-tracking tools like Exploding Topics Pro to see mentions of brands, products, and individuals across channels.

5. Analyze Online Presence

The online presence of your competitors tells an important story. Search engine optimization (SEO) tools reveal competitors you might miss through traditional market research.

There are 3 ways to discover your competition’s online presence using Semrush:

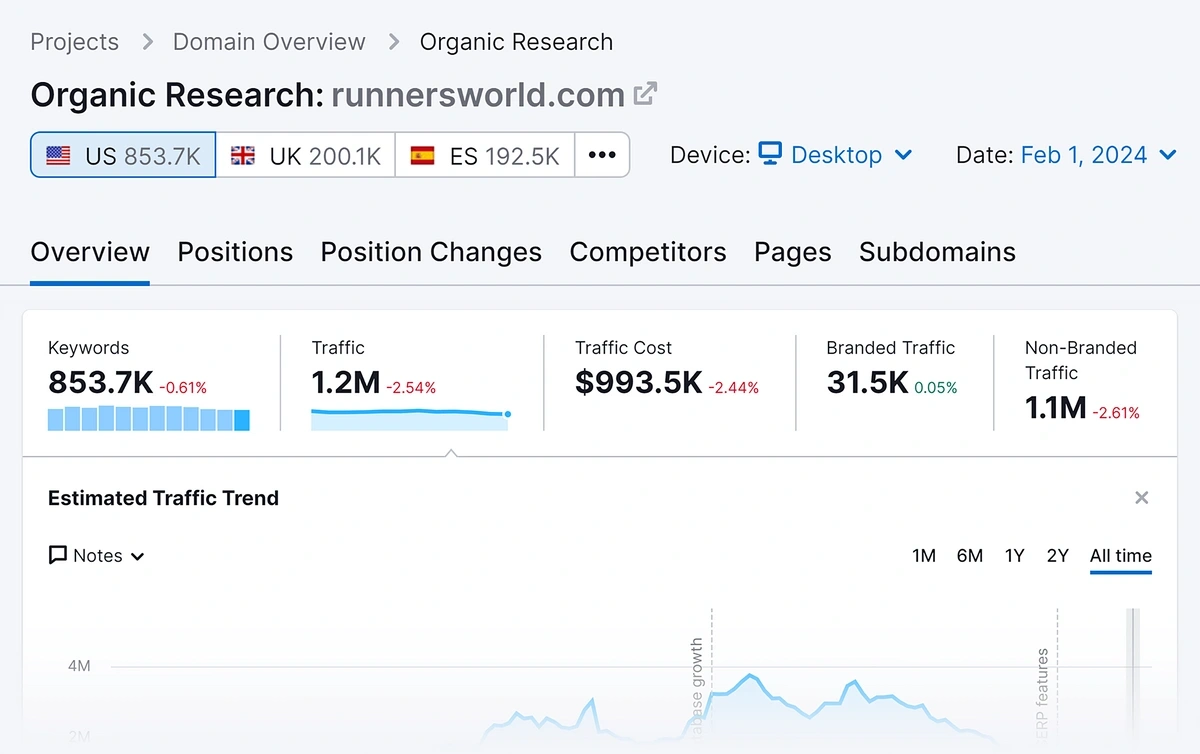

- Organic Research shows which keywords drive traffic and how their visibility has changed over time.

- Backlink Analytics lets you dig into backlinks to find out who the competitor is working with.

- Organic Competitors shows sites that rank for many of the same keywords as yours.

6. Understand Technology Stack

The technology choices your competitors make impact their capabilities and limitations.

Your technology analysis should examine:

- Customer service systems

- Payment processing solutions

- Analytics tools

- Marketing automation platforms

- Mobile capabilities

- Integration options

Knowing how competitors are meeting customer demand can help you identify their probable strengths and weaknesses. You might even uncover better ways to meet the same demand.

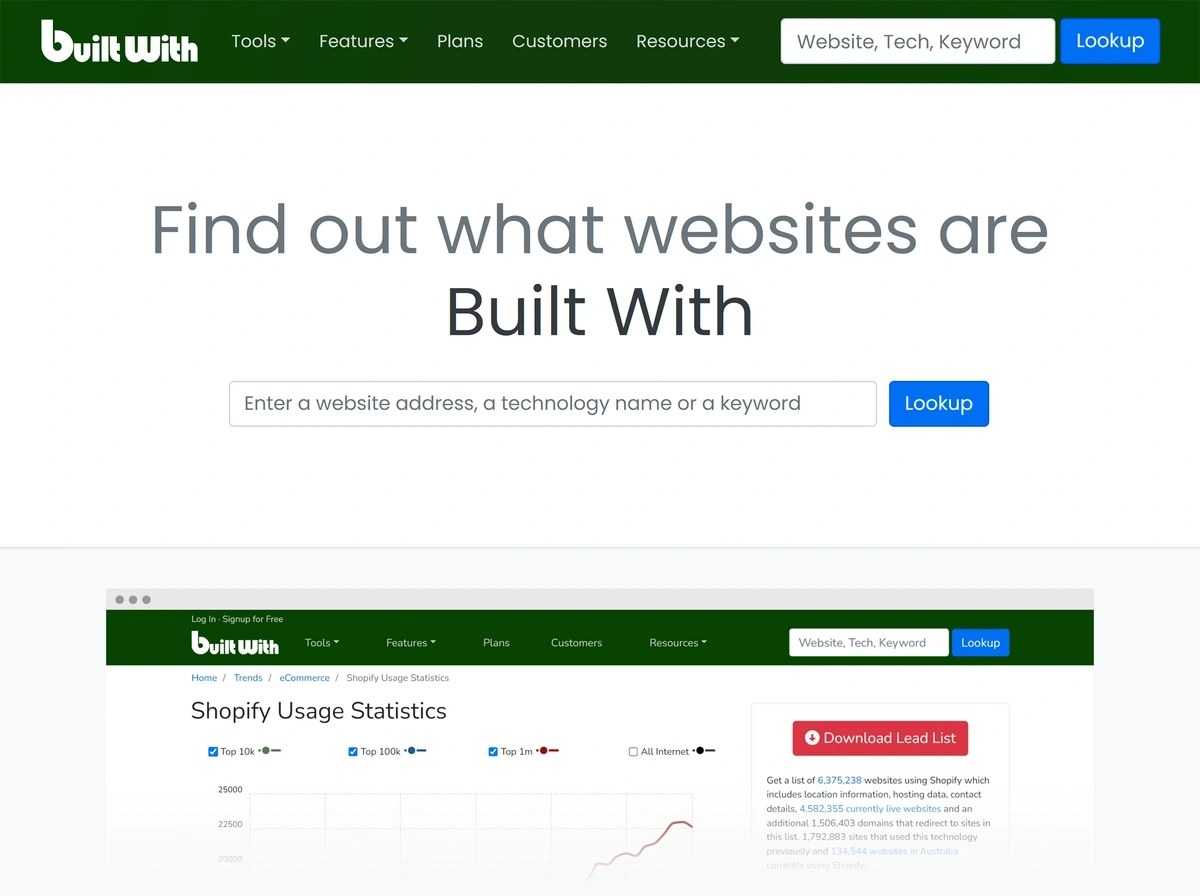

Tools like BuiltWith can reveal the platforms and systems powering your competitors’ operations. Then, compare and contrast them to your own setup.

7. Analyze Marketing Tactics

A competitor's marketing strategy reveals its priorities and resources.

When examining email campaigns through tools like Mailcharts, notice how messaging changes across customer segments. A company sending different emails to enterprise and small business customers signals a multi-tier market approach.

Pro Tip: You can learn a lot by signing up to your competitors' newsletters. From onboarding sequences, cancellation email messaging, and promotions, newsletters are excellent sources of competitive analysis (and they're usually free!).

Likewise, social media activity can reveal key insights through:

- Post frequency and timing

- Content type preferences

- Message engagement rates

- Audience interaction patterns

- Platform focus areas

The mix of organic and paid promotion also signals strategy. For example, a heavy focus on pay-per click (PPC) campaigns might mean the company is struggling to rank organically. They might also be targeting a specific competitor.

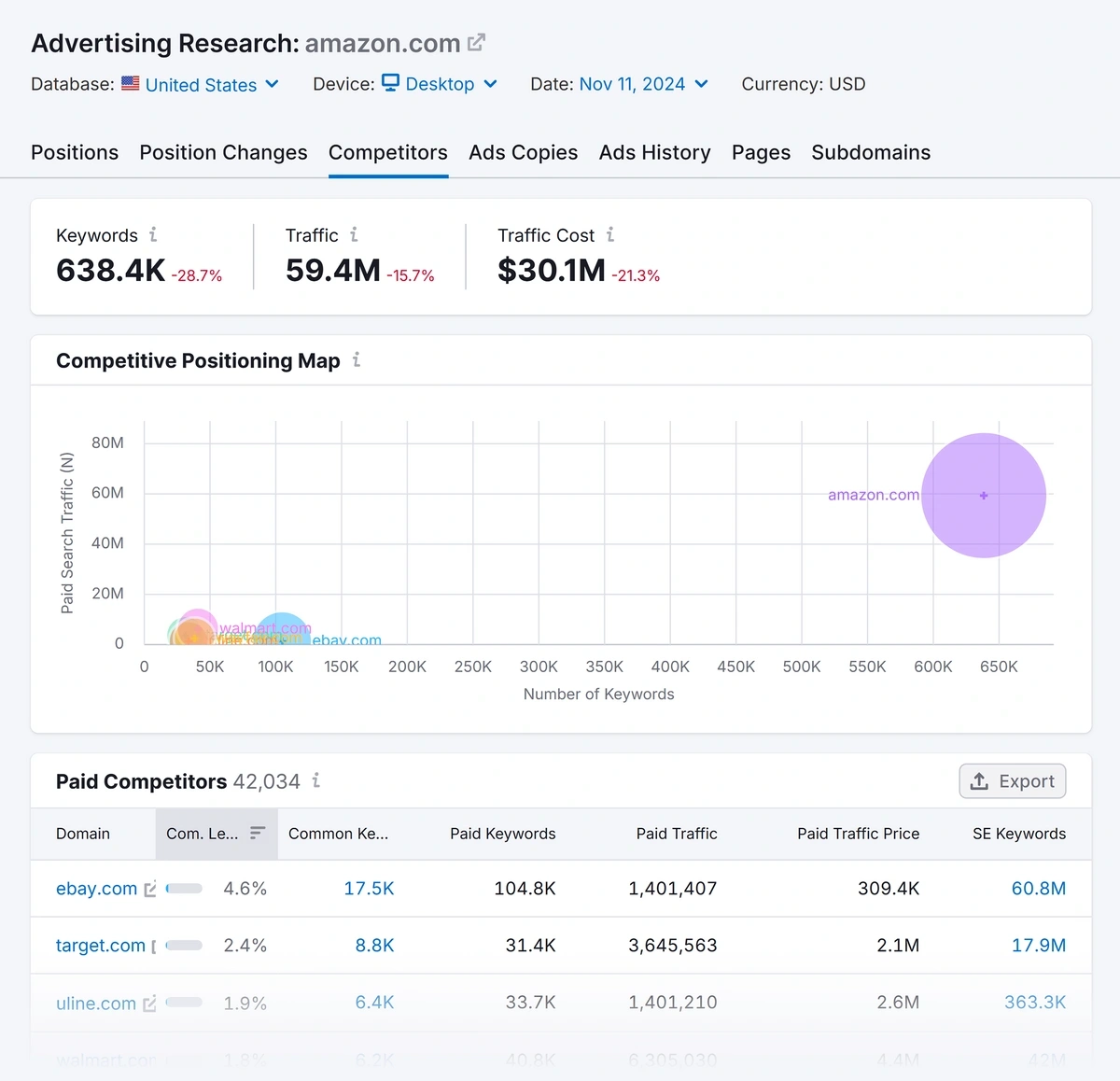

Watch paid search patterns in Semrush's Advertising Research. When a rival increases spending on enterprise-focused keywords while reducing small business terms, they're likely shifting market focus.

Content and Communication Patterns

Our free competitor analysis tool reveals the top pages on your competitors' sites. This helps you to understand what kind of content is working best for them.

When you're ready to do a deep dive, monitor these elements in competitors’ content:

- Topic coverage depth

- Content gaps and focus areas

- Publishing frequency

- Content types and formats

- Audience targeting

- Expert positioning

- Resource allocation

Track publishing patterns using tools like BuzzSumo. When competitors increase content production in specific areas, they're often responding to customer demand.

Sales Strategy and Pricing Models

Price changes often signal deeper strategic shifts.

- Lower prices might reveal pressure from new market entrants.

- Premium pricing paired with new enterprise features suggests an upmarket move.

Watch how competitors structure their pricing tiers.

For example, when Monday.com introduced per-seat pricing for larger teams while maintaining flat rates for small businesses, they showed different value propositions for each market segment.

When rivals drop prices, sometimes maintaining premium positioning serves better than joining a race to the bottom.

Partnership and Integration Networks

Partnership announcements merit special attention. Microsoft's integration with OpenAI sparked a wave of AI features across the software industry.

Similar shifts happen at smaller scales. When several competitors integrate with the same e-commerce platform, they're betting on that platform's growth.

8. Analyze Customer Experience

Your competitor analysis should examine:

- Website usability and design

- Onboarding processes

- Customer support quality

- User reviews and feedback

- Sales team responsiveness

- Common complaints and praise

- Response times and methods

Contact their sales team as a potential customer. Their sales process often reveals their ideal customer profile and competitive advantages.

9. Look For Investment Signals

Watch for these investment indicators:

- Infrastructure spending – Are they laying out big IT expenditures? Building or renovating physical spaces? Revamping their website?

- Marketing budget shifts – Are they focusing on a new market segment? Doubling down on existing audiences?

- Channel investment changes – Have they increased social media posting? Are they launching on a new platform? Have they ramped up website content production?

- Geographic expansion signals – Have they moved into a new state, region, or country? Are they increasing physical marketing presence in certain locations?

- Product development focus – Do earnings reports mention research and development? Are engineers and product people talking about exciting developments in public forums (conferences, interviews, etc.)?

- Technology adoption patterns – Are they leading the way or following tech industry trends?

Where competitors spend time, effort, and money is the best hint for what they plan to do in the future.

10. Watch Talent Movement

Track where competitors are hiring talent. Look at which roles they’re prioritizing:

- A surge in product management hires often precedes major feature launches.

- New sales territories signal geographic expansion plans.

- C-suite and upper management postings may indicate a change in strategic direction.

LinkedIn company pages and job listings can provide general intelligence. For more specific information, you might want to look at niche recruiting companies for the areas you’re interested in.

11. Turn Competitor Analysis into Action

Raw data needs context to drive decisions. When you spot a change in a competitor's strategy, ask:

- Does this change affect our market position?

- What customer needs drive this change?

- Should we respond?

- What resources would a response require?

- How urgent is the threat or opportunity?

You don’t necessarily need to change what you’re doing just because a competitor starts doing something differently. Doing this competitor analysis will help you discern what your best options are.

Analyze and Repeat Your Competitor Analysis

Competitor analysis works best as a focused tool for making specific business decisions. When done regularly, it helps you spot opportunities, avoid market blind spots, and build stronger market positions.

Our free competitor analysis tool is great for getting a high-level overview of what a competitor is doing.

For more information, check out how to find low-competition keywords and learn how keyword gap analysis can help you create content that challenges your top competitors.

Stop Guessing, Start Growing 🚀

Use real-time topic data to create content that resonates and brings results.

Exploding Topics is owned by Semrush. Our mission is to provide accurate data and expert insights on emerging trends. Unless otherwise noted, this page’s content was written by either an employee or a paid contractor of Semrush Inc.

Share

Newsletter Signup

By clicking “Subscribe” you agree to Semrush Privacy Policy and consent to Semrush using your contact data for newsletter purposes